Investors may be looking the wrong way in this stock market rally.

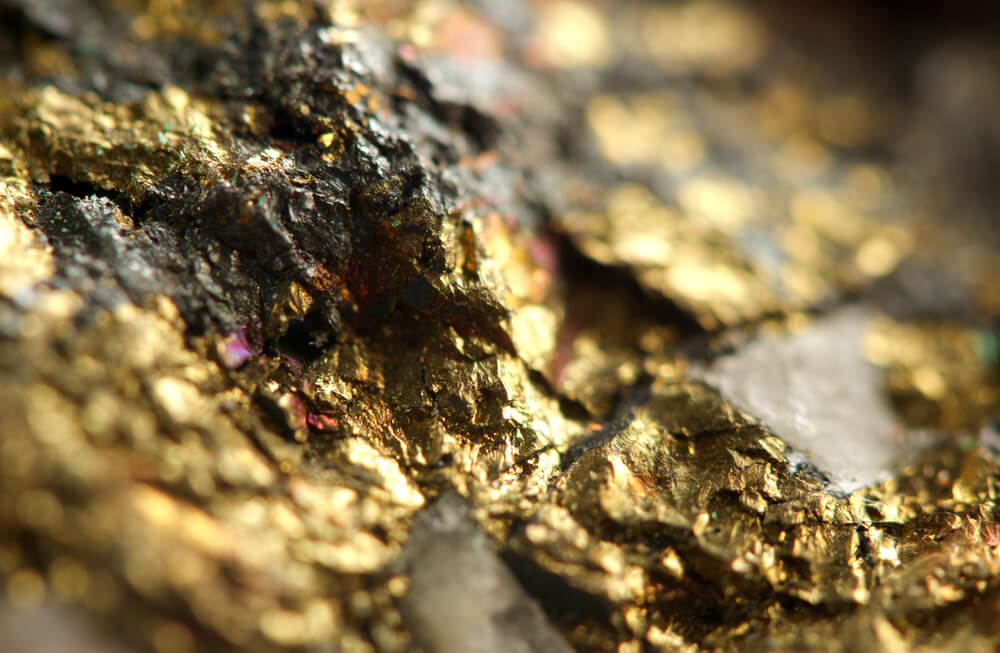

It seems intuitive: When the price of a commodity goes up, we should buy the producers. And that’s true for gold today.

But it’s not the case for oil producers right now. In this column, I’ll contrast the two and show you why gold miners are a buy and oil producers are not.

It’s important to understand that these companies are “price takers.” That’s different than most of the companies in the stock market. When Microsoft comes out with a new gaming console, they already know what they will charge for it. It doesn’t really matter if it only costs $50 in materials, they can charge $1,000 if the market will pay that much.

Why Gold Miners are a Better Buy Than Oil Producers

With commodity companies, they get the market price. For oil companies, they averaged over $60 per barrel for more than a decade. Even though the price fell hard in 2016, these giant companies expect oil prices around $60 per barrel. Lower than that, and they’re in trouble.

For gold companies, the low gold price over the last few years forced them to get lean. Most of them are profitable when gold is above $1,200 per ounce.

You can see the problem today. Oil prices are finally rising to $35 per barrel … and gold prices are over $1,700 per ounce for the first time since 2012.

Many investors, based on the number of emails I receive, are more interested in oil stocks today than in gold.

And that’s a huge mistake. Here’s why…

We’ll start with one of our big, independent oil and gas producers, Apache Corp. (NYSE: APA). In 2019, the company realized an 8% decline in oil price, from $65 per barrel in 2018 to $60 in 2019. That small decline in oil price created a 24% fall in operating cash flows, from $3.8 billion in 2018 to $2.9 billion in 2019.

In other words, a drop less than $5 in the oil price caused this giant company to lose a billion dollars in operating cash flow. That contributed to its massive $3.6 billion loss. Now, imagine how bad 2020 will be, when the average oil price so far is half of 2019’s average price.

Oil stocks fell because this information got priced in. There is no chance that they will be profitable. There is a good chance that many will either go bankrupt or take years to recover. They are rallying because speculators are too dumb to do the math.

Now let’s look at a giant gold miner, Newmont Mining (NYSE: NEM), in contrast. As we discussed earlier, the gold miners adjusted to low gold prices.

In 2018, Newmont sold its gold for just $1,260 per ounce. The company generated $158 per ounce in pure profit at that price.

In 2019, the gold price rose 11% to $1,399 per ounce. Newmont’s profit soared 42% to $225 per ounce. That’s free cash flow, so it’s real cash in the bank.

Now consider that the average price of gold in 2020 is up another 22% — over $300 per ounce. Newmont and its peers are going to have massive profits in 2020. That should continue for years.

But here’s the thing: Gold stocks, as tracked by the VanEck Vectors Gold Miners ETF (NYSE: GDX) are down 20% since January 2013. You can see it from the chart below:

What most investors see is the big rally in 2020. They think they missed out on the rally — but there hasn’t been a better time to buy gold miners in the last decade. The high price for GDX in 2012 was over $60 per share.

That’s over 70% higher than today. The takeaway here is simple — don’t buy oil companies, buy gold miners.

Good Investing,

Matt Badiali

• Money & Markets contributor Matt Badiali is the Editor of