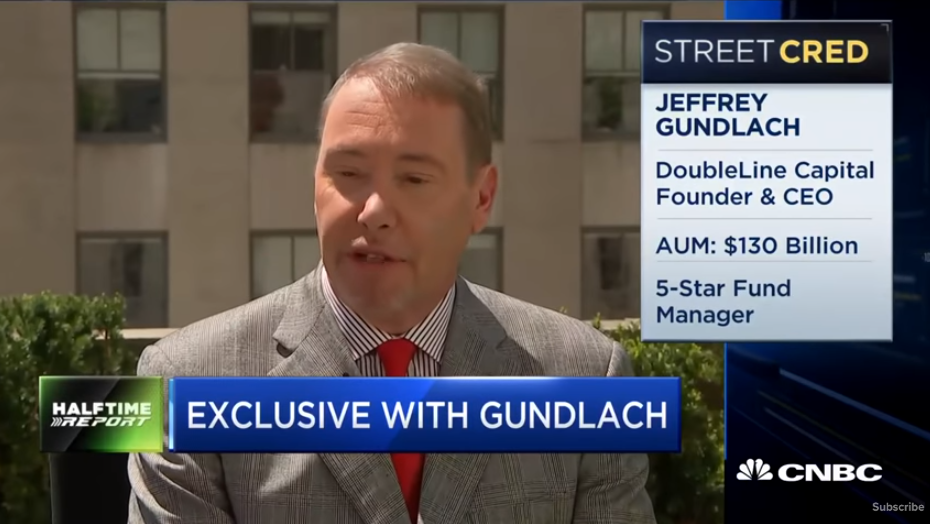

DoubleLine CEO, respected markets forecaster and “Bond King” Jeffrey Gundlach said the chances of recession are rapidly rising and that he is banking on gold with tough times approaching.

“I am certainly long on gold,” Gundlach said during a webcast with investors on Thursday, adding that he expects the U.S. dollar to finish the year lower. When the dollar weakens, gold generally rises as it becomes cheaper for investors holding other currencies.

Gold prices indeed hit a three-month high in June as investors flee equities amid escalating trade tensions between the U.S. and China. The dollar also fell to an 11-week low on Wednesday this week as Wall Street is increasingly betting on a Federal Reserve interest rate cut in the coming months.

Gundlach noted that 2019 has been the “opposite of 2018” because gold, Bitcoin, stocks and bonds all are making money. Despite the ongoing trade war and nearly having new tariffs placed on Mexico, the S&P 500 is up more than 15% on the year, even as the 10-year Treasury fell to its lowest levels since 2017.

The benchmark yield also dipped below the three-month note, forming an inverted yield curve, a time-tested sign of an incoming recession. There has been much debate of late whether or not the yield curve is as accurate as it used to be in forecasting recessions, but it is still closely watched by economic experts and the Federal Reserve.

Gundlach said he sees a 40% to 45% chance of a recession hitting the U.S. economy in the next six months, but that rises to 65% within the next year.

Several warning lights are blinking, Gundlach said, including the spread between consumer confidence expectations and current conditions, which in near all-time lows.

Gundlach also warned of the skyrocketing national debt, which could get “much, much worse in the next recession,” he said, also noting that despite low rates, U.S. debt interest as a percentage of GDP is expected to hit new records.