Today, we examine just what is the coronavirus, or COVID-19, that is impacting global markets and the fact that you be worried about it as an investor.

It’s taken China by storm, with the death toll rising above 47,000, and cases have started popping up all over the globe.

The coronavirus has also had a negative impact on U.S. and global markets as all three major indexes fell into bear market territory in March.

But a harder question to answer is just what is the coronavirus? And, more importantly, why we be worried about it?

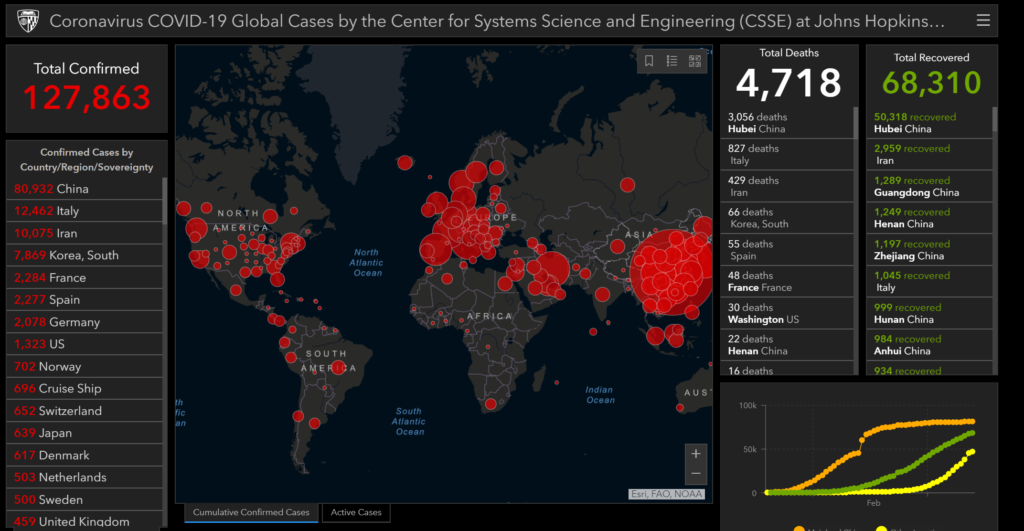

As of this story, the coronavirus has spread to more than 116 countries — including the U.S., Canada, France and Australia. According to Johns Hopkins University, there are 127,869 individuals globally who have been confirmed to have contracted it.

What Is the Coronavirus?

First and foremost, the coronavirus is actually a larger family of viruses, not just one, according to the Centers for Disease Control.

Those viruses vary from animal to human. It is rare, however, that the virus passes from animal to human. Diseases like Severe Acute Respiratory Syndrome, or SARS is one such virus that can pass from animals to humans.

The outbreak dominating headlines today is a novel (new) coronavirus — labeled 2019-nCoV by the CDC.

The virus is known to exhibit upper-respiratory tract illness, similar to the common cold or flu. Some of those symptoms include:

- Runny nose.

- Headache.

- Cough.

- Sore throat.

- Fever.

- A general feeling of being unwell.

Coronaviruses can also cause lower-respiratory tract illnesses, like pneumonia or bronchitis. These illnesses are more common in people who already have a cardiopulmonary disease or those with weak immune systems.

This particular strain of the coronavirus is spread similar to the flu — by coughing or sneezing near another person — by human contact or touching a surface with viral particles on it. Symptoms of the coronavirus can appear anywhere between two and 14 days after a person has been exposed.

How Did This Coronavirus Start?

Chinese health officials trace the outbreak to a large seafood and animal market in Wuhan City, China, located in the Central Chinese province of Hubei.

Wuhan is the largest city in the province and the provincial capital. Its center is divided by the Han and Yangtze rivers, making it a port city and center of travel and trade.

Wuhan is the largest city in the province and the provincial capital. Its center is divided by the Han and Yangtze rivers, making it a port city and center of travel and trade.

What makes the coronavirus different is, because of its origin, it is one that appears to have started in animals and was transferred to humans. Early studies suggest this strain of the coronavirus started in snakes.

“Analysis of the genetic tree of this virus is ongoing to know the specific source of the virus,” the CDC said.

The disease moved from potential animal-to-human transmission to human-to-human transmission, and that human-to-human transmission has been sustained in China.

The Coronavirus in the U.S.

According to the CDC, the first case of the coronavirus in the U.S. was reported on Jan. 21, 2020.

As of March 12, 2020, there were 1,215 confirmed positive cases, 36 deaths and 42 states and the District of Columbia where cases have been confirmed. That makes the total number of people in the U.S. under investigation 988 in all 50 states.

Cases in the U.S. have been confirmed to be people who both traveled and those who did not. The World Health Organization declared the virus a pandemic on March 11, 2020.

The Coronavirus Globally

Currently, there are confirmed cases of this coronavirus in 116 countries — hitting Europe and Asia particularly hard.

The virus has hit Italy particularly hard. The country has reported 12,462 confirmed cases with 827 deaths. That the most of any country outside of China. Iran has reported 10.075 confirmed cases with 429 deaths.

China has a large majority of confirmed cases — 80,932 — with all the deaths reported there. Of the 4,718 deaths, a 3,056 are in the Hubei province.

Johns Hopkins University has developed a dashboard tracking the spread of the virus globally in near-real-time.

Investors Should Be Concerned?

Aside from the physical implications of a virus that spreads like the flu, investors are thinking of something else: profits.

When there is an outbreak, people stay home. They don’t go out to eat, they don’t travel, they don’t go out shopping.

That means profits for restaurants, travel companies and retailers will go down because people aren’t spending their money with those companies.

Even if the outbreak stays mostly contained to China, because China is such a large player in the global economy, any slowdown in China will impact even the U.S. economy.

There are some companies that will be hit harder than others … mainly travel companies.

Companies like United Airlines Holdings Inc. (Nasdaq: UAL), American Airlines Group Inc. (Nasdaq: AAL) and Southwest Airlines Co. (NYSE: LUV) have seen their share prices drop because of virus concerns.

Additionally, entertainment companies like Wynn Resorts Ltd. (Nasdaq: WYNN) Las Vegas Sands Corp. (NYSE: LVS) are getting hammered because of their casino businesses in Macao — a Chinese administrative region across the Pearl River Delta from Hong Kong.

While travel, entertainment and large manufacturing take a hit from the spread of the coronavirus, major indexes are also getting hammered.

On March 11, 2020, the Dow Jones Industrial Average reached a bear market level — as the index dropped 20% from its previous record high. A day later, the S&P 500 and Nasdaq Composite were on track to follow suit.

Investors should be concerned about the virus, but if they are smart they know what to invest in and when to do. The impacts of the coronavirus on the markets will be felt, and they will be felt globally.