The idea for today’s Power Stock came from an email from a member of our premium stock research service, Green Zone Fortunes. (If you aren’t a member of Green Zone Fortunes, click here now to find out how you can join for under $5 a month!)

Patrick writes:

I was looking into a stock (United Microelectronics Corp. [rwc_multi_symbol name="UMC"]). I checked it on your valuations, and it came in with a strong 83. Could you look at this and tell me what you think?

Absolutely, Patrick. Thanks for writing in.

For starters, semiconductors conduct electricity. You’ll find them in thousands of different products from smartphones to gaming consoles and medical equipment.

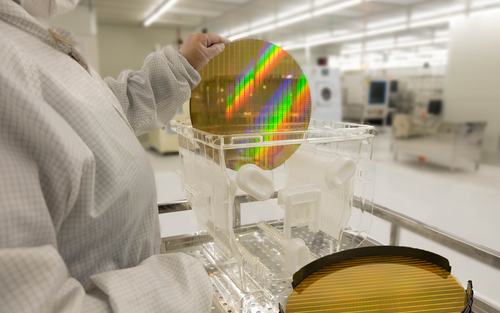

A semiconductor needs two components: a chip and a wafer.

The chip is embedded into the wafer, and one won’t work without the other.

The chart above breaks down the global semiconductor sector by application.

In 2020, the global market’s value hit $467 billion, with most semiconductors used in smartphones and personal computers (the two darkest green bars).

By 2030, the market will expand to $940 billion — a 101.3% increase — as semiconductor use grows.

That brings me to Patrick’s question:

Today’s Power Stock is United Microelectronics Corp. (NYSE: UMC), one of the largest semiconductor foundries in the world.

UMC Stock Power Ratings in June 2022.

UMC operates semiconductor wafer factories in Asia and the U.S.

The company builds wafers, which other companies use with their chips.

United Microelectronics stock scores a “Strong Bullish” 83 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

UMC Stock: Strong Growth + High Quality

Several items stood out about UMC. Here are two highlights:

- In the first quarter of 2022, UMC had $2.2 billion in operating revenue — up 37.5% from the same quarter a year ago.

- The company increased its gross profits 120% from first-quarter 2021 to first-quarter 2022.

UMC has a ton of growth potential.

Its one-year annual earnings-per-share growth rate is 99%, and its sales growth rate is 27%. It earns a 98 on our growth metric — in the top 2% of all stocks we rate.

UMC is a high-quality stock to boot. Its return on equity of 24.2% beats its semiconductor equipment peers’ average of 17%.

Plus, UMC’s gross margin of 56.5% is higher than its peer average of 44.9%.

UMC stock dropped 40.2% from its 52-week high in December 2021 to its low in April.

From that low, the stock has gained 14.3% despite a broader sell-off in the tech sector.

It’s down 5.4% over the last 12 months, but UMC still beats the semiconductor equipment sector, which is down 10%.

United Microelectronics Corp. stock scores an 83 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Demand for semiconductors isn’t going away … it’s getting stronger.

UMC provides crucial components for semiconductor manufacturers. That’s why UMC belongs in your portfolio.

Bonus: UMC’s forward dividend yield of 3.3% means it pays shareholders $0.29 per share, per year to own the stock.

Stay Tuned: Healthcare Staffer Helps Fill Massive Nurse Shortage

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a healthcare staffing stock that I have high conviction in.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Thanks again to Patrick for writing in about UMC! If you have a question about a stock or a comment about Stock Power Daily, reach out to Feedback@MoneyandMarkets.com!