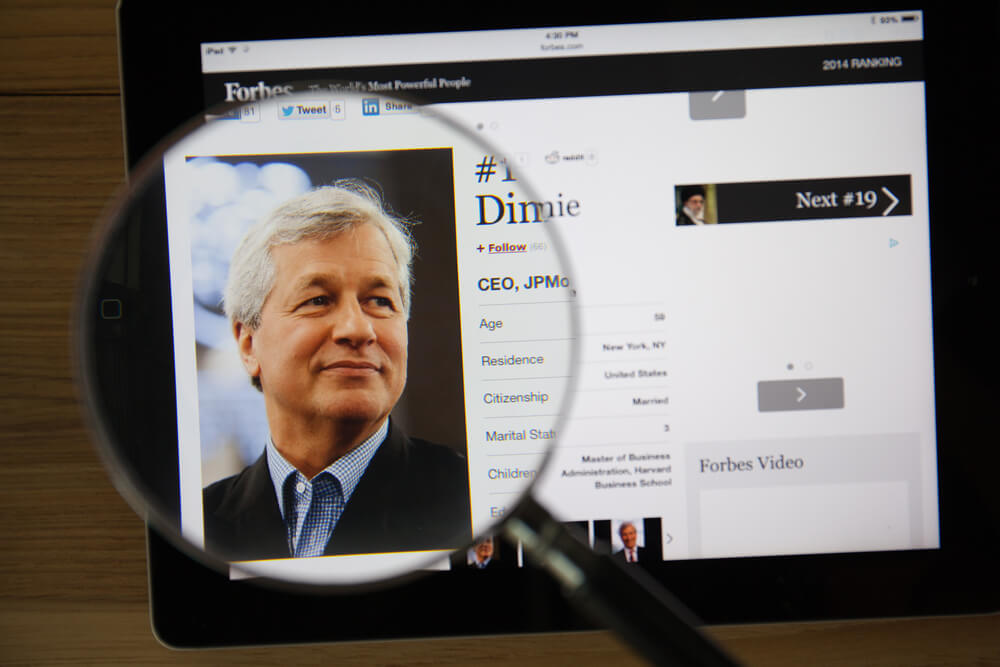

JPMorgan CEO Jamie Dimon released his annual letter to shareholders Thursday, bashing socialism, defending record stock buybacks and warning investors of volatility ahead for the markets.

Per CNBC:

“When governments control companies, economic assets (companies, lenders and so on) over time are used to further political interests – leading to inefficient companies and markets, enormous favoritism and corruption,” Dimon wrote in the letter, which was released along with the bank’s 2018 annual report.

“Socialism inevitably produces stagnation, corruption and often worse – such as authoritarian government officials who often have an increasing ability to interfere with both the economy and individual lives – which they frequently do to maintain power. This would be as much a disaster for our country as it has been in the other places it’s been tried,” he added.

Dimon in his annual letter, which is required reading every year for Warren Buffett and others on Wall Street, acknowledges there are flaws with capitalism and that it should be combined with a strong social safety net.

“I am not an advocate for unregulated, unvarnished, free-for-all capitalism. (Few people I know are.) But we shouldn’t forget that true freedom and free enterprise (capitalism) are, at some point, inexorably linked,” Dimon said.

Defense of big business

His comments come amid an escalating debate about America’s future and ahead of an election season that is starting to heat up.

A Democratic faction led by presidential candidate Sen. Bernie Sanders and echoed by freshman upstarts including New York Rep. Alexandria Ocasio-Cortez — both of whom identify as democratic socialists — have called into question the fundamental pillars of the U.S. system and have advocated new program that echo socialist ideals.

Without wading directly into the political debate, Dimon defended the capitalistic system.

“Show me a country without any large, successful companies, and I will show you an unsuccessful country – with too few jobs and not enough opportunity as an outcome,” he wrote. “And no country would be better off without its large, successful companies in addition to its midsized and small companies. Private enterprise is the true engine of growth in any country.”

At the same time, he said his bank, the largest by assets in the U.S., is bracing for a possible economic slowdown, though he does not expect a recession.

“The key point here is that a fairly healthy U.S. economy will be confronting a wide variety of issues in 2020 and 2021,” Dimon wrote. “It’s hard to look at all the issues facing the world and not think that the range of possible outcomes is broader and that the odds of bad outcomes might be increasing.”

The letter featured both a look to the future and the challenges ahead, as well as a look back at the financial crisis and what lessons have been learned.

Concerns about next crisis

Regulation needs to be stringent to prevent another crisis, Dimon said, with particular focus on several areas, including nonbank lenders, mortgage reform and liquidity levels.

One area he defended was stock buybacks, which have come under scrutiny from critics who believe companies used 2017′s landmark tax cuts to pad investors’ pockets. Dimon called share repurchases “an essential part of proper capital allocation” though he acknowledged that companies should focus on investing for the future.

“Many investors legitimately demand that companies think long term and explain their strategies and policies,” he said. “Meanwhile, these same investors, who demand long-term thinking from companies, often invest in funds that are paid a lot of money for how a stock performs in one year. I hope these investors appreciate the disconnect and hope they will consider the pressures for short-term performance they may have helped to create.”

He warned about over-regulation, cautioning that in the next financial crisis, big institutions like J.P. Morgan won’t be able to provide the lending they did during the last crisis.

“When the next real downturn begins, banks will be constrained – both psychologically and by new regulations – from lending freely into the marketplace, as many of us did in 2008 and 2009. New regulations mean that banks will have to maintain more liquidity going into a downturn, be prepared for the impacts of even tougher stress tests and hold more capital because capital requirements are even more procyclical than in the past. Effectively, some new rules will force capital to the sidelines just when it might be needed most by clients and the markets,” he wrote.