PREMIUM SERVICES

PREMIUM SERVICES

Adam O’Dell is among the top investment analysts in the world. He left the grind of running a multimillion hedge fund to identify top profit opportunities for main street Americans. In Green Zone Fortunes, Adam and his team look for trends in the market that no one else sees and uses the powerful Stock Power Ratings system to find strong investments with the potential to grow your portfolio year after year.

Who this is for

Investors of any experience level who are looking to take control of their money and learn the tools to make money in any market.

ELITE PREMIUM SERVICES

These faster-paced publications allow our experts to dive deeper into an investing strategy and give subscribers the chance at even quicker, higher profits.

ELITE PREMIUM SERVICES

These faster-paced publications allow our experts to dive deeper into an investing strategy and give subscribers the chance at even quicker, higher profits.

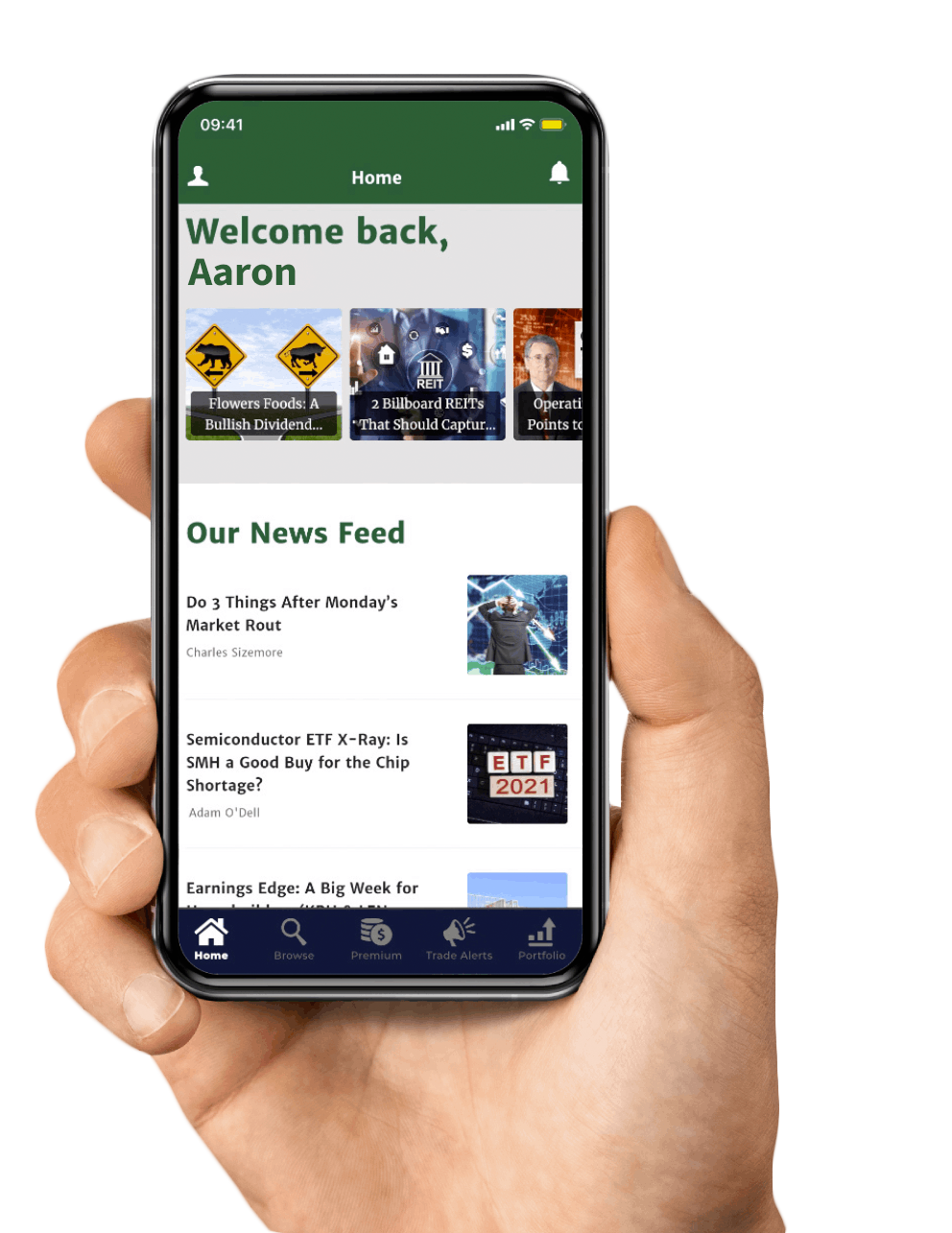

INVESTING IS MADE EASY WITH MONEY AND MARKETS

ADAPTIVE

Markets go up and markets go down. We use our Adaptive Investing™ methodology to find profit no matter what the market is doing.

SAFER

We give you the research, recommendations and tools to take control of your money. You control your investments and we’re here to walk side-by-side with you on your financial journey.

SMARTER

We don’t give you any hype. Our Stock Power Daily and research is rooted in sound, proven analysis from our experts.

INVESTING IS MADE EASY WITH MONEY AND MARKETS

ADAPTIVE

Markets go up and markets go down. We use our Adaptive Investing™ methodology to find profit no matter what the market is doing.

SAFER

We give you the research, recommendations and tools to take control of your money. You control your investments and we’re here to walk side-by-side with you on your financial journey.

SMARTER

We don’t give you any hype. Our Stock Power Daily and research is rooted in sound, proven analysis from our experts.

Money & Markets Daily

LatestBuy and Hold With a Seasonal Twist Beats Market by 10.5X

The Apex Calendar is a powerful investment strategy, similar to buy-and-hold but with all the advantages of trading seasonals.

Investing

LatestStrong Bullish Momentum in an Overlooked Oil Sector

The oil and gas infrastructure market is growing at a steady clip. This "Strong Bullish" oil stock is set to benefit in a big way.

Money & Markets Daily

LatestChart of the Day: Unemployment, Interest Rates & More

Have you missed any of Mike Carr's charts in Money & Markets Daily? See what he's found in regards to unemployment, interest rates and more.

Investing

LatestWhat Traders Have Known for 120 Years

While many investors may worry about the latest stock market pullback, history shows this is shaping up to be a new buying opportunity.

Meet Our Experts

Adam O’Dell

Chief Investment Strategist

Mike Carr

Senior Technical Analyst

Matt Clark

Chief Research Analyst

Meet Our Experts

Adam O’Dell

Chief Investment Strategist

Mike Carr

Senior Technical Analyst

Matt Clark

Chief Research Analyst

Frequently Asked Questions

How do I access the services I paid for?

Click here or on “Log In” in the menu bar at the top right of this page. That will bring you to the login page where you can enter your username and password to access all of your services under the “Premium Content” tab as well as manage your account.

How do I sign up for Stock Power Daily?

Great question. At Money & Markets, we publish one unique free-investing e-letter to all investors … called Stock Power Daily. You don’t have to be a subscriber to our premium services to sign up for Stock Power Daily. Click here to start getting Stock Power Daily in your email inbox every day. For more on how our daily e-letter works, check this out.

What’s the difference between your free e-letter and premium services?

Another great question. In short, our premium services are for subscribers that are looking for regular stock, options or other investment recommendations, detailed trade alerts and updates, and model portfolios. The free e-letter offers stocks to buy or avoid based on our Stock Power Ratings system. For more on this, check this out.

How do I contact Customer Care?

There are a number of ways to get in touch with us. Our Contact Us page shows you all of your options. Phone, email, chat … We’re here for you, real people, ready to answer your questions.

Frequently Asked Questions

How do I access the services I paid for?

Click here or on “Log In” in the menu bar at the top right of this page. That will bring you to the login page where you can enter your username and password to access all of your services under the “Premium Content” tab as well as manage your account.

How do I sign up for Stock Power Daily?

Great question. At Money & Markets, we publish one unique free-investing e-letter to all investors … called Stock Power Daily. You don’t have to be a subscriber to our premium services to sign up for Stock Power Daily. Click here to start getting Stock Power Daily in your email inbox every day. For more on how our daily e-letter works, check this out.

What’s the difference between your free e-letter and premium services?

Another great question. In short, our premium services are for subscribers that are looking for regular stock, options or other investment recommendations, detailed trade alerts and updates, and model portfolios. The free e-letter offers stocks to buy or avoid based on our Stock Power Ratings system. For more on this, check this out.

How do I contact Customer Care?

There are a number of ways to get in touch with us. Our Contact Us page shows you all of your options. Phone, email, chat … We’re here for you, real people, ready to answer your questions.

User Testimonials

Thank you for this link. It was very helpful! I was going to buy a stock this morning based on some of my own research. After looking at it on your rating, I think I will wait. Thanks again!

-Donald

Hello, Matt. Thank you for reviewing NOVA. I have it in my portfolio and will be selling it. Please keep advising us on buy and SELL recommendations.

-Dina

I must say, I love your Stock Power system! Thank you!

-Rick

I thought your article on Robinhood was most interesting and while I’ve seen various articles and heard negative feedback regarding the company’s financial stability, I never saw just how deep in the red the company truly is.

-John

User Testimonials

Thank you for this link. It was very helpful! I was going to buy a stock this morning based on some of my own research. After looking at it on your rating, I think I will wait. Thanks again!

-Donald

Hello, Matt. Thank you for reviewing NOVA. I have it in my portfolio and will be selling it. Please keep advising us on buy and SELL recommendations.

-Dina

I must say, I love your Stock Power system! Thank you!

-Rick

I thought your article on Robinhood was most interesting and while I’ve seen various articles and heard negative feedback regarding the company’s financial stability, I never saw just how deep in the red the company truly is.

-John