The three kings of bond investing, Jeffrey Gundlach, Dan Ivascyn and Scott Minerd, have reportedly been lagging their respective benchmarks this year, according to a report by Reuters.

The cause of their underperformance is attributed to the the big rally in U.S. corporate bonds and Treasurys as investors turn away from a volatile stock market, sending yields down and causing the yield curve to invert several times the past couple of weeks. The inverted yield curve is a primary indicator of an impending recession.

U.S. corporate bonds have posted total returns of 13.4% this year year, according to Bank of America Merryl Lynch’s U.S. Corporate Bond Index. Treasury returns are up 8.1% year-to-date, according to Bloomberg’s and Barclays’ compiled index.

Exacerbating things is that about 95% of all investment-grade corporate debt in the world that has a positive yield is here in the United States, according to Back of America Merrill Lynch, which has investors around the world looking here.

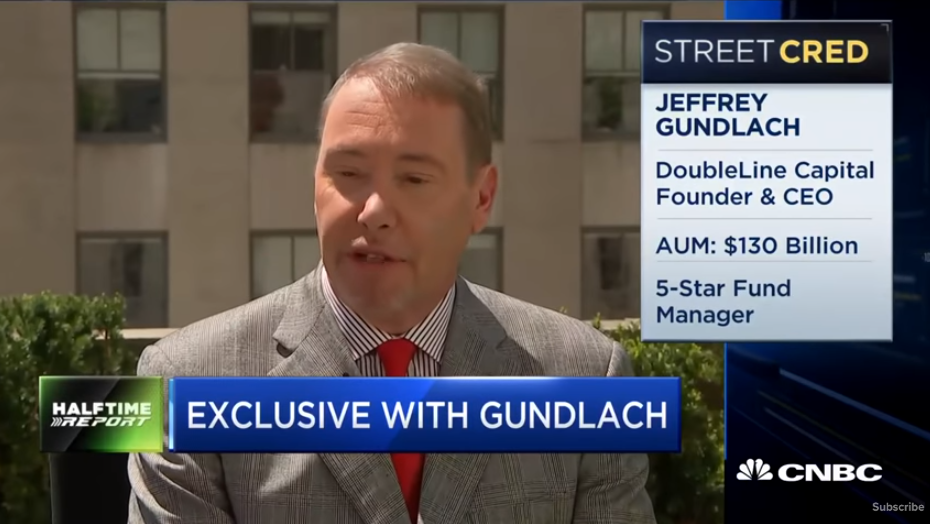

Gundlach is the CEO of DoubleLine Capital, Ivascyn is the chief investment officer of Pacific Investment Management Co. and Minerd is the global chief investment officer of Guggenheim Partners, and all three have failed to live up to their previous benchmarks this year.

All three also told Reuters they’re OK with their underperformance at this point because of what’s ahead for corporate bonds.

“We have never owned a single corporate bond in the Total Return Strategy dating back to 1993. Look it up,” Gundlach said. “When corporate bonds become very overvalued, especially when rates fall due to recession prospects increasing — well?”

The DoubleLine Total Return Fund (DBLTX.O) holds $54.5 billion in assets and is up 6.17% on the year, lagging its Intermediate Core-Plus Bond category by 2.50%, and lagging 90% of its peers this year. The Intermediate Core-Plus category is mainly invested in U.S. fixed-income issues like government, corporate and securitized debt, and holds assets of about $724 billion.

Gundlach said that while times aren’t great right now, things will come back around.

“Everybody knows what this fund is,” he said. “You know what you are getting. There are no surprises.”

Ivascyn, who manages $1.84 trillion in assets at Pimco, agreed.

“We believe that corporate credit is fundamentally weak and could overshoot to the downside if the economy deteriorates,” he said.

Ivascyn’s Pimco Income Fund (PIMIX.O) is the largest actively managed bond fund in excess of $130 billion and is lagging 93% of its Multisector Bond category contemporaries.

Minderd’s Guggenheim Total Return Bond Fund (GIBIX.O) is trailing 95% of its Intermediate Core-Plus Bond category mates this year.

“As the Fed begins its easing campaign to try to extend an already long-in-the-tooth expansion, credit spreads are already tight across the fixed-income spectrum,” Minerd told Reuters. “Credit spreads could get tighter in this liquidity-driven rally, but history has shown that the potential for widening from here is much greater.

“We think developed government bond yields are too low and could easily reverse so we are comfortable with low rate exposure.”