Sometimes, it feels like nothing works.

My hometown Dallas Mavericks are facing elimination against the Golden State Warriors in the NBA playoffs… And I’m not seeing the world through rose-colored glasses right now.

I’ll admit my sour mood is bleeding over into my investing as well.

And it seems I’m not alone. Plenty of investors see the glass half empty these days.

Let’s see what we can do about that using a good old-fashioned (and “Strong Bullish”) dividend stock.

Don’t Try to Time the Tech Bottom

Shares of former social media darling Snap Inc. (Nasdaq: SNAP) tanked 40% after the company reported a disappointing outlook for the rest of 2022. It’s one of the latest in a string of tech stock sell-offs.

Inflation and fears of a recession are dampening company enthusiasm.

And investors are choosing to sell first and ask questions later.

We don’t know yet whether we’ll have a recession this year. And if we do go into one, we don’t know how deep it will be.

We also don’t know how long inflation will wreak havoc on tech valuations. All of this makes it hard to try and call a bottom for tech stocks.

My advice?

Don’t even try. Tech will become investable again soon enough.

But in the meantime, stick with the trends that are working.

As an example, and I wrote about this earlier this week, we know that millennials are buying houses… And that they’re buying older properties in need of a little tender loving care.

Home improvement stocks should have nice tailwinds for a long time to come.

Lowe’s Stock: Home Renovation Supplier, Dividend Payer

With that in mind, let’s look at Lowe’s Companies Inc. (NYSE: LOW), the home improvement chain.

As far as dividend stocks go, its yield is modest at 1.7%. But Lowe’s has a long history of raising the payout. Last year, it hiked payouts by one-third, and its dividend has more than doubled since 2017.

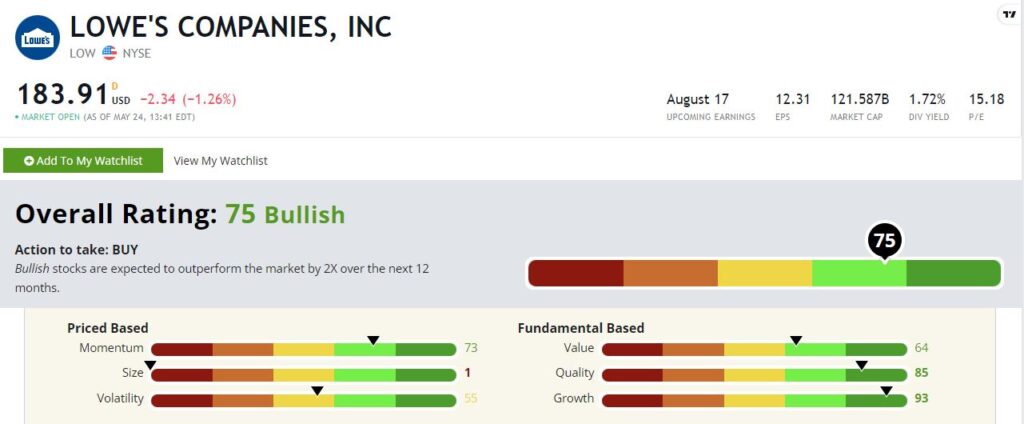

LOW shares have slid lower all year, so you might want to look for an entry point after the stock establishes a new uptrend. But our Stock Power Ratings indicators suggest the stock will enjoy a turnaround sooner rather than later. LOW rates a “Bullish” 75 out of 100.

Let’s pick that apart.

LOW’s Stock Power Rating

Growth — Lowe’s rates highest on growth, with a factor rating of 93. The pandemic was a boon to the home improvement sector. But Lowe’s solid growth predates the pandemic. I believe that growth isn’t going to slow any time soon.

Inflation and slower economic growth are mild, short-term headwinds. But the family formation of the millennials is a major, long-term tailwind.

Quality — Retail is a tough business. Competition is brutal, sales are cyclical and margins aren’t super high … unless you’re Lowe’s. It has managed to carve out a high-margin niche as a higher-end home improvement retailer, and it rates a solid 85 on our quality factor as a result.

Momentum — Momentum is a bit of a relative term this year, as the market has trended lower and not much of anything has exhibited true positive momentum. That said, Lowe’s boasts a solid 73 on momentum. And once this bout of market volatility runs its course, I would expect Lowe’s to be one of the leaders in the next move higher.

Value — Lowe’s isn’t cheap right now. High-quality growth stocks rarely are. Investors don’t mind paying up for shares because they are banking on that future growth. That said, LOW rates a reasonable 64 on our value factor, with a price-to-earnings (P/E) ratio of just 14.

Volatility — You win by not losing in a bear market. For the most part, this means avoiding the most volatile stocks. Lowe’s rates a 55, which means it’s just about in line with the market’s broader moves.

Size — Lowe’s loses some points due to its large size. It rates a 1 on our size factor. But that’s not a deal-breaker. We’re not looking for a small, undiscovered gem here. We’re looking for high-quality growth. Lowe’s delivers on that front.

Bottom line: Lowe’s is in a great position to lead the market higher when it does turn around.

And if you’re looking for more stocks that will charge out of this bear market to massive gains, click here.

My colleague Adam O’Dell has been working on a project that aims to do exactly that. And he’ll have more details at an upcoming virtual event.

Click here to sign up for his free presentation and set a reminder for June 9. This one can’t be missed.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.