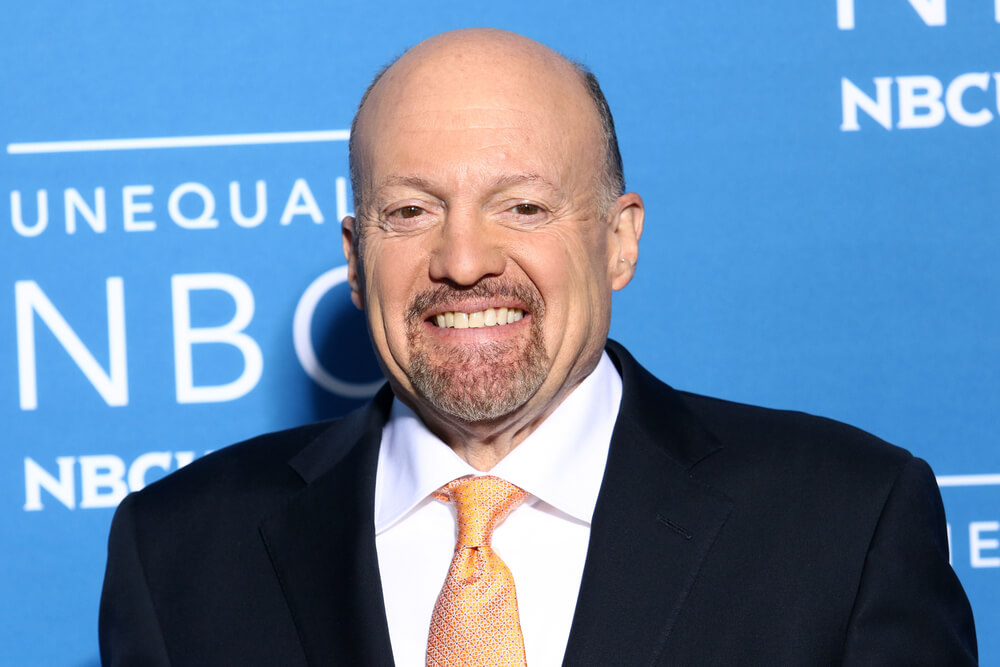

As investors continue to watch bond yields sink, CNBC’s Jim Cramer warned against falling for the recession warnings of this specific yield curve inversion, and argued that stocks are still the way to go.

“Until we get some tangible signs that the economy’s picking up, you’re going to have to get used to the screams of this needy bear cub of a market.”

Around 1:45 p.m. EDT Wednesday, the yields between 2-year and 10-year Treasurys were once again inverted, with the 2-year sitting at 1.49% and the 10-year at 1.45%. But Cramer doesn’t see that as cause for alarm, according to CNBC.

“I think the yield curve linkage is wrong,” Cramer said on his “Mad Money” program Tuesday. “Until we get some tangible signs that the economy’s picking up, you’re going to have to get used to the screams of this needy bear cub of a market. But I have to urge you to stay the course because … I do think the linkage will be exposed as faulty and stocks will remain the best investments.”

While the yield curve inversion between the 2-year Treasury and the 10-year note has been a reliable recession red flag, preceding every recession of the last 50 years, Cramer cites foreign markets as the root cause of the current inversion. Because U.S. bonds are yielding more than their foreign counterparts, Cramer believes foreign investors flooding the U.S. market is what’s causing the flip of the curve.

“All that foreign … buying has created an inverted yield curve, where short-term rates are higher than long-term ones,” Cramer said.

Bond yields fall as prices rise, and U.K. Government Bonds are trading around 0.50%, with many German Government Bonds actually trading in the negative.

Cramer sees positives of lower interest rates, though, because consumers should be able to borrow money at a cheaper rate as lenders set car loans and mortgage rates using the 10-year yield benchmark.

“I think this will be a huge boon, especially to housing,” Cramer said.

And while Cramer doesn’t think this yield curve inversion is indicating a recession, he does believe it’s bad for managed care stocks like Humana, which fell almost 6% Tuesday.