YOUGHAL, IRELAND — Today, we gasp in horror. We hold our breath in disbelief. And we rub our hands in greedy expectation.

The feds are doing something so stupid, it will bash the economy … and maybe even wreck the government, too. But they are doing it with such lunatic confidence, we think we can take it to the bank.

Taking shape here is not just another gloomy view of the world ahead, but a cheerful anticipation of the money that can be made (or at least not lost) by betting against it.

Injecting Money

We begin by checking the headlines. Markets Insider has this headline:

The Fed says it will continue overnight repos of at least $75 billion through November 4

The previous end date on this program of money-market-calming measures was October 10. But earlier this month, the Federal Reserve announced it would continue pumping up to $75 billion into the money markets until early November … with more and more to come if needed.

But that’s not all. The Fed is also injecting money into the system as part of its “reserve management” program; it began this week with $7.5 billion.

Together, these initiatives should put over $850 billion of new money into the system over the next 12 months — even without a crisis.

The fix is in, in other words.

Old Tricks

But to fully understand it, we need to go back to its genesis nearly half a century ago. In 1971, the feds pulled the old switcheroo, substituting a new currency — Federal Reserve notes — for the old, reliable gold-backed dollar.

The old dollar was handcuffed to gold at a fixed rate of $35 per ounce. Where gold went, the dollar went, too.

But the new dollar was more obedient; it went wherever its masters wanted it to go.

And for the last 30 years, the feds’ central bank — the Federal Reserve — has been slipping the new bills to Wall Street and the elite. It funded their speculations, their buybacks, and their bonuses … and it guaranteed their investments wouldn’t go down (or not for long, at any rate).

And it left them with about $30 trillion in extra wealth that they never earned. That — not greed, not robots, not Piketty’s silly r > g, not deregulation, not tax cuts — is why the rich are so much richer, compared to everyone else, than they were 30 years ago.

And now, after a brief and insincere flirtation with “normalcy,” the Fed is back to its old, perverted tricks — robbing the middle classes in order to reward the rich.

The nice thing about it is that it is so predictable. More fake new dollars. More debt. More nutty booms. More terrifying busts. And more inflation, with no Paul Volcker to straighten it out.

Handouts Galore

We’re not talking about just monetary policy. When the next crisis comes, both the Fed and the federal government will be handing out the new money. And not just to bankers and insiders.

To prove it, we turn to another headline, and remarkable article, this time from Reuters:

In planning for next U.S. recession, economists say, don’t fret about debt

Economists are divided about when the next U.S. recession will arrive, but they largely agree on this: the country will need to fight it with a massive fiscal program, and be ready to swallow deficits that may eclipse the trillion-dollar shortfall run by the Trump administration this year. (…)

In the next recession, the United States should contemplate “a pretty generous package,” of perhaps as much as $1.7 trillion, double the amount approved for recession fighting in early 2009 during a steep downturn, Karen Dynan, a former Fed and Treasury official now at the Peterson Institute for International Economics, said in a recent discussion of the world economic outlook.

“We do have fiscal space,” she said.

This pro-debt attitude finds broad agreement among corporate economists, academics, think tank analysts, and private forecasters alike, and not just in the U.S.

The article explains that the only issue outstanding is which boondoggles will get funded. Direct payments to taxpayers? Infrastructure? Climate change?

That is, of course, what the next election will decide. American writer Ambrose Bierce once described an election as an “advance auction of stolen goods.”

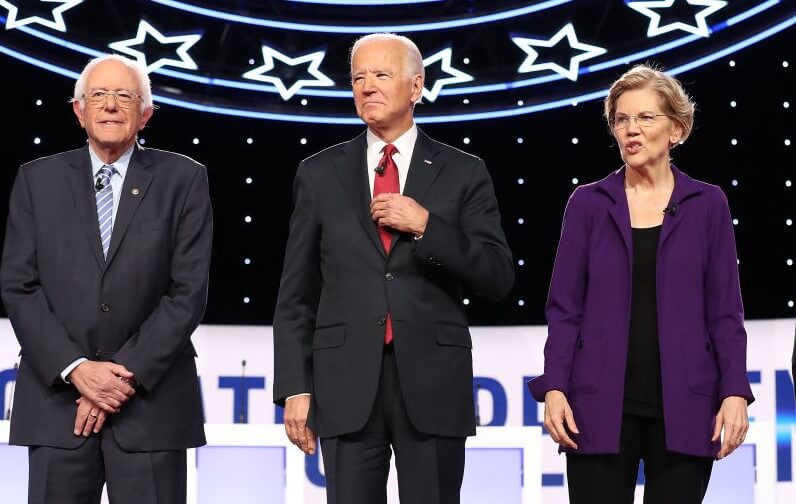

The 2020 presidential sweepstakes will be the biggest Rip-Off-A-Thon ever held. It will determine which grifters get the money.

But the money they get is not likely to be as valuable as they hoped. The whole system will soon be drowning in new dollars, which will lose value faster than ever.

So, what should you do? Isn’t it obvious?

Stay tuned …

Bill

• This article was originally published by Bonner & Partners. You can learn more about Bill and Bill Bonner’s Diary right here.