My grandfather, whom I looked up to my whole life, spent his career as an aircraft engineer.

I would always ask him about his work … I was fascinated by what he was making.

A critical component he worked with in building aircraft was aluminum.

From the fuselage to the seats, aluminum is used everywhere.

And while aluminum has been in use for decades, its market is growing at a rapid pace.

The chart above shows the growth of the global aluminum market.

Precedence Research projects it to grow 63.4% from 2021 to 2030.

Today’s Power Stock is a major global supplier of aluminum products: Mueller Industries Inc. (NYSE: MLI).

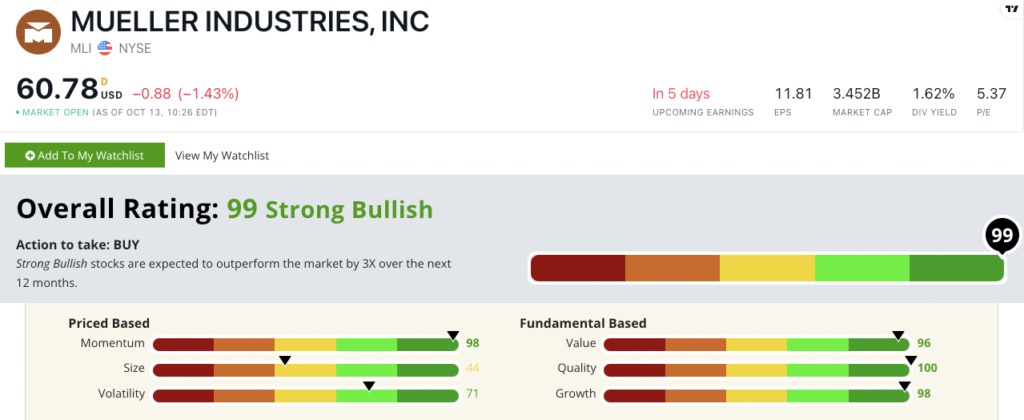

MLI’s Stock Power Ratings in October 2022.

Tennessee-based Mueller Industries supplies aluminum products to various industries:

- Construction.

- Energy.

- Automotive.

- And aerospace.

The company also manufactures copper, steel and plastic pipes, fittings and valves.

Mueller Industries stock scores a “Strong Bullish” 99 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

MLI Stock: Market-Crushing Quality + Strong Momentum

Mueller’s last quarter was outstanding.

Take a look at this inside information:

- Operating income was $268.9 million — a 70.4% increase over the same quarter a year ago.

- The company reported $202.5 million in cash at the end of the quarter … and no net debt.

MLI is a terrific growth stock, as you can see from its 98 score on that factor in Stock Power Ratings above.

It's just as strong on quality (100) and value (96).

The company’s price-to-earnings and price-to-cash flow ratios are all lower than the industry average.

MLI’s returns on assets, equity and investment are at least four times higher than its peers’.

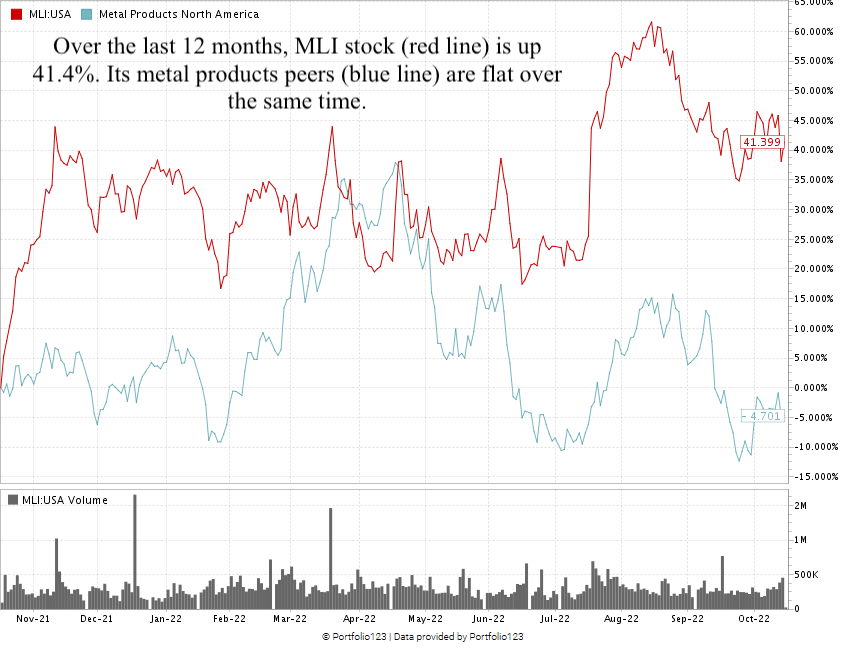

This is also a smart momentum play:

Created in October 2022.

From its recent low in June 2022, MLI stock climbed 37.6% to a new 52-week high in August.

Over the last 12 months, MLI is up 41.4%. It blows away its industry peers (the blue line in the chart above), which are almost flat.

Mueller Industries stock scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Aluminum is used in everything from aircraft to kitchenware.

Mueller is a $3.5 billion global supplier of aluminum.

That makes MLI the perfect play on the rise of the aluminum market.

Bonus: Mueller’s forward dividend yield of 1.62% translates to a $1 per share, per year payout for shareholders.

Stay Tuned: Top-Rated Petroleum Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on petroleum gas stock that’s crushing its peers.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.