We joke in the office that my colleague Charles Sizemore is the stodgy, old dividend guy. In his words, “Boring is beautiful!”

Well, boring companies aren’t always boring stocks. Not every market-crushing trade has to involve cutting-edge technology that sounds like it’s straight out of a science fiction novel. Sometimes the least-sexy sectors offer the best profit opportunities.

Take self-storage real estate investment trusts (REITs).

I can’t think of anything more boring than a storage unit. Yet, the economics here are fantastic.

Self-Storage: The Perfect Business Model?

Let’s compare a self-storage unit to, say, a luxury hotel property.

Luxury Hotels

Luxury hotels, and the travel industry in general, are in lockstep with the economic cycle. It’s a boom or bust business.

Customers are demanding. If they’re paying top dollar, the place has to be pristine. You can’t have chipped paint or stained carpets.

You also have to maintain a large staff of employees. That isn’t cheap.

To top it all off, you’re in a constant race with your competitors to offer a more luxurious experience at a reasonable price.

Self-storage units? Not so much.

Self-Storage

Construction is cheap, and maintenance is almost nonexistent. You’re talking about a concrete box with a metal door. No one cares if the paint is chipped.

You can run the business with a skeleton crew of employees. And you don’t have to worry about clogged toilets or unruly guests trashing a hotel room.

Self-storage is also largely immune to the ebb and flow of the economy. Moving your stuff out of a locker is a time-consuming pain. The path of least resistance is to just keep your stuff there. And even if they raise the rent on you every year, it’s not going to be enough to motivate you to move.

Speaking of raising the rent…

Real Estate and Inflation

Real estate has historically been a great inflation hedge.

Self-storage businesses fall right in line with that trend. The land and buildings tend to rise in value over time, keeping up with — or even outpacing — inflation. Storage business cash flow is in the same boat because landlords will raise rents at or above the rate of inflation.

For REIT investors, those higher rents translate into higher dividends. Self-storage REIT dividends are nearly as stable and predictable as corporate bond coupon payments. The latter is a fixed asset, meaning you lose value over time due to inflation.

2 Self-Storage REITs Ready to Rip Higher

Self-storage is a fantastic business to be in. So, I wasn’t surprised last week when a blue-chip self-storage stock popped up on my weekly Money & Markets Hotlist. And this week, two more storage REITs made the list: Life Storage Inc. (NYSE: LSI) and Extra Space Storage Inc. (NYSE: EXR).

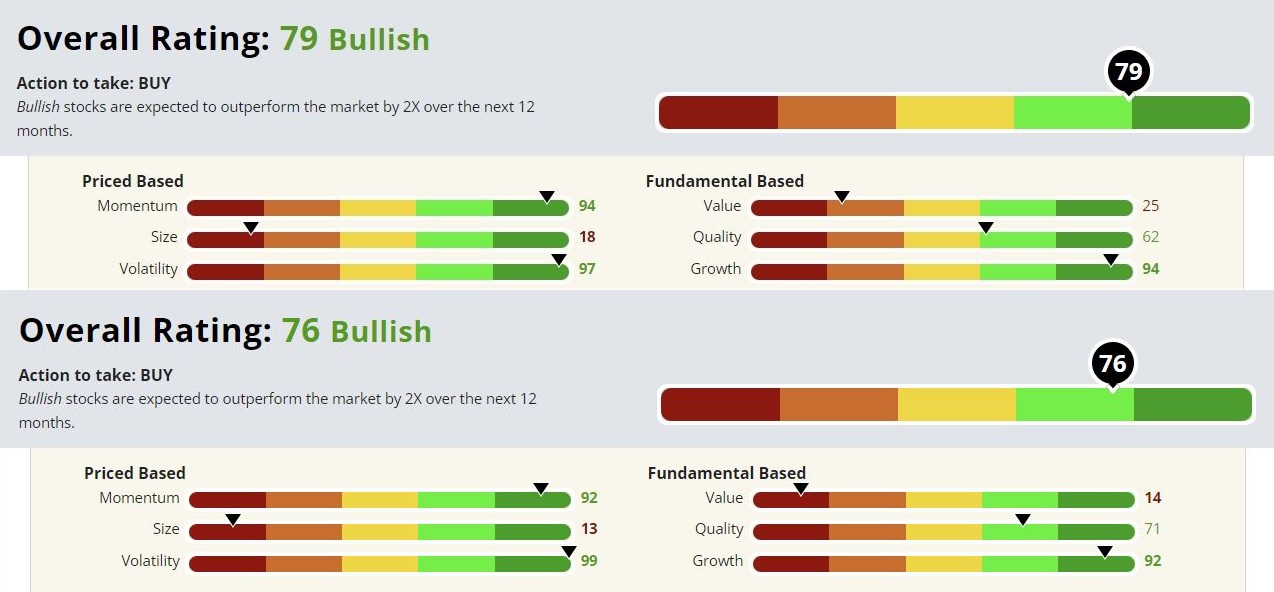

Both of these self-storage REITs rate “Bullish” in my proprietary Green Zone Ratings system. Bullish stocks are projected to beat the overall market by 2x over the next 12 months.

LSI and EXR Mirror Each Other

LSI (top) and EXR’s Green Zone Ratings on January 6, 2022.

When looking at the six individual factors, LSI and EXR are in the green where it counts. Both companies rate in the top 10% of more than 8,000 stocks on momentum, volatility and growth.

Both self-storage REITs get dinged on value. High-growth stocks are often dinged on value as investors pay a premium for growth.

With market capitalizations (outstanding shares times current stock price) of $10 billion for LSI and $30 billion for EXR, we shouldn’t expect a price spike that smaller companies benefit from. That’s why we see low size ratings for both of these REITs.

I don’t think you can go wrong with either of these stocks as an inflation hedge or dividend play.

The Money & Markets Hotlist

And if you are looking for more opportunities like these, click here to make sure you are following my Money & Markets Hotlist. It’s a list of 10 stocks that rate well on my Green Zone Ratings system and exhibit the short-term momentum characteristics I like to see in a trade. These stocks are primed to crush the market over the next two to three months. And you can track it here.

Of course, if you want to be one of the first to see the newest Hotlist picks, you need to join my premium research service Green Zone Fortunes. As part of your subscription, you’ll find the top 10 list in our update we send straight to subscribers’ inboxes each week.

On top of that, you’ll gain access to our model portfolio, where you can see how Green Zone Fortunes readers are investing in some of the top mega trends of 2022 and beyond.

Click here to see how you can join us today!

To good profits,

Adam O’Dell

Chief Investment Strategist