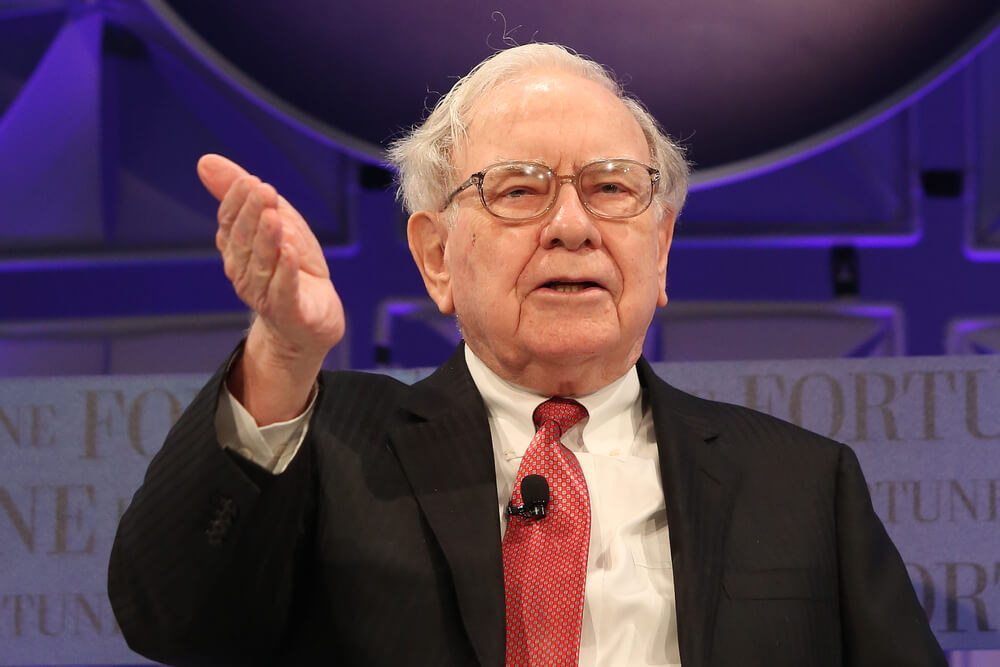

Forecasting where the market is headed is a crap shoot, even for the most seasoned and successful investors. However, investors are always looking for any tidbit hinting where the market is headed, and two of the most notable gurus in the game, Warren Buffett and Robert Shiller, are always looked to for advice.

Both have a stock market valuation method they prefer, and both of those are of course closely followed by financial experts to forecast market trends.

Both Buffett’s and Shiller’s methods indicate annual returns are about to slow drastically and could potentially even decline over the next decade. The forecasts were recently compiled by New York economist and financial expert Stephen Jones for a story by MarketWatch via Investopedia:

What Market Wizards Are Telling Us

(S&P 500 Index Performance Over Next 10 Years)

- Buffett Model: -2.0% average annual decline in the index

- Shiller Model: +2.6% average annual real total return

Source: Economist Stephen Jones per MarketWatchSignificance For Investors

Buffett has said in the past that the ratio of the S&P 500 Index to U.S. GDP is “probably the best single measure of where valuations stand,” per MW. He hasn’t made recent public comments on this matter, but there is no evidence that his view has changed. For this ratio to revert to long-term historical averages gradually over the next 10 years, the S&P 500 would fall by 2.0% per year.

Nonetheless, Buffett’s public statements indicate he still prefers stocks to bonds right now. “If I had a choice today for a 10-year purchase of a 10-year bond at whatever it is…or buying the S&P 500 and holding it for 10 years, I’d buy the S&P 500 in a second,” he told CNBC recently.Buffett is not the first person to suggest this metric. A similar one is the Q Ratio, associated with the late James Tobin, also a Nobel laureate. Q Ratio analysis suggests that stocks will fall 0.5% per year over the next decade.

Shiller’s View

Shiller formulated the cyclically-adjusted price/earnings ratio (CAPE), based on inflation-adjusted average earnings per share (EPS) over the past 10 years. This method is supposed to smooth the passing effects of the business cycle and one-off events on earnings.

While offering no specific predictions, Shiller has noted that valuations have been high relative to historic norms, and that low returns going forward are thus likely. Based on CAPE methodology, MW projects that real total returns, adjusted for inflation and including dividends, will average 2.6% annually over the next decade.

The current dividend yield for the S&P 500 is 2.0%, per The Wall Street Journal. This implies that the inflation-adjusted average annual increase in the value of the S&P 500 will be only about 0.6%.

Looking Ahead

The projections offered above rest on assumptions about GDP, corporate earnings, and inflation over the next decade that could change dramatically–and thus alter the market’s direction.

Regarding Buffett’s favored ratio, rising GDP down the road could support further gains in the S&P 500. And in the case of Shiller’s CAPE ratio, if earnings grow, and inflation stays low, that may justify even greater future annual returns than 2.6%.

But the reality of today’s market–driven by slowing GDP growth and slashed profit forecasts — suggests that the grim forecasts of these two market wizards’ models may be accurate.