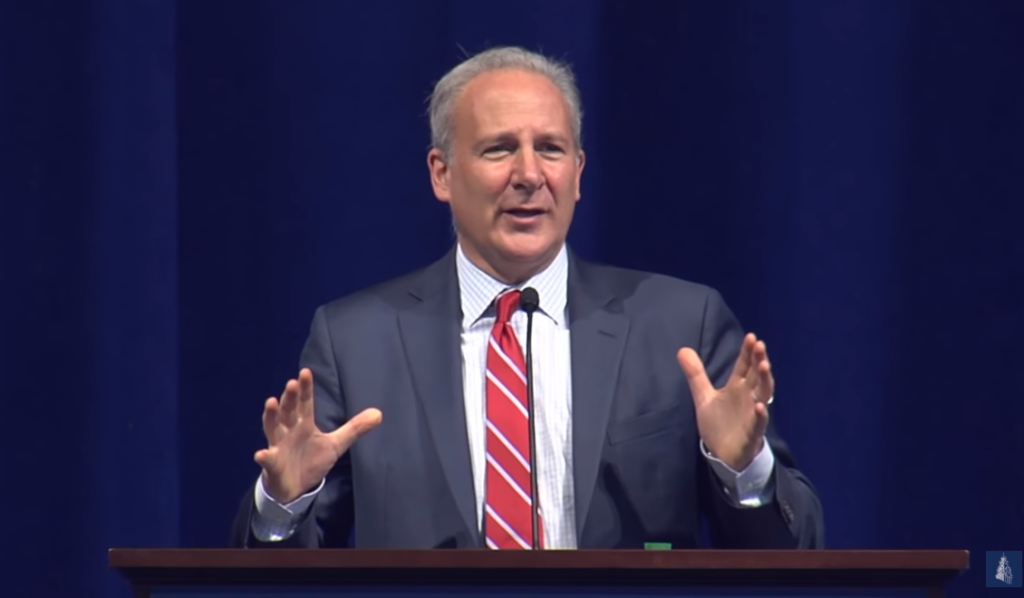

Euro Pacific Capital CEO Peter Schiff said in an interview this week on RT’s “Boom Bust” show that soon the Federal Reserve will cut interest rates to zero to combat a slowdown due to the coronavirus outbreak.

In fact, the bond market, which saw the yield on the 10-year Treasury fall to an all-time low 1.32% yield and the 30-year Treasury dip to 1.798%, is signalling the future rate cuts now, Schiff said.

“Whether they commit to moving to zero or not, that’s exactly where they’re going. And in fact, the bond market is telegraphing right now that we’re going to have several more rate cuts I think between now and the end of the year, and I think the bond market is right,” Schiff said. “But it’s not that this is the appropriate policy — the Fed should not be cutting interest rates, but that’s what they’re going to do because that’s the only thing they can do.

“But it’s not going to cure the coronavirus or the economy. It’s simply going to make the U.S. economy sicker.”

The CME FedWatch Tool projects a 67% chance the Fed will cut interest rates at the April 29 meeting (50.5% chance of a 0.25% cut and a 16.5% chance of a 0.5% cut), and a 33% chance rates stay the same. But that number falls to just a 17.9% chance the Fed stays in the current 1.5% to 1.75% range by the June meeting.

Schiff has been bearish on the U.S. economy in general for over a year now, and he again reiterated his call that it’s a “giant bubble,” and said coronavirus could “be the pin.”

“Look, the U.S. economy, for example, is a giant bubble and maybe the coronavirus is going to be the pin. I have no idea, but if it wasn’t this, it was going to be something else. But there are some much deeper problems than the coronavirus: The markets in general are very overvalued, you have a lot of leverage in the system,” he explained. “If we had a healthier economy we could better withstand the coronavirus, whatever it turns out to be.”

The bigger problem, Schiff said, is the Fed’s cure is worse than the disease because if the coronavirus gets out of control then production will be slashed with fewer people working, which means companies can’t get the supplies they’ll need and there will be mass shortages if supply chains are choked off.

“The correct monetary policy is to drain liquidity to match the reduction in supply,” he said. “But instead, if the Fed and other central banks pour even more liquidity and create increased demand for a diminishing supply of goods, then you really get a big increase in consumer prices and that worsens the downturn — you get a worse case of stagflation.”

Schiff then tackled comments made by Treasury Secretary Steven Mnuchin this week when he said the coronavirus won’t have a material impact on the U.S.-China phase one trade deal that was signed earlier this year, and that the Fed doesn’t need to coordinate with the Treasury to battle recessions.

“The Chinese were not going to live up to those commitments anyway — they weren’t even real commitments and there’s no way they know how much agriculture, for example, the Chinese are going to buy let alone how much they’re going to buy from the United States,” Schiff said. “So the whole thing was a smoke screen to cover up the fact that we don’t really have a deal. But now the coronavirus actually gives the Chinese a better excuse as to why they’re not living up to a deal that they weren’t going to live up to anyway.”

Finally, Schiff and the hosts discussed the strength of the U.S. dollar and whether or not other countries are devaluing their currencies.

“I don’t think other central banks are deliberately weakening their currencies. They’re pursuing the same type of inflationary monetary policies that we are, but what’s happening is traders — speculators — are buying into the dollar because they falsely believe it’s a safe haven. It’s not. They should be buying gold and of course other people are,” he explained. “You’re seeing prices for gold where gold has never traded at. In the U.S. we’re at a seven-year high but we’re getting close to an all-time high in dollars too.

“So all currencies are weakening right now, it’s just that the dollar is weakening more slowly than a lot of other currencies. But that is going to change because people who are piling into the dollar because they think it’s a safe haven are eventually going to pile out and the dollar is going to start to fall.”