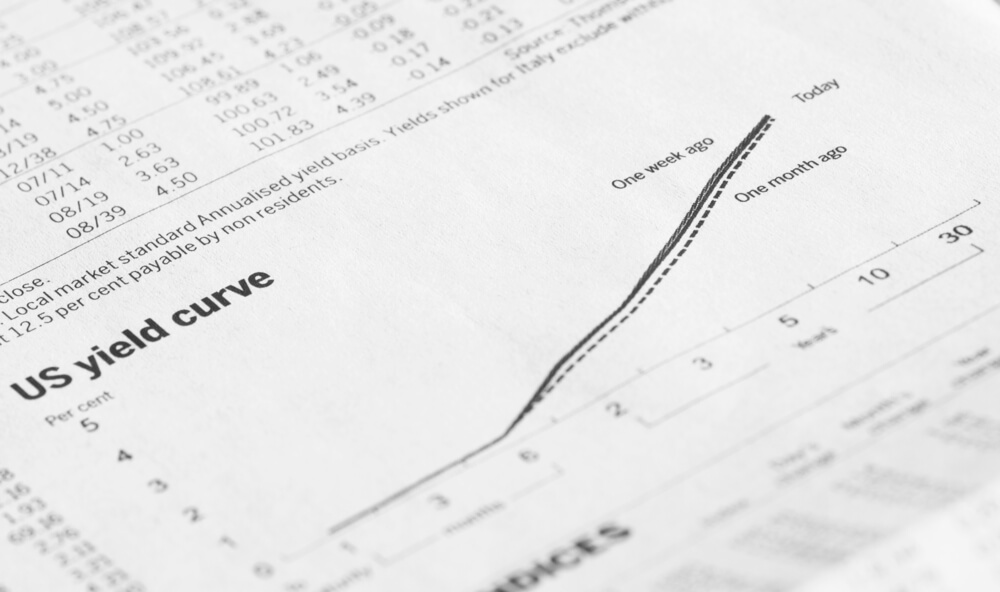

The yield curve is flattening, meaning the percent of returns on U.S. government bonds are becoming more and more similar to one another, regardless of duration.

When one invests in an asset, you would expect to make more for the longer amount of time it’s under the other party’s control. You could even think of it as car insurance — your six-month policy at Geico is going to cost less than the 12-month policy simply because there is a longer amount of time your car is insured.

As of June 27, the difference between 10-year (2.83 percent) and two-year (2.52 percent) notes is just 0.31 percent, or 31 basis points. That’s 31 additional cents on every $100 invested for the additional eight years. This curve flattening is even worse when comparing the 10-year note (2.83 percent) to the 30-year bond at 2.97 percent. The difference between the two is just 14 basis points. So for 20 additional years of having your capital tied up, you would earn 14 additional cents for every $100 invested on average.

TLT (iShares 20+ Year Treasury Bond ETF) is one way to look at trading the yield curve. While it doesn’t translate directly to the spreads mentioned above, it does track the longer duration bond prices, which are inverse to interest rates. So if you think long-term bond rates will go higher, then you will want to go short TLT. But if you think long-term rates are going to go further to close the gap, then you will want to go long TLT.

TLT’s option prices are suppressed right now, independent of its current market price of $122.11. TLT’s implied volatility rank is only at eight, meaning prices on the options are only 8 percent as high as they’ve been over the past year. At these prices, a Debit Spread is optimal because we can take advantage of market direction and a potential increase in option prices.

If you think long-term bond rates will rise, pushing off the trend and steepening the yield curve, then we could look to buy a Put Debit Spread. By selling the 122 Put and buying the 124, it establishes a short position in bonds and has a 56 percent profit probability. TLT could go up to $122.75 and this trade would still profit. But even more importantly, if the option prices rise, this trade could potentially profit even if the breakeven is breached. Debit Spreads are optimally suited to take advantage of rising option prices. This trade has a max profit of $75 and a max risk of $125.

But if you think the yield curve will continue to flatten, pushing long-term rates down even further, closing the gap to short-term rates, then we would look to go long TLT with a Call Debit Spread. By buying the 120 Call and selling the 122, this trade has a 58 percent probability of profit and a breakeven of $121.19, with a max profit of $81 and a max risk of just $119.

In order to get dollar returns like this, you would have to buy (or sell) 100 shares of TLT, which would cost as much as $12,211 without margin. But by using options, we can make trades that have a greater than 50-50 probability of profit and fit these trades in any size portfolio. TLT is the most liquid bond ETF and has the most liquid options market, making it a great vehicle if you’re looking to trade the yield curve.

Christopher M. Uhl, CMA, MOSM

10minutestocktrader.com

Email: chris@10minutestocktrader.com

Twitter: @10minutetrading

Instagram: @10minutetrading