QE, or not to QE.

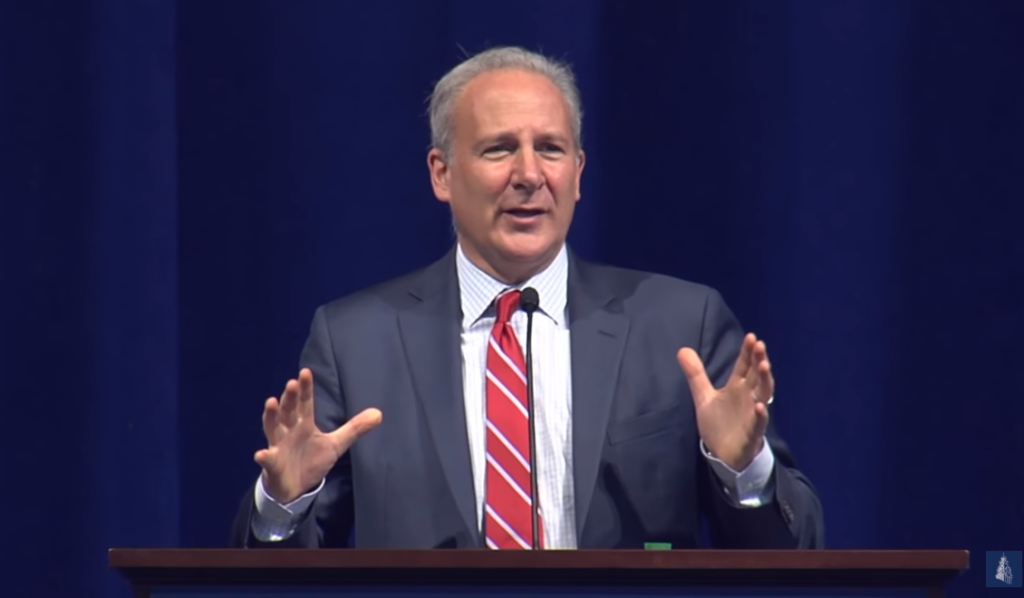

Economist and precious metals expert Peter Schiff penned an op-ed for his website blasting the Federal Reserve and Chair Jerome Powell for his obfuscation regarding monetary easing the central bank is reemploying.

Amid the Great Recession, the Fed employed three rounds of quantitative easing (QE) in which it bought bonds to pump new money into the economy. At the time, it was considered a drastic monetary policy to be used only amid the worst of recessions — but the Fed is doing it again now and just calling it by a different name, Schiff contends.

Powell announced on Oct. 8 that the bank is buying regular amounts of short-term government debt, saying “This is not QE. In no sense is this QE.”

The New York Fed then said the program will buy $60 billion per month of Treasurys through the second quarter of next year at least. And at least through January of 2020, the Fed will buy $75 billion in overnight repurchases and $35 billion in term repurchases twice a week, pushing its balance sheet back up to $4.2 to $4.3 trillion by Q2 of 2020.

“Of course, since the actual size of the purchases required to keep interest rates from rising could be much larger, the Fed’s balance sheet could be significantly larger as well,” Schiff said before adding, if it “looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck” in regards to whether or not this is QE, which the Fed of course denies.

And as far as the program ending by the middle of next year, Schiff said there’s no chance of that. If you look at what happened with the Fed trying to clear some of the money off its balance sheet, it was only able to roll off 25% of the debt before having to stop and slash rates twice, the first two rates cuts in more than a decade.

Now it’s stuck in QE for perpetuity, Schiff said, wondering when investors will figure that out and stop being fooled.

“As I have said many, many times, quantitative easing is a monetary Roach Motel: Once central bankers check-in, they can never check out,” Schiff wrote. “For now, Chairman Powell is occupying a different room in this particular motel than had his predecessors. But rest assured, not only will he occupy that room, but I expect he will also be expanding into many more. None of the rooms will have a good view and all will have dirty linen.

“The real question is when investors will get wind of the stench? The Fed has been successful in fooling the markets regarding the temporary nature of zero-percent interest rates, the efficacy of QE, and its ability to normalize rates and shrink its balance sheet. Had the markets not been fooled, the program would have produced a much different result. Its “success” was purely a function of the belief that the policy was temporary and reversible. The realization that it is neither could cause a flight from the dollar and Treasuries that could usher in a financial crisis far worse than what was experienced in 2008.”