My family didn’t have a lot of money when I was growing up.

So if I wanted to buy a pack of baseball cards or a Star Wars action figure, I had to earn cash.

The best way to do that was to recycle the aluminum cans I found around my house and neighborhood.

The recycling market for aluminum — and steel — is big business now:

The chart above shows the size of the global waste recycling market, including steel and aluminum.

From 2020 to 2030, waste recycling revenue will increase 59.7%.

Steel is important for construction, but recycling it helps conserve valuable resources and divert metal from landfills.

I’m pleased to tell you I found a way we can profit from this trend.

Today’s Power Stock is Steel Dynamics Inc. (Nasdaq: STLD), a $14.8 billion steel manufacturer and recycler.

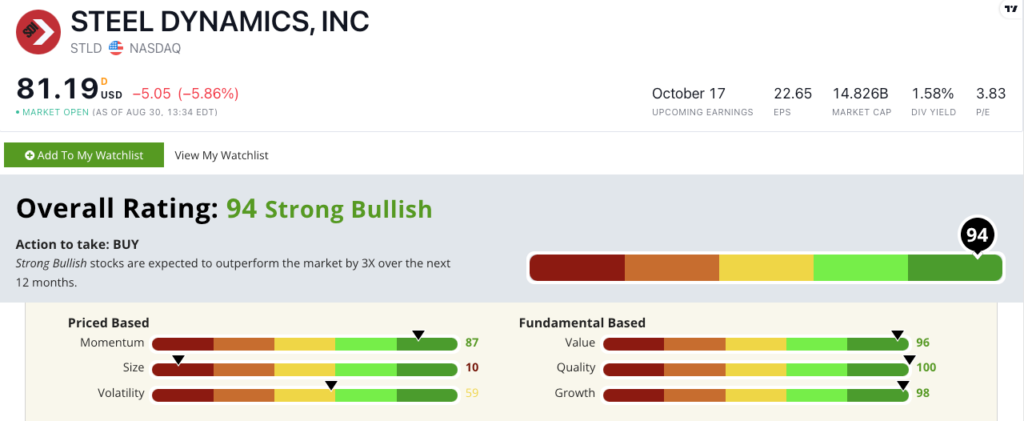

STLD Stock Power Ratings in September 2022.

Steel Dynamics makes steel for building and road construction.

It also recycles steel and sells it to companies looking for scrap.

STLD stock scores a 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

STLD Stock: Among the Best Fundamentals I’ve Seen

Steel Dynamics recently closed out a killer second quarter.

Highlights include:

- Net sales of $6.2 billion — a 409% increase over the same time last year … and a company record for quarterly sales.

- A gross profit of $1.8 billion for the quarter — more than all of 2021.

STLD falls in the top 4% of all stocks we rate on all three fundamental metrics (value, quality and growth).

Its price-to-earnings ratio is half the metal products industry average — that earns STLD a 96 on value!

On quality, STLD’s operating margin is more than four times higher than the industry average. It earns a perfect 100 on quality.

The company’s growth is outstanding as well: Its one-year annual sales growth rate is an impressive 92%. Its earnings-per-share growth rate is even better … 500% year over year.

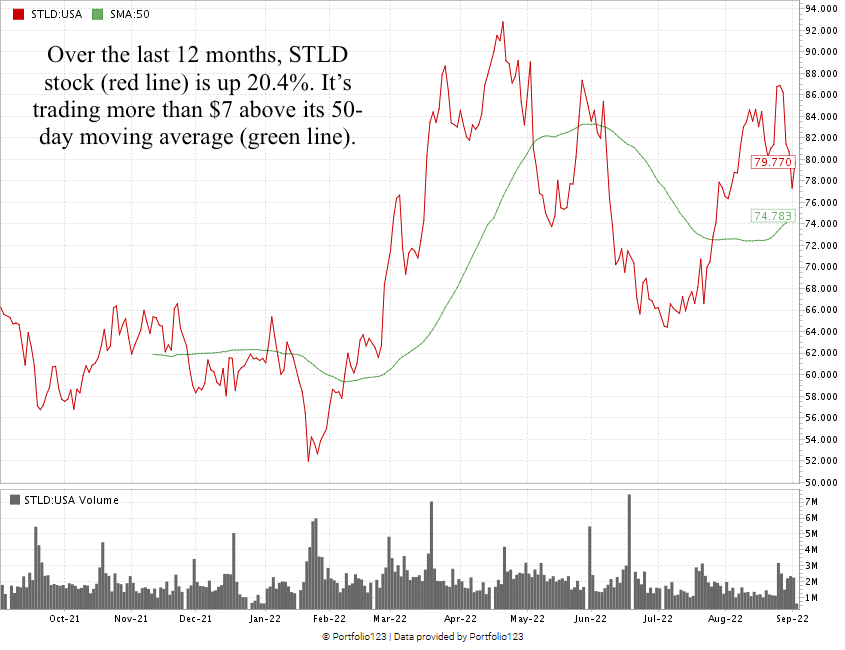

From a low in July to August 25, 2022, STLD stock rose 34.9%.

Only the broader market sell-off at the end of August stopped its momentum.

I’m confident it will regain its footing and shoot even higher.

Steel Dynamics Inc. stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Demand for steel won’t go away anytime soon.

The market for recycling steel is growing.

A leader in both producing and recycling steel, STLD is a strong contender for your portfolio.

Bonus: Steel Dynamics’ 1.6% forward dividend yield pays $1.36 per share, per year.

Stay Tuned: “Strong Bullish” Gas Station Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an American stock whose ticker symbol comes from its dinosaur logo.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.