We all like things. We like them so much that we’ve built an entire Internet of Things.

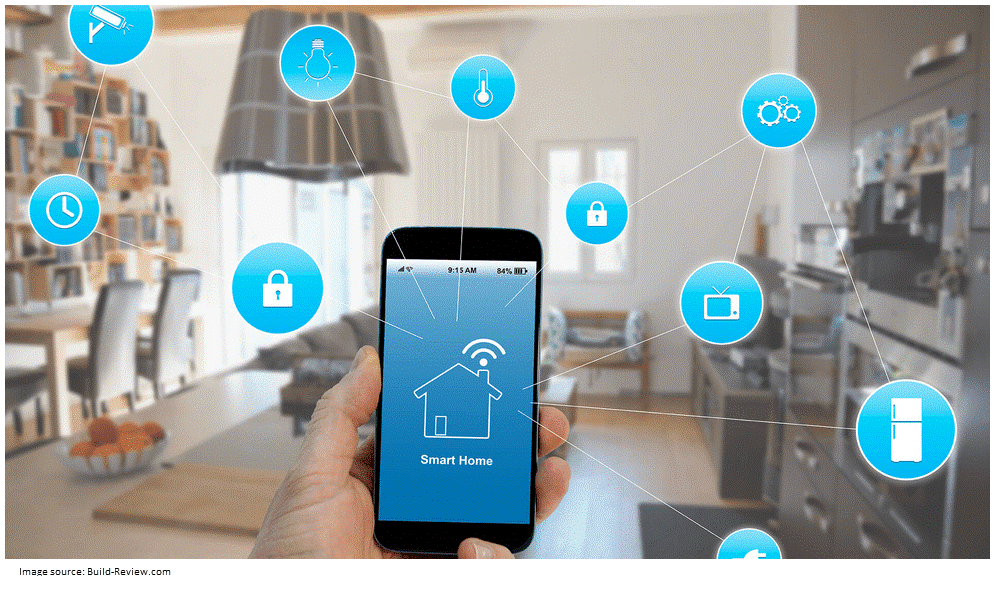

This network of interconnected “things” can range from your home’s thermostat and appliances to devices like your smartwatch, Amazon Alexa or Google Home.

They use embedded sensors and software to exchange data with other devices and systems over the internet. The Internet of Things (IoT) is what allows you to tell Alexa to “dim the lights” or use your thermostat app to turn off the AC while you are away at work.

It’s a somewhat new concept, but it’s starting to take off.

Internet of Things Market

In 2017, consumers spent around $110 billion on devices considered part of the IoT.

By 2025, that spending is expected to grow to $1.5 trillion.

Just between 2020 and 2025, end user spending on the IoT will jump 531%.

As you can see in the chart below, it’s a potentially huge market. And I’ve got the perfect stock to buy before growth surges higher.

About Synaptics Inc.

The stock I am recommending today is Synaptics Inc. (Nasdaq: SYNA).

Synaptics started as a company developing human interface products for electronic devices like touchpads for laptops, touch displays for smartphones, tablets and automobiles. It even developed the fingerprint ID technology that some smartphones use.

But the company has transformed.

In 2020, the company paid $250 million to buy Broadcom Inc.’s wireless IoT business. That business included Wi-Fi, Bluetooth and GPS technologies.

The acquisition paid off for Synaptics in the fourth quarter of 2020.

Synaptics reported profits of $2.30 per share — up over the $2.04 per share it reported in the same quarter a year earlier — and beat Wall Street’s consensus of $2.13 per share.

In that quarter, Synaptics reported the highest gross margin, net income and per-share profits in its history.

Since March 2020, shares of Synaptics have grown 159% to where they are priced today.

SYNA (Red) Grows 159% Since March 2020 Low

SYNA’s Green Zone Rating

Using Adam’s six-factor Green Zone Ratings system, Synaptics rates an 84 overall — meaning that only 13% of all other companies score higher.

Synaptics Inc.’s Green Zone Rating on February 19, 2021.

Quality — SYNA earns a 90 on the quality metric. Its returns on investment, equity and assets are considerably better than the average for the semiconductor manufacturing industry.

Growth — It comes with solid sales growth — it ranks an 82 on the growth metric. Sales are on the rise as Synaptics bulls straight ahead into the Internet of Things market. Synaptics has also beaten Wall Street projections for earnings per share in each of the last five quarters.

Momentum — SYNA rates a 75 on momentum, signaling a decent uptrend without a lot of downswings (64 on volatility). Its price-to ratios are also less than the industry average.

Bottom line: Things are only going to get better for Synaptics, and I think it will outperform the broader market by three times over the next 12 months.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

P.S. Check out The Bull & The Bear podcast every week for more picks from Adam, Charles and me. You can listen on Apple Podcasts, Spotify, Amazon and Google Podcasts. You can also catch episodes on our YouTube channel here.