It’s a necessary evil that we all have to pay for.

And if there is one big lesson learned from natural disasters such as Hurricane Ian, it’s the need for insurance.

Estimates indicate Ian caused South Florida and the Carolinas $53 billion to $74 billion in insured losses.

That makes it the most expensive storm in Florida’s history.

Statista projects the value of insurance premiums written to businesses and individuals in the U.S. to reach $2.6 trillion by 2024.

Today’s Power Stock specializes in underwriting property, casualty and surety insurance in the U.S.: RLI Corp. (NYSE: RLI).

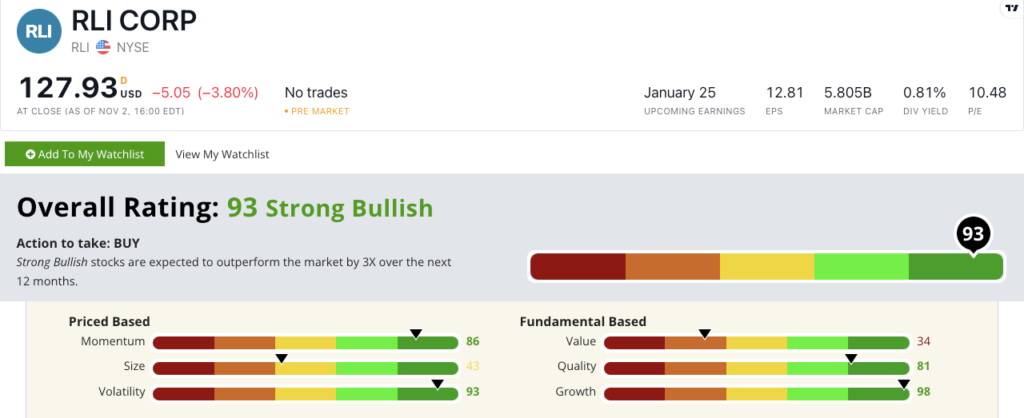

RLI’s Stock Power Ratings in November.

RLI underwrites insurance covering everything from your pets to natural disasters.

RLI stock scores a “Strong Bullish” 93 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

RLI Stock: Strong Momentum + Solid Growth

Here’s what stood out from RLI’s most recent earnings report:

- Net earnings of $439.9 million is a 1,406.5% year-over-year increase!

- Over the last five years, the company has paid more than $513 million in shareholder dividends.

Those figures illustrate why RLI earns a 98 on our growth factor.

But RLI is a great quality stock.

Its return on equity is 43.9%, which is nearly 10 times greater than the insurance industry average.

What’s more, RLI’s net margin is 53.5%, compared to the industry average of just 3.8%.

This tells me RLI can turn strong profits and grow its sales base.

Created November 2022.

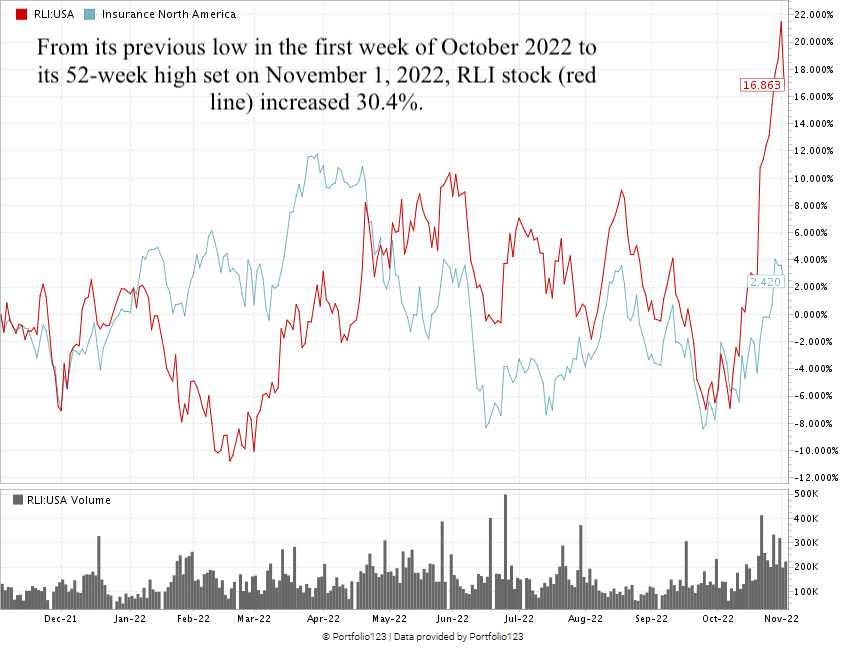

RLI stock is up 18.4% over the last 12 months, while the insurance industry is averaging just 2.7% in gains over the same time.

But the stock shot up more than 30% in October.

The climb followed a strong third-quarter financial report.

RLI Corp. stock scores a 93 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Hurricane Ian was devastating for South Florida and the Carolinas.

Its destruction underscores the need for everyone to carry property and casualty insurance.

As a market leader, you can see why RLI is a great addition to your portfolio.

Bonus: The company’s forward dividend yield of 2.38% means it will pay $3.04 per share per year just to own the stock.

Stay Tuned: The Natural Gas Stock to Beat Russia

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an international natural gas stock that helps Europe decrease its dependence on Russian energy.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.