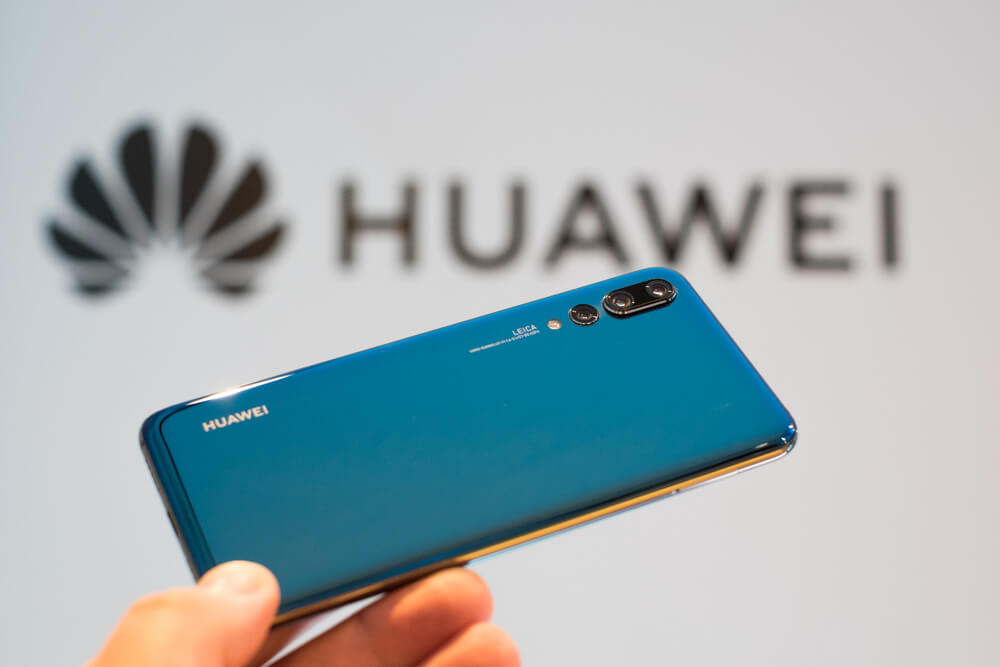

Taiwan is mulling an expansion of its five-year-old ban on network equipment produced by Chinese companies Huawei Technologies and ZTE Corp. amid security concerns, and more in Tuesday’s Markets In Brief.

Officials sought over the weekend to reassure lawmakers and the public that such measures have been effective and the threat to the communications sector is minimal.

On Monday, legislators called for extending the ban on Huawei to the financial industry, where it has reportedly sought business providing digital finance services.

Financial Supervisory Commission Chairman Wellington Koo was quoted by local media as saying the government would consider such a move based on provisions under Taiwanese law and World Trade Organization rules.

Most Taiwanese banks use components made by IBM in their servers and Huawei doesn’t have a high market share in terms of such equipment,” he was quoted as saying by the newspaper Taipei Times.

The commission itself does not use any Chinese-made cybersecurity equipment, Koo said.

Huawei, based in southern China’s Shenzhen, near Hong Kong, is the world’s largest supplier of network gear. ZTE is one of its rivals

Huawei has established a presence in Taiwan, with its handsets among the top sellers. The company also sponsors a Christmas extravaganza in a Taipei suburb that features a giant Santa emblazoned with Huawei’s logo.

While several countries have similar bans in place, the risk for Taiwan is potentially greater since China claims the island as its own territory and threatens to use military force to bring it under its control. Back-doors that some allege Huawei has built into its products could give Beijing access to military and economic secrets or even to disable crucial infrastructure in the event of a conflict.

Taiwan has already accused China of meddling in last month’s local elections by spreading false news online.

MARKETS IN BRIEF

US Wholesale Prices Rise 0.1%., a Sign Inflation in Check

U.S. wholesale prices barely rose last month as a sharp decline in the cost of gas offset pricier freight trucking services and mobile phone plans.

The Labor Department said Tuesday that the producer price index — which tracks cost changes before they reach the consumer — increased 0.1 percent in November from the previous month. That’s down sharply from a 0.6 percent gain in October. Wholesale prices rose 2.5 percent from a year ago, the smallest annual increase this year.

Excluding the volatile food and energy categories, wholesale prices rose 0.3 percent in October and 2.7 percent from a year earlier.

The figures suggest inflation pressures have subsided since late last year. That could affect the Federal Reserve’s deliberations on how quickly to lift short-term interest rates in 2019. Fed policymakers are expected to hike rates for the fourth time this year at their next meeting later this month. But the pace of rate increases next year is uncertain as recent speeches by some Fed officials have hinted that the central bank could take a more wait-and- see approach

Consumer prices rose 2.5 percent in October, the government said last month. Excluding food and energy, they rose 2.1 percent.

That’s just above the Fed’s target of 2 percent. The Fed seeks to keep inflation at that level to avoid rapidly rising prices but also to prevent a destabilizing bout of deflation, which lowers prices but also wages and can make it much harder to repay debts.

Wholesale gas prices fell 14 percent last month, the steepest fall since February 2016. That is a function of lower oil prices, which have plunged from $75 a barrel in early October to $51.70 on Tuesday. The sharp fall has prompted the oil cartel OPEC to plan production cuts to boost prices.

Lower wholesale prices could bring more relief at the pump for consumers. The average price for a gallon of gas nationwide fell 29 cents from a month ago to $2.41 Tuesday.

Canada’s Aurora Cannabis Buys Mexico’s Farmacias Magistrales

Aurora Cannabis Inc. of Edmonton, Alberta, said Monday it has signed a letter of intent to acquire all outstanding shares of Mexico’s Farmacias Magistrales SA.

Farmacias Magistrales is a Mexican importer of raw materials containing THC, the active ingredient in marijuana. It will distribute medical cannabis products containing over 1 percent THC, apparently through health care professionals.

In 2017, Mexico approved the use of marijuana for medicinal purposes. The previous year, the Mexican government began granting permits letting some patients import medicinal marijuana products.

The Farmacias web page is still under construction, but Aurora said in a press statement that the company is Mexico’s first and only federally licensed importer of THC products. The deal is subject to regulatory approval.

Aurora started as a medicinal cannabis producer in 2016.

Canada has become a leader in the global marijuana industry after the country became the world’s largest legal marijuana marketplace in October.

Hemp Supporters Cheer Crop’s Inclusion in Farm Bill Deal

Hemp’s supporters are cheering a final agreement on the federal farm bill that would legalize the crop that’s making a comeback in Kentucky.

Senate Majority Leader Mitch McConnell said Tuesday that the crop is “ready to take off” and has the potential to become a significant cash crop.

McConnell has played a key role in turning hemp into a legal crop by removing it from the federal list of controlled substances.

Growing hemp without a federal permit was banned decades ago because of its ties to marijuana. Hemp and marijuana are the same species, but hemp has a negligible amount of THC, the psychoactive compound that gives marijuana users a high.

The 2014 farm bill allowed hemp to be grown on an experimental basis. Kentucky farmers planted 6,700 acres (2,710 hectares) of hemp in 2018.

UK Wages Rising at Decade High While Employment Hits Record

Official figures show that wages in Britain are rising at their fastest rate in a decade while employment has hit a record high.

The Office for National Statistics said Tuesday that average earnings were up 3.3 percent in the three months to October from the year before. That’s the highest rate since the summer of 2008, just before the most acute phase of the global financial crisis. Meanwhile, employment rose by 79,000 to 32.48 million.

The figures provide further evidence that the labor market remains robust despite the uncertainty surrounding Brexit.

However, with concerns rising that Britain may crash out of the European Union in March with no deal, there are worries that firms may start laying off staff as they put in place contingency measures.

Greece: Parliament to Vote On Canceling Further Pension Cuts

Greek lawmakers are debating legislation cancelling a major round of pension cuts which were to take effect on Jan. 1, after the country secured the agreement of bailout lenders that the cuts were no longer necessary for a balanced budget.

Parliament is to vote Tuesday on whether to cancel articles in a law passed last year that would impose cuts worth 1 percent of gross domestic product. The measures would have seen 1.4 million of Greece’s 2.6 million pensioners face monthly losses of at least 14 percent, according to European Commission estimates.

Greece’s third and final international bailout program ended in August, but the country pledged to continue imposing stringent fiscal policies for years in return for lenders’ promise to ease repayment terms on existing loans.

© The Associated Press. All rights reserved.