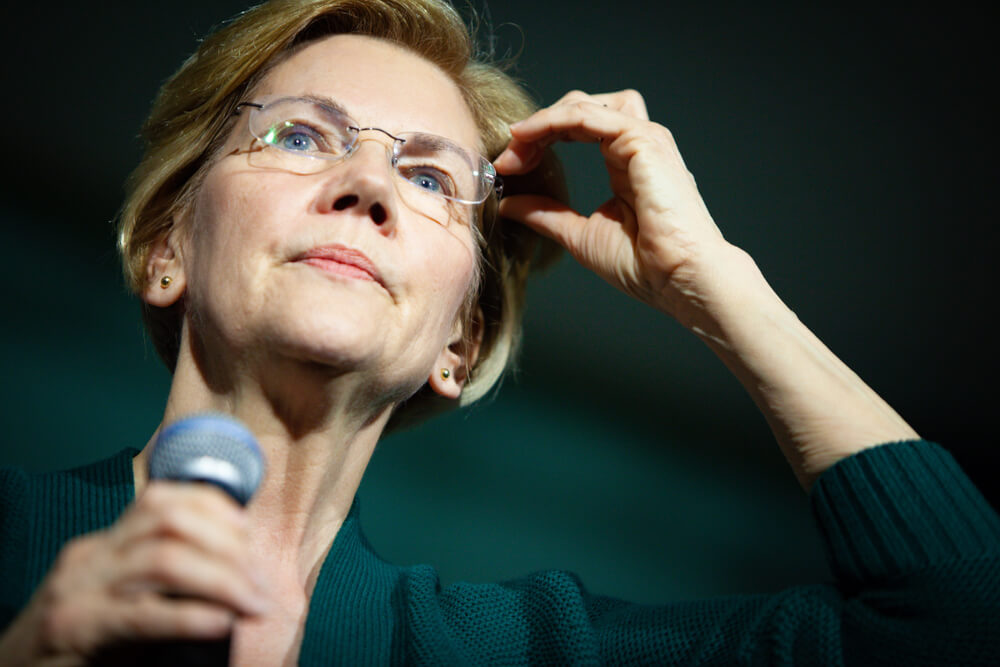

So as it turns out, Elizabeth Warren in fact does not have a plan for everything.

“It’s fascinating that the person who has a plan for everything has no plan for the single most consequential issue in this election in the minds of the American people across the board. And you know, credibility matters.”

Sure, she’s a veritable fountain of policy proposals, lapping the Democratic primary field several times over when it comes to big (bad) ideas.

She wants to soak the rich with a couple of different wealth taxes to pay for all of her social programs and giveaways, break up big tech companies and hammer Wall Street and big banks. Those programs include wiping out student loan debt ($640 billion), free college ($610 billion), green energy (a chunk of $27 billion) and universal childcare (a whopping $1.07 trillion) to name a few.

And yet with all of her plans she is coming up short — to say the least — on one of her biggest proposals that would affect every single taxpaying American: Medicare for All.

How short?

Oh, about $30 trillion — yes, that’s trillion with a ‘t’ and not a ‘b.’

Warren got a lot of heat at this week’s Democratic primary debate for dodging questions about how she (meaning taxpayers) will cover the $30 trillion needed to fund such a proposal, which also would wipe out private health insurance.

The reason she’s being vague is because, even with all her wealth taxes, her team doesn’t have a plan to pay for it. The most likely scenario is raising taxes on the middle class, but of course she doesn’t want to say that.

“Her taxes as they currently exist are not enough yet to cover fully replacing health insurance,” economist Emmanuel Saez, who worked with the Warren campaign to develop her wealth tax, told Bloomberg.

So even with her proposed wealth taxes, corporate surtaxes, increased estate taxes and wiping out President Donald Trump’s tax cuts, she’s still short a pretty big chunk of change.

She did say during the debate that “taxes will go up,” but refused to say exactly who they’ll go up for, other than the wealthy. Her campaign says it will continue reviewing options to fund free healthcare for everyone and will support pay-fors that help reduce costs for the middle class, according to Bloomberg.

Warren’s wealth tax is 2% on assets above $50 million and a 3% tax on fortunes above $1 billion. But after her other proposals are paid for there’s only about $303 billion left — a far cry than the $30 trillion needed to fund a government-run healthcare system.

According to her campaign, her agenda calls for about $6 trillion in all and her tax increases would amount to $7.3 trillion.

“She is offering a Medicare for All plan and not offering even close to enough to pay for it,” Tax Foundation economist Kyle Pomerleau said. “One place she hasn’t gone yet is raising the existing individual income tax for top earners.”

But even doing that, she still wouldn’t have nearly enough to pay for free healthcare for everyone. Sen. Bernie Sanders, who also is offering up Medicare for All, is at least bold enough to say it would come via raising taxes.

But during the debate, Warren wouldn’t answer a “yes or no” question about raising taxes on the working class, instead focusing on the overall costs of the plan.

“Costs will go up for the wealthy, they will go up for big corporations and for middle-class families, they will go down,” Warren said Tuesday night. “I will not sign a bill into law that does not lower costs for middle-class families.

“We know that there are a lot of different cost estimates for Medicare for All and they vary by trillions and trillions of dollars. We know there a lot of different revenue streams.”

Those revenue streams are the middle class, according to “public finance experts across the political spectrum,” says Bloomberg.

Saez also argued that by eliminating health care premiums for people covered through a work plan, it would free up more money to raise wages.

“It’s true that we might have to pay an extra tax but it can be structured in a way that we gain in extra wages, bigger than whatever extra tax will be there,” he said.

If they’re counting on employers to suddenly take the money they’ll save on health care and just give it to their employees as raises, we’ve reached the “pie in the sky” segment of this discussion.

Her top rival, former Vice President Joe Biden, who would like to expand Obamacare but also keep private plans intact, also hit her over the funding shortfall.

“I don’t want to pick on Elizabeth Warren but this is ridiculous, absolutely ridiculous,” Biden said Wednesday. “It’s fascinating that the person who has a plan for everything has no plan for the single most consequential issue in this election in the minds of the American people across the board. And you know, credibility matters.”