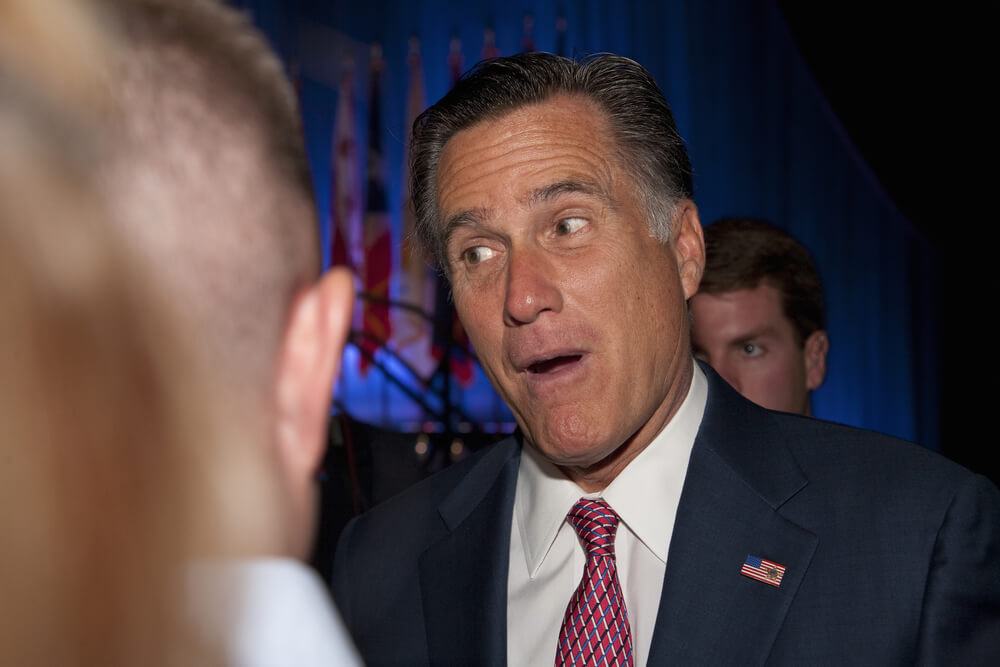

Social Security, along with other programs like Medicare, faces a grim future concerning funding, but Utah Sen. Mitt Romney may have a solution.

This week, Romney and a group of bipartisan senators introduced a bill that would examine the solvency of government trust funds like the Social Security Old-Age and Survivors Insurance along with Medicare Hospital Insurance. The Social Security trusts are projected to run out of funds by 2035 if no fix is implemented, which would lead to only 80% of benefits being paid out to individuals.

Romney’s plan, the Time to Rescue United States’ Trusts Act (TRUST), would create bipartisan committees for each fund tasked with developing legislation to “restore and strengthen endangered federal trust funds,” according to a press release announcing the bill.

“We must put in place a responsible process now to prevent dramatic cuts to programs like Social Security and Medicare or be forced to enact massive tax hikes down the road, both of which would be devastating to middle-class Americans,” Romney said while promoting the bill.

But Romney’s plan is being blasted for lack of transparency and details. Social Security Works President Nancy Altman blamed Romney for “acting true to his income” with his plan that would provide cover to perform the very cuts that he says the bill is trying to prevent.

“They want to pretend that they’re saving the program, and they are going to do it behind closed doors in a fast-track process,” she continued. “They want to do something the American people don’t want, which is why they’re doing it this way.”

Dan Adcock, director of government relations at the National Committee to Preserve Social Security & Medicare, does think it’s “important to address solvency,” but making sure the benefits are adequate is of equal importance “because of the struggle that the middle class and working class have these days in saving for retirement.”

The criticisms aren’t completely unfounded, either, as Romney pushed to raise the retirement age during his 2012 presidential run.

The Social Security 2100 Act could be the solution for adequacy issues. Created by Rep. John Larson, D-Conn., and co-sponsored by 208 House Democrats, the bill could soon move to the House floor after a markup by the House Ways and Means Committee. Here’s how the proposal would address concerns raised by Adcock, per CNBC:

The Social Security 2100 Act calls for increasing benefits, including a broad boost equal to 2% of the average benefit and a new minimum benefit that would be 25% above the poverty line.

It would also raise the income thresholds before benefits are taxed to $50,000 for individuals and $100,000 for couples, up from $25,000 and $32,000, respectively.

To pay for those changes, the bill also calls for applying payroll taxes to wages above $400,000. Only wages up to $132,900 are currently taxed.