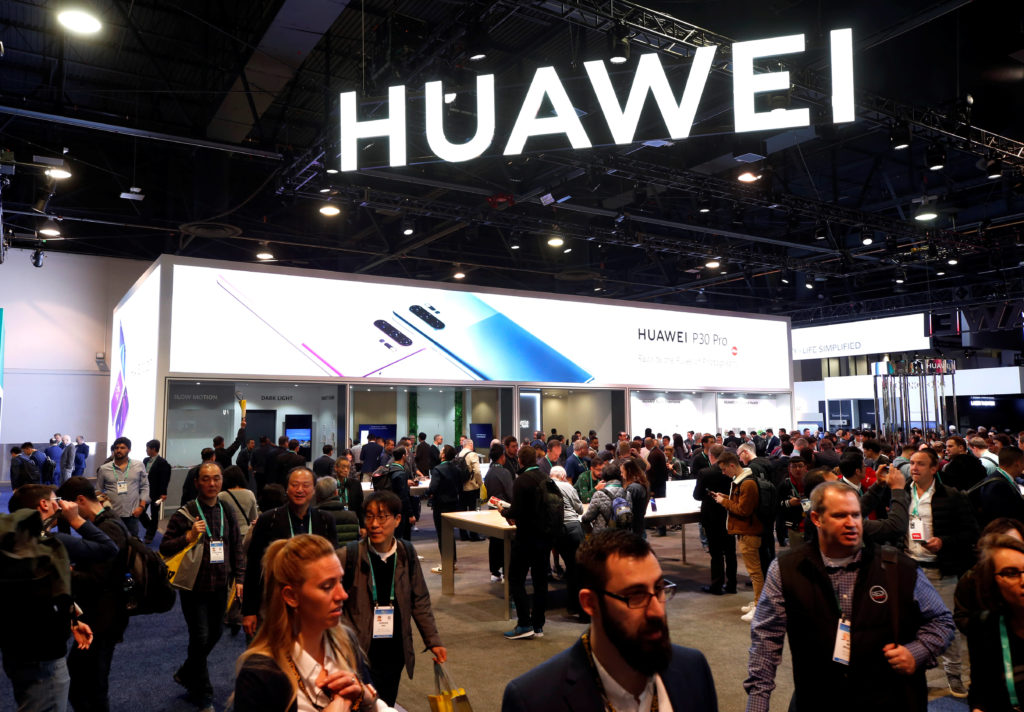

The U.S. government is considering additional steps in its war against Chinese telecom giant Huawei with another ban.

In the next two weeks, meetings could result in commerce restrictions that halt the shipment of chips to Huawei from companies. Those companies would not be just American companies, but foreign ones as well.

(Side note: Taiwan Semiconductor Manufacturing is one of our four semiconductor stocks to buy now.)

Sources told Reuters a draft proposal barring the sale of chips has been proposed but not yet approved.

“What they’re trying to do is make sure that no chips go to Huawei that they can possibly control,” a source said.

It would be the latest in government-led attacks on the Chinese company. U.S. officials claim Huawei — which is contesting to build 5G network capabilities in many countries — can be directed by the Chinese government to use its technology to spy on foreign governments.

Not the First Huawei Ban

Last year, U.S. President Donald Trump issued an executive order banning equipment from Huawei from U.S. networks. In August, employees were found to use cellular data to track the location of political opponents in some African nations.

More recently, the U.S. government attempted to pressure British Prime Minister Boris Johnson to ban Huawei from helping to build out 5G services in the U.K., citing it would compromise British intelligence.

The U.K. spurned that and elected to allow Huawei to be used on its 5G network.

What Would Change With the Latest Proposal

In order for the U.S. government to stop the sale of chips from international companies to Huawei, it would have to change the Foreign Direct Product Rule, which subjects some foreign-made goods based on U.S. technology or software to U.S. regulations.

According to a draft proposal, foreign companies that use U.S. chipmaking equipment — like Taiwan Semiconductor — would need a U.S. license before supplying Huawei. That could have negative repercussions as it could be viewed as an expansion of U.S. control of foreign exports.

The Rock and The Hard Place

The latest Huawei ban would put companies like Taiwan Semiconductor in a tough spot as it supplies chips for Huawei’s HiSilicon unit. The crux is that TSM also supplies chips to Apple Inc. (Nasdaq: APPL) and Qualcomm Inc. (Nasdaq: QCOM). The company would have to determine if the risk of continuing to supply Huawei outweighs the reward of a potential U.S. ban.

Other chip manufacturers like Applied Materials Inc. (Nasdaq: AMAT) and Lam Research Corp. (Nasdaq: LRCX) also supply equipment produced by U.S. companies, and could be impacted by the proposal.

The other potential negative impact from the proposal would be the further complication of a trade deal with China as the U.S. is negotiating a second phase. Beijing could see the proposal as antagonizing and specifically targeting one of its biggest companies.

The move could also force companies like Taiwan Semiconductor to look for equipment elsewhere, hitting American equipment manufacturers in the pocketbook.