Pessimists say President Biden’s budget proposal could sink the stock market. Realists understand that final budgets won’t include every idea floated.

A proposed billionaire tax and an increase in the corporate tax rate are capturing headlines. These measures would affect stocks. Billionaires would pay taxes on unrealized capital gains and could be forced to sell winning stocks to fund the tax, and higher corporate taxes would reduce earnings.

These factors could slow — but not collapse — the bull market.

Another idea in the budget could lead to a bear market and a slow recovery. Namely, the proposal to prevent corporate executives from selling shares for three years after a stock buyback.

According to The New York Times: “To support this move, the administration is likely to cite academic research that found company executives tend to sell far more stock in days following a buyback announcement than at any other time.”

That would reduce the incentive to execute stock buybacks. Executives often need to sell shares to remain diversified and protect their wealth.

That would also affect earnings. Share buybacks reduce the number of outstanding shares. This makes earnings per share higher. More than 52% of companies in the S&P 500 reduced their share count in the most recent quarter, and 15% of the companies on the index improved earnings by at least 4% with their buybacks.

According to analysts with Goldman Sachs, companies could buy back more than $1 trillion worth of stock this year, up 12% from $991 billion in 2021. That would make 2022 the second consecutive record-setting year.

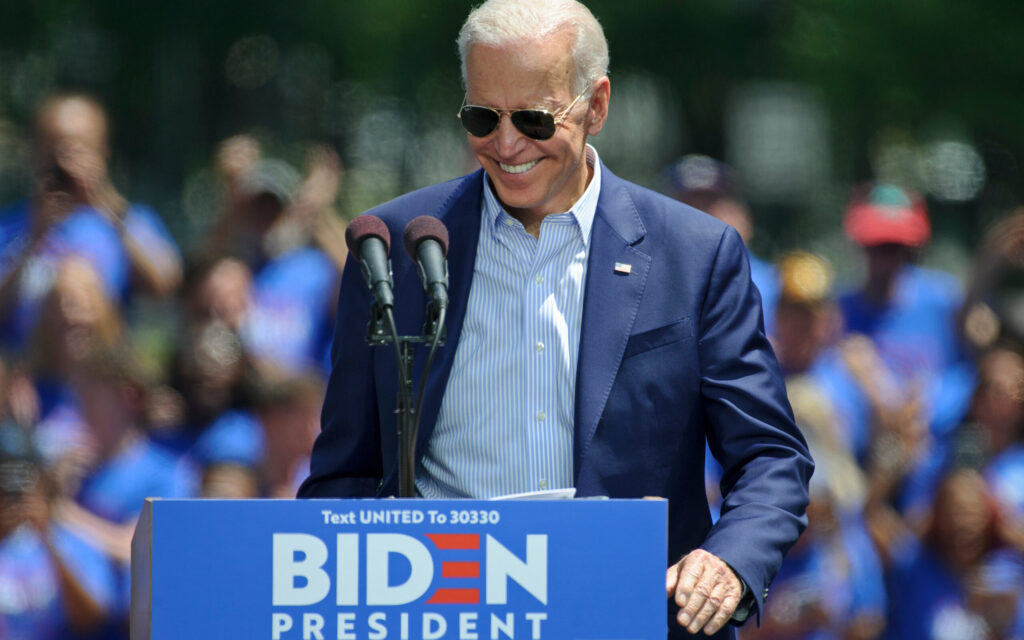

Biden’s Budget Threatens Corporate Optimism

Goldman based their analysis, in part, on announcements of buybacks. Companies tend to announce their plans when executives are optimistic about their business and they’re confident in their ability to execute.

“Authorizations have historically been a signal for executions in the subsequent year,” Goldman strategist David Kostin wrote. “YTD authorizations are also tracking above the record pace from 2021, pointing to managements’ belief that firms have excess liquidity.”

If Biden’s budget proposal passes, it eliminates this stock market’s support and could trigger a bear market.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.