Nearly 20 years ago, I interviewed for a newspaper job in Florida.

It was always my dream to live in the Sunshine State, so when I got the call to visit and interview, I jumped at the chance.

The interview went great, but when it came to discussing pay, I was more than disappointed.

I asked the manager about the offer and his response was: “What we lack in pay, we make up for in sunshine.”

I went back to Kansas and turned down the job.

Now I live in South Florida and one thing I’ve learned is that the manager was right … sunshine is in abundance here. But sunshine doesn’t pay the bills.

That leads me to an industry on the rise and one company that will capture big gains for investors because of it.

Governments Are Helping Fuel Solar Power Adoption

Recent developments in the U.S. solar industry have been surprising.

Since 2012, the rise in solar power generation in the U.S. has been massive.

In 2019, Americans generated more than 72 billion kilowatt hours of solar power. To put that in perspective, that generation was just 4 billion kWh in 2012.

That massive jump is supported by a 30% federal investment tax credit (ITC). It allows you to deduct a percentage of the cost to install a solar energy system from your federal taxes. It applies to both commercial and residential installations.

On top of the federal tax break, states like California, New York and New Jersey have state-level ITCs and other incentive programs.

But the market is about to get even bigger …

The Solar Market Is on the Cusp of a Massive Boom

While California has led the way in solar installation, other states are on the rise.

California has a state law requiring that new homes to include solar panels.

Now, solar companies are looking for new markets with huge growth opportunities. These include states like Texas, Arizona and my home state of Florida.

Here are a few reasons why:

- States like Texas and Florida allow for net metering. This is the ability to sell unused energy back on the power grid back to the power company. Florida is the only state that has a retail-rate net metering policy while Texas varies by utility provider. This gives solar-powered homes a credit for the extra energy their panels produce.

- Electricity is cheaper in states where solar companies aim for greater market penetration. Keep in mind that solar adoption occurs when costs are competitive.

- The penetration of solar power in these emerging markets is very low. In Florida and Texas, solar power penetration is only 1%. That means there is plenty of room for expansion. But in both states, the expansion of solar power is rapid.

That is going to push solar capacity to a sixfold gain over the next three decades.

And there’s one company that stands to gain from this massive expansion of the solar industry.

High Growth, Quality Means Big Profits for You

M&M Chief Investment Strategist Adam O’Dell

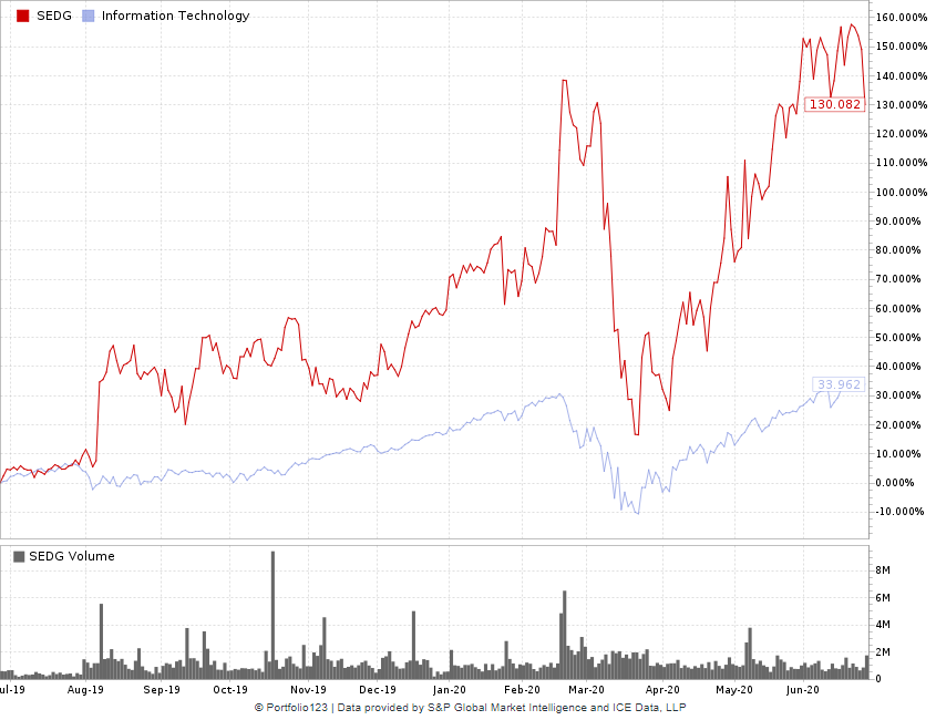

Money & Markets Chief Investment Strategist Adam O’Dell’s proprietary stock rating system shows us there’s a company in the solar sector with solid growth and quality.

SolarEdge Technologies Inc. (Nasdaq: SEDG) designs and sells systems for solar panel installations worldwide. It caters to both residential and commercial solar installation.

Looking at the metrics, we found:

- Quality — SolarEdge beats the industry average in returns. Its return on investment is 21.2% compared to the solar industry average of 3%. Its return on equity is 22.7% compared to just 2.8% for the rest of the market. The company has a return on assets of 12.6% while the rest of the industry averages just 0.6%. SEDG also has operating cash flow of $310 million.

- Growth — The company had sales of more than $1.5 billion in 2019. What’s more its sales figures have beaten Wall Street expectations in each of the last five quarters, including a 2.2% surprise in Q1 2020. Its five-year sales growth rate is 60.6%.

The Takeaway

The solar industry is poised for a big boom — and soon.

Remember, the states that solar companies are looking at for expansion only have 1% market penetration. That leaves a lot of room for upside.

As an investor, you don’t want to miss out on this growing boom that will charge up your gains, thanks to sunshine.

We see SolarEdge Technologies as a fantastic way to do just that.