It’s the holiday season, and maybe you’d like to treat yourself to a new dividend stock or two.

We run so many stocks through our six-factor Green Zone Ratings model. It helps us narrow our focus and find the best stocks to buy.

But, at the end of the day, many dividend stocks don’t rate well in our model.

That’s fine! Chief investment strategist Adam O’Dell created his proprietary system to find market-crushing stocks, and a ton of dividend payers don’t fit that mold.

But some stocks rate well and spit out decent yields.

That’s a combo that’s tough to ignore…

Dividend Stocks and Green Zone Ratings

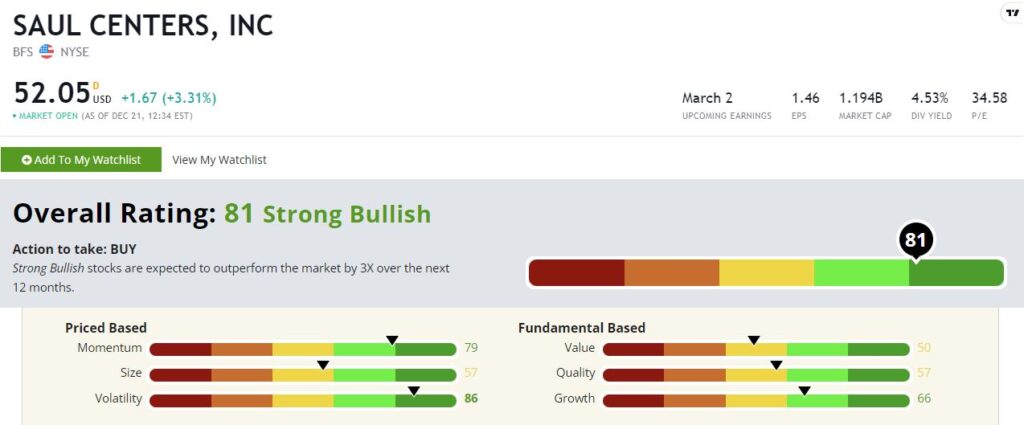

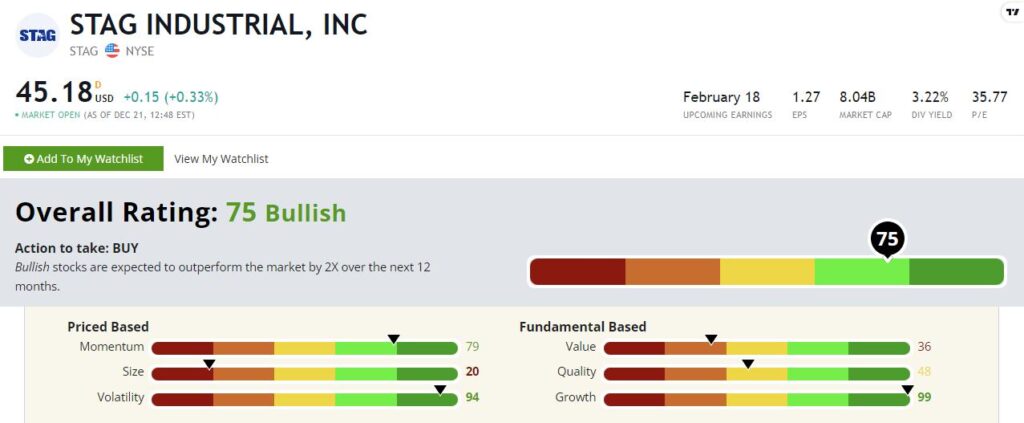

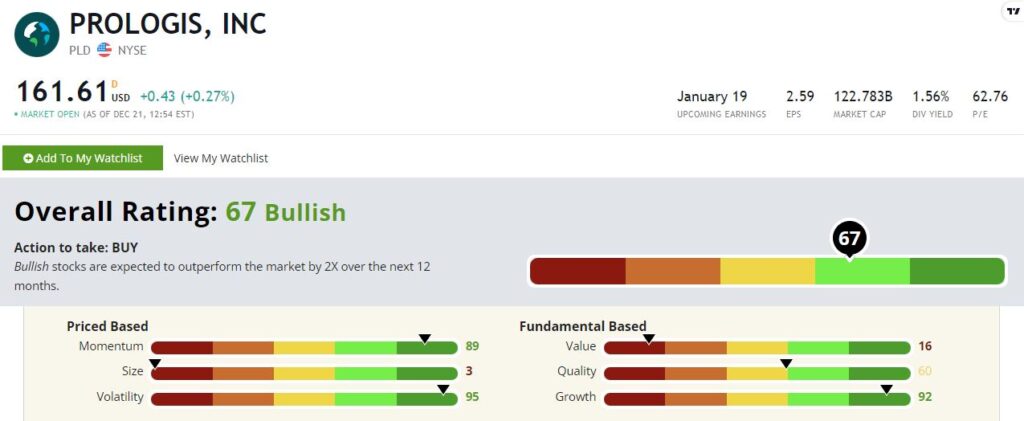

The Green Zone Ratings system rates more than 8,000 based on six factors. Three factors are price-based: momentum, size and volatility. The other three factors are based on fundamentals: value, quality and growth.

Dividend stocks tend to rate highly in our volatility score. High dividend-yielding stocks tend to be low-volatility stocks.

They are good, stable workhorses that throw off those dividends every quarter and don’t give you any drama.

But they tend to not rate well on, for example, growth. Growth companies are not paying out much in the way of dividends for the most part. They’re reinvesting all of their profits into growth.

Look at Amazon. Amazon is not paying a dividend anytime soon. Why would it? Its business is growing like a weed. Every dollar it earns, it just reinvests in the business for more growth. That’s what it should be doing at this stage.

So, dividend stocks are at a different stage. They’re mature cash cows, for the most part. They tend to be middle of the pack in terms of growth.

And that’s OK. You know that going in.

They can rate high on momentum if dividend stocks are in vogue in the market. But generally, they’re not going to; they tend to be middle-of-the-pack at best.

So, the low growth score and often the low momentum score pull down high dividend-yielding stocks. They don’t often rate super well in our model.

But sometimes, they do. I have put together a shortlist of three dividend stocks that rate well within Green Zone Ratings.

I’ve traded some of these stocks in the past. I think these are stocks that you can buy and hold for a while. You can collect that dividend stream and not worry about it.

These are low-drama stocks that aren’t going to give you any trouble. And they rate well on our Green Zone Ratings system, so I expect decent capital gains, to boot.

Now, let’s dig into the shortlist here.

Holiday Dividend Stock No. 1: Saul Centers Inc. (NYSE: BFS)

I like Saul Centers. It rates an excellent 81 overall, and it yields about 4.5%. Its “Strong Bullish” rating means we expect the stock to outperform the market by three times over the next 12 months.

What does Saul Centers do? It owns property in Washington, D.C. It owns a lot of strip malls and retail locations.

I don’t know if you’ve noticed, but the government is not getting any smaller. It seems like that’s a one-way street; we just go from big government to bigger government, to bigger government, to bigger, to bigger, bigger.

We may not like it, but that’s the reality. It is what it is. We might as well make money on it.

If you believe, as I do, that Washington, D.C., will get bigger, and that’s not going to change, then Saul Centers is a way to play growth in that market.

Again, this highly-rated stock pays a respectful dividend.

I think this is one you could buy, drop in a drawer and not look at for a few years.

Holiday Dividend Stock No. 2: STAG Industrial Inc. (NYSE: STAG)

STAG Industrial is about as boring and gritty as a dividend stock gets. It owns boring stuff: logistics centers, light warehouses — the kind of stuff you don’t want in your backyard, but the stuff that you need to operate the global economy.

STAG rates a solid 75 overall, and it yields about 3.2%.

STAG isn’t the highest-yielding stock, but it’s a real estate investment trust (REIT). I don’t see a scenario in which this stock doesn’t grow well over the next five to 10 years.

The stock price will fluctuate just like anything else, but the underlying business is solid. I don’t think you can lose buying warehouses and distribution centers in the age of Amazon.

And that brings me to my last pick here.

Holiday Dividend Stock No. 3: Prologis Inc. (NYSE: PLD)

Along the same lines, I think Prologis is one of the very best REITs you’re ever going to own.

It rates a 67 overall on our Green Zone Ratings system.

It only yields about 1.6%.

But this is a REIT that has been growing like a weed for years.

Amazon is its biggest single tenant. Think about Amazon: You order something on Amazon; it’s elegant, it’s easy. You can just pick up your phone and … done. In three seconds, I’ve ordered a T-shirt.

But somebody has to fulfill it. And there’s an entire layer of the economy that most people never see.

All those Amazon trucks go from one distribution center to another. There are many steps along the way.

That’s Prologis; that is what it does.

The founder of the company identified this as a fantastic trend back in the ‘90s. He saw the growth of e-commerce, and he said: “I want to be part of that.”

The rest is history.

This is a REIT that mints money. Again, it yields 1.6%; it’s not a super high-yielder.

But it does raise its dividend pretty much every year, and I don’t think that’s going to change. So if you want a good, solid income producer that will never give you trouble, Prologis is a terrific option.

If you like what we’re doing, and you wish you had a few extra dividend stocks to put the icing on the cake, then these three stocks are solid options.

Happy holidays!

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.