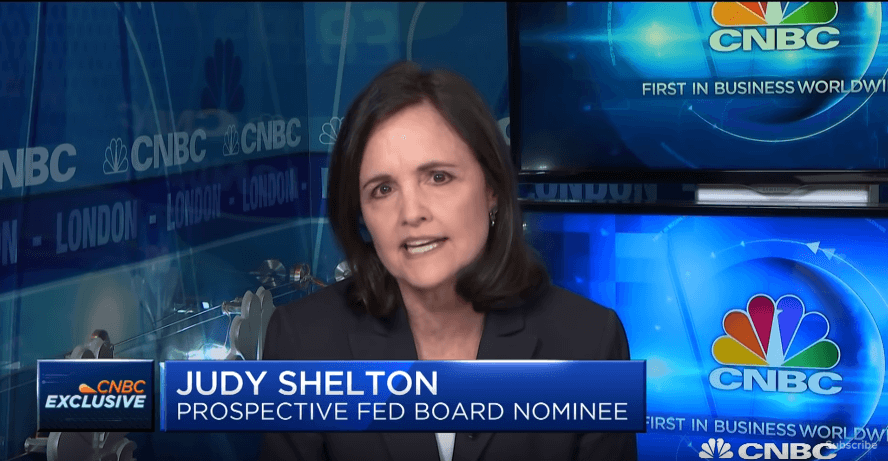

With two seats still vacant on the Federal Reserve board, potential nominee Judy Shelton wants to provide a new perspective for the Fed’s approach to U.S. economic policy, particularly in the methodology behind setting interest rates.

Shelton has been vetted by the Trump administration according to the New York Times after being interviewed by some officials in the White House concerning the position, including economic adviser Lawrence Kudlow. The last two candidates that received endorsement did not pan out as both Herman Cain and Stephen Moore withdrew their candidacies after not receiving backing from the Senate.

Shelton served as an informal adviser for President Donald Trump during his 2016 campaign, and at that time she was critical of lower interest rates and their tendencies to boost wealthy investors and corporations, but she has shifted her views since then according to an interview with the Wall Street Journal.

“Things have changed,” Shelton said as she called to the success of Trump’s tax and regulatory policies and how they have boosted the economy without increasing inflation which is not how the economy used to work earlier this decade.

“It was just a matter of people arbitraging….The Fed was feeding the market and the beneficiaries were already-wealthy investors,” Shelton told the WSJ. “The picture has changed because of the rest of the pro-growth agenda kicking in.”

So what kind of changes does Shelton have in mind if she was nominated and confirmed for the Fed board? Shelton says she would first look to the markets as way to determine economic policy according to her interview with the WSJ.

“What bothers me most about the way the Federal Reserve currently operates is more the mechanism,” she said. “We can talk about whether rates should go up or down,” she said. “I would like to see more market-determined rates.”

The Fed used to change levels of reserves, or deposits, in the banking system to set target interest rates, but that all changed with the financial crisis in 2008 when it flooded reserves with trillions of dollars while buying bonds. As it pays interest on those reserves it sets the current interest rate higher or lower.

“It’s like universal basic income for banks. They get paid to do nothing,” Shelton said in opposition to the current way the Fed works. “I suppose the Fed could say that’s our primary way to raise interest rates, but I think it’s very unhealthy.”

Her plan of attack would be to phase out interest payments on reserves over a one to two-year period. She told the WSJ that if inflation became a concern, the Fed could sell off bond assets in their $3.9 trillion portfolio.

People familiar with the search process to fill the Fed position have said that Shelton is a favorite of Kudlow, but “the people that Larry would like are not necessarily the people that Trump would like,” someone told the WSJ citing her past views.