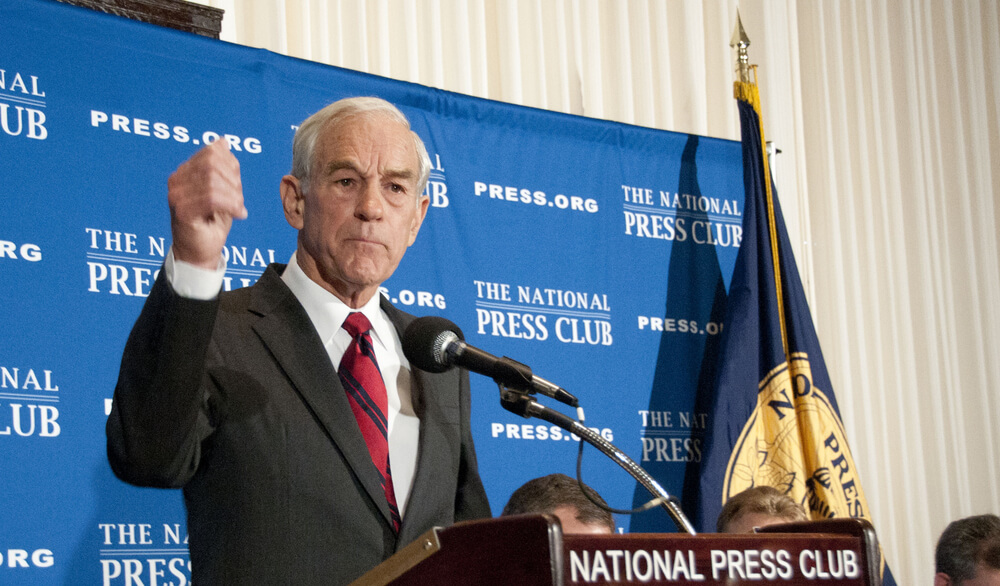

It’s been just more than a decade since the Great Recession began in 2008, and former Libertarian and Republican presidential candidate Ron Paul wonders in his weekly column if another one is right around the corner, soon to pop because of the Federal Reserve.

Per his column:

In 2001-2002 the Federal Reserve responded to the economic downturn caused by the bursting of the technology bubble by pumping money into the economy. This new money ended up in the housing market. This was because the so-called conservative Bush administration, like the “liberal” Clinton administration before it, was using the Community Reinvestment Act and government-sponsored enterprises Fannie Mae and Freddie Mac to make mortgages available to anyone who wanted one — regardless of income or credit history.

Paul says banks and lenders quickly embraced the “ownership society” agenda with a “lend first, ask questions when foreclosing” policy that ended up disastrous for the U.S. economy.

The result? Millions of Americans found themselves in homes they couldn’t afford, setting the stage for the 2008 housing crisis.

Paul says the government should have stayed out of it and let the downturn run its course, correcting malinvestments made during the “Fed-created boom,” which would have ensured the recovery would be based on a strong foundation rather than another bubble, a bubble that could be ready to blow up in our faces in the near future.

Of course Congress did exactly the opposite, bailing out Wall Street and the big banks. The Federal Reserve cut interest rates to historic lows and embarked on a desperate attempt to inflate the economy via QE 1, 2, and 3.

Low interest rates and quantitative easing have left the Fed with a dilemma. In order to avoid a return to 1970s-era inflation — or worse, it must raise interest rates and draw down its balance sheet. However, raising rates too much risks popping what financial writer Graham Summers calls the “everything bubble.”

Paul notes a number of current bubbles: credit card debt of more than $1 trillion, another $1.5 trillion in student loans, auto loans and yet another housing bubble on the brink. But there’s one bubble in particular that scares him most — the national debt that currently exceeds $21 trillion and is expanding by “tens of thousands of dollars per second.”

This is where he says the Federal Reserve will protect the government to the best of its ability by not raising interest rates so as not to explode the national debt, but rather it will go with slight increases to delay bursting the “everything bubble.”

But since we have failed to learn anything from the 2008 Great Recession, Paul says, the Fed will fail and we will experience a recession worse than the Great Depression of the 1920s.

This crisis is rooted in the failure to learn the lessons of 2008 and of every other recession since the Fed’s creation: A secretive central bank should not be allowed to manipulate interest rates and distort economic signals regarding market conditions. Such action leads to malinvestment and an explosion of individual, business, and government debt. This may cause a temporary boom, but the boom soon will be followed by a bust. The only way this cycle can be broken without a major crisis is for Congress both to restore people’s right to use the currency of their choice and to audit and then end the Fed.