Ron Paul says we’re currently in the midst of the biggest bond bubble in history and negative interest rates are going to wreck the global economy as a whole, and the U.S. won’t be spared.

“I don’t think anything even existed coming close to what we’re facing today.”

“We will join the rest of them and go to total negative rates in hopes that that will be the solution,” Paul said on CNBC’s “Futures Now” program. “We’ve never had as many currencies in negative interest rates. $17 trillion worth of bonds (are) in negative interest rates. It’s never existed before. And that’s a bubble. So we’re in the biggest bond bubble in history and it’s going to burst.”

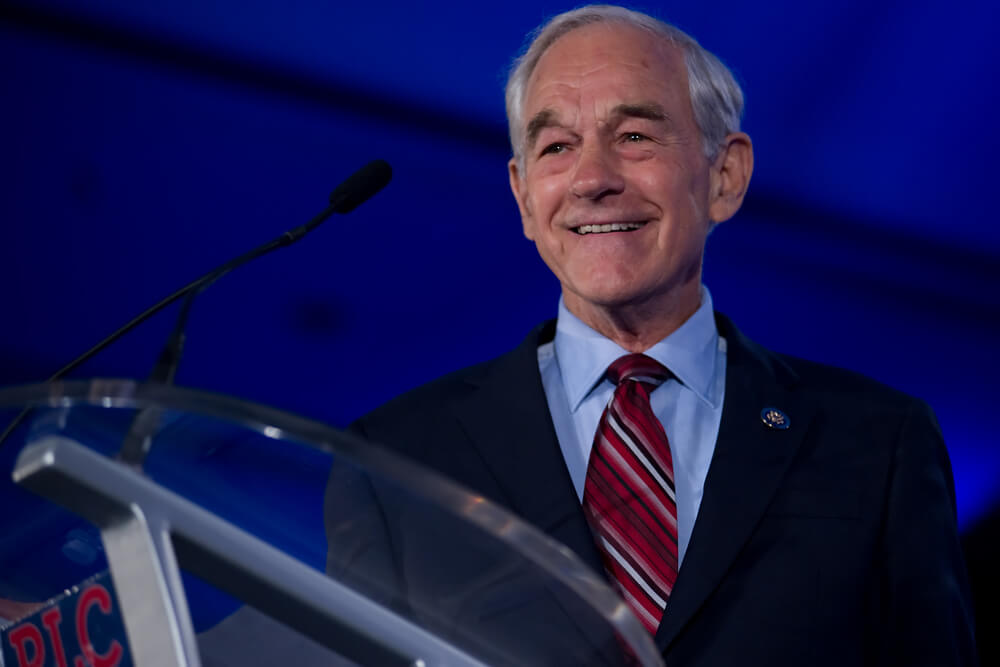

Paul is a former Libertarian and Republican congressman and presidential candidate who is famous in part for his economic and stock market warnings. Paul also is well-known for his stances on the U.S. Federal Reserve, constantly calling for Congress to audit and end the Fed.

The Fed is expected to cut interest rates for the second time in more than a decade when the Federal Open Market Committee meets again Sept. 17-18. However, Paul doesn’t believe any amount of easing by the central bank is going to save the U.S. economy when the bubble finally bursts.

“You can’t predict exactly where the creation of credit goes,” Paul said. “We have a ton of inflation with all that QE (quantitative easing). And every time you lower interest rates below market levels and create new credit, that’s a bubble.”

Paul has been warning of a market collapse of up to 50% or more for several years now. With talk about negative interest rates from U.S. President Donald Trump, Paul said the danger of the bubble ballooning to unprecedented levels could speed the demise of the markets.

“You don’t know this precise time. But you know it can happen,” he said. “How do you sell a bond that pays a negative rate? Who’s going to jump up and down?

“I don’t think anything even existed coming close to what we’re facing today,” he later added.