My friend John’s mom was struggling.

At 89 years old, she had just broken her hip and was suffering from early-onset dementia.

But she still wanted her independence.

That meant John had to choose between moving his mother to a nursing home or enlisting a home health care professional.

And many Americans face the same challenging situation.

This chart shows revenue generated from the home health care market in the U.S.

From 2020 to 2024, Statista expects the market’s value to grow almost 18% to $100 billion.

That’s ideal for today’s Power Stock, U.S. home health care provider Addus HomeCare Corp. (Nasdaq: ADUS).

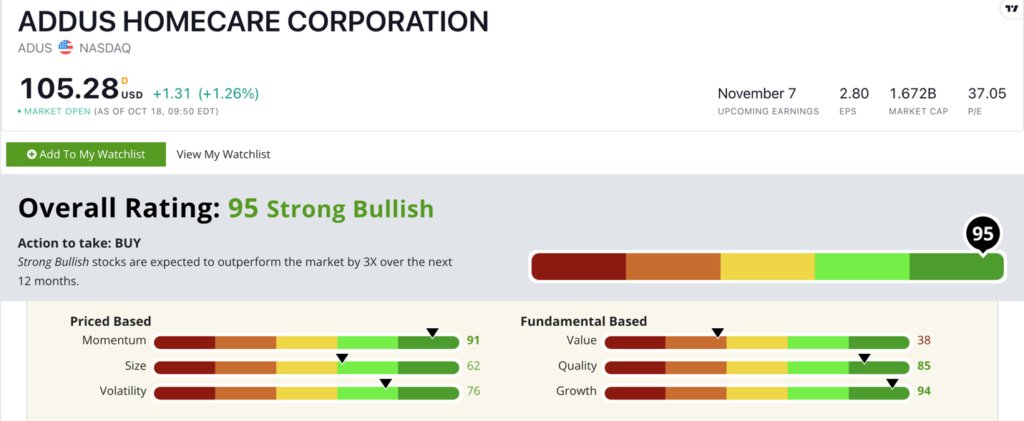

ADUS’ Stock Power Ratings in October 2022.

ADUS operates in 25 states.

John’s home state of Florida is on that list.

Addus HomeCare scores a “Strong Bullish” 95 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

Let’s take a closer look.

ADUS Stock: “Strong Bullish” Growth and Quality

While deep-diving into ADUS, I discovered two compelling items:

- In the second quarter of 2022, ADUS generated $236.9 million in total revenue — an 8.7% increase from a year ago.

- The company just acquired Chicago-based Apple Home Healthcare Ltd., which serves 450 patients across 11 counties in Illinois.

The increase in quarterly income is a big reason ADUS earns a 94 on our growth factor.

While the company is strongest on growth, I want to focus on quality.

ADUS’ net margin is at 4.9%. Its industry peers average negative 31.4%.

This tells us that ADUS is more profitable than its peers and more efficient with how it generates those profits.

ADUS’ returns on assets, equity and investment are all positive.

Its patient care industry peers average returns that are all in the red.

The stock is up more than 30% over the last 12 months!

This beats the broader patient care industry, which is down 26.4%.

ADUS is trading just below its 52-week high and showing the “maximum momentum” we love to see in stocks.

Addus HomeCare Corp. stock scores a 95 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Caring for our elderly loved ones is paramount.

We want to ensure they get the best assistance but are comfortable in their environment.

Like John’s mother — who chose home health care, by the way.

With its wide reach across the country, ADUS is a perfect home health care stock for your portfolio.

Stay Tuned: An EV Stock to Avoid

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an electric vehicle (EV) stock that’s one of the worst-rated stocks within our system.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.