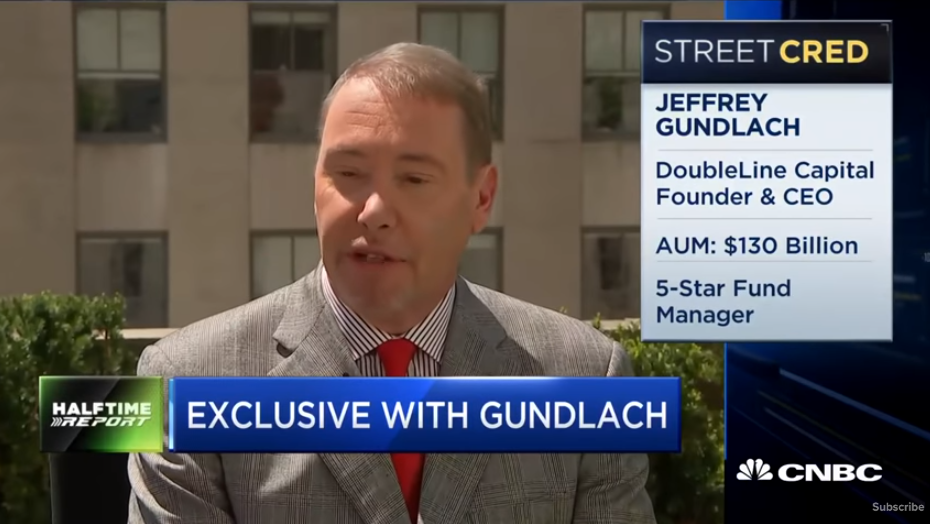

DoubleLine Capital CEO Jeffrey Gundlach held a recent webcast with investors in which the self-described “Bond King” said U.S. GDP growth relies almost “exclusively” on rising government, corporate and mortgage debt, and there is a 50% chance the economy sinks into recession in the next year.

“Nominal GDP growth over the past five years would have been negative if U.S. public debt had not increased,” Gundlach said.

Over the past five years, the nominal GDP grew by 4.3%, while public debt grew by 4.7%, higher than the entire country’s GDP.

Why is that noteworthy? It can’t possibly be sustained, Gundlach says, because it now costs several dollars of debt to create just one dollar of GDP. And as debt continues to rise, so do the interest payments, which brings us to the soaring U.S. national debt, which is a major cause of concern.

Gundlach also went on to say second-quarter GDP will be a big letdown from the first quarter’s 3.2%, which was surprisingly high.

The GDP will sink as prices rebound, which also will effect the stock market, which has had a tremendous year thus far. The S&P 500, the Dow Jones and the Nasdaq have risen about 15%, 11% and nearly 20% on the year, respectively.

Yet if the economic numbers and GDP start coming disappointing Wall Street, we should see more weakness in the market, Gundlach said.

While President Donald Trump touts the strong economic numbers, Gundlach believes weakness is evident in economic indicators, citing the Atlanta Fed’s forecasted 1.6% real GDP in the second quarter, which it then downgraded to 1.2% a week later. Retail sales figures were weaker than expected, as was industrial output data for April.

Gundlach noted the Atlanta Fed figures can be volatile, but he also noted Citigroup’s Economic Data Change Index, which hit its lowest level since the 2008 financial crisis.

As for the probability of recession, Gundlach says it “would be extremely high” the next two years, and the chance for one in the next year is about 50%, and about 30% in the next six months.

Gundlach also said he is “comfortably” long on gold because U.S. stocks and bonds are headed for more volatility. He said gold prices are likely headed for $1,300 an ounce.