With news of the Institute for Supply Management index of national factory activity dipping to a 10-year low and contracting for the second straight month, stock markets faced a major sell-off through the middle of last week.

“This is no different than a Politburo in the Soviet Union deciding what the price of bread is going to be.”

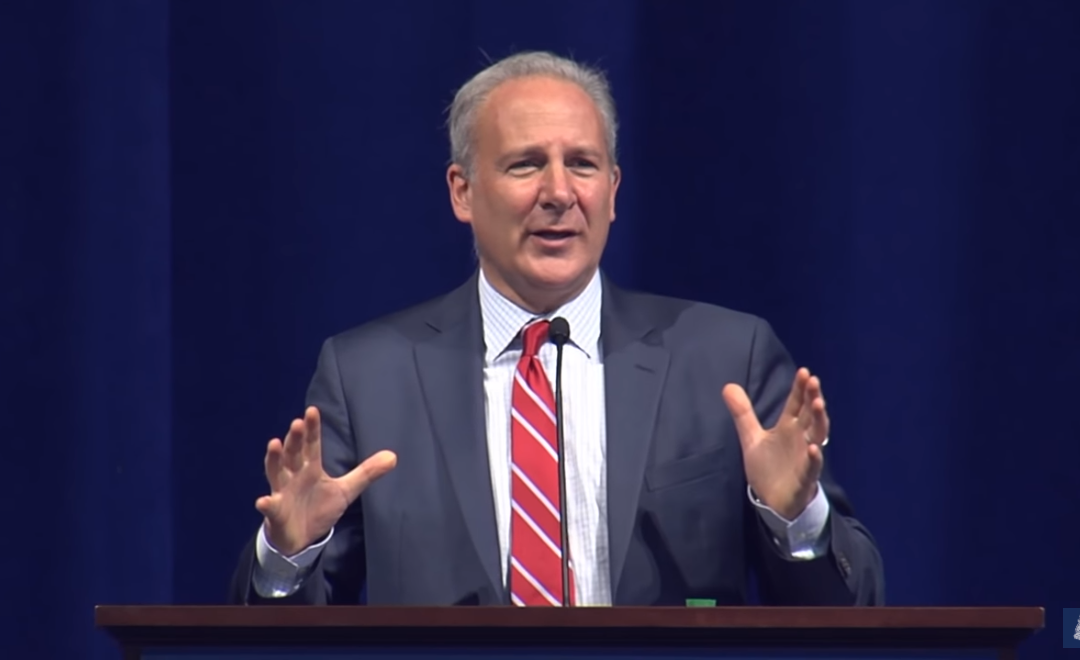

Economist and precious metals expert Peter Schiff said on his latest podcast that the service sector is next up to follow manufacturing into a recession.

The ISM index fell from 56.4% in August to 52.6% for September, the lowest reading in three years and a big drop off that was much weaker than the expected 55.5%. Economic talking heads are now warning that sagging service sector data will only compound growing recession fears.

The ISM news sent the Dow tumbling 300 points, only to see it recover later in the day because the likelihood of the Federal Reserve cutting interest rates again rose to 90%.

“So what basically saved the market was the increased probability that the Fed was going to come to the rescue of the market by cutting rates,” Schiff said. “The service sector is the only part of the economy that is not in recession, so the evidence that now the service sector is starting to buckle made people worry, but also made people relieved because now the prospects of a Fed rescue are more likely.

“I think that there already is enough expectations for rate cuts that the probability going up is not enough to really put in a floor on the market.”

The markets saw a drastic sell-off during the fourth quarter of 2018, culminating in a Christmas Eve bloodbath that saw the S&P 500 fall 2.7%, the Dow crash 2.9% and the Nasdaq tank 2.2%. The Fed then announced it would reverse course and “pause” raising rates further. This led to the rebound we saw the first of the year — but that won’t happen again because the central bank has been cutting rates for the first time in a decade since July.

“When the markets responded to those threats by collapsing, the Fed was able to do a complete policy 180, going from rate hikes to rate cuts, and in fact, going from quantitative tightening to effectively having quantitative easing,” Schiff said. “But if all that is already in play, if the markets start to tank again, I don’t really think there’s enough ammunition left in the Fed’s chamber there to have a meaningful impact on the markets, and I think traders are overestimating the ability of the Fed to rescue the market the way it has rescued it in the past.”

As far as QE, Schiff didn’t mean another round of bond buying similar to what happened three times during the Great Recession, but rather the Fed’s repo buys when the Fed’s balance sheet grew by $88.1 billion in just a week.

The Fed has continued repo buys, ballooning its balance sheet $176 billion over the past three weeks. Before you know it, Schiff said, the balance sheet will be back to $4 trillion like when it was buying $85 billion worth of bonds every month, wiping out all of the gains made to reduce the load.

“That was an official quantitative easing program. Today, there is no quantitative easing program,” Schiff said. “The Fed says they’re not doing any quantitative easing. Yet the balance sheet is now growing twice as fast — more than twice as fast — when they’re not doing quantitative easing than when they were. So obviously, that’s exactly what they’re doing.

“The Federal Reserve is creating money out of thin air and then using the money that it creates out of thin air to buy up debt instruments for the sole purpose of preventing interest rates from rising. This is no different than a Politburo in the Soviet Union deciding what the price of bread is going to be.”

Economists claiming the U.S. economy is in good shape now said the same thing just before the 2008 financial crisis. They’re wrong again. The reason we had a crisis was because the economy was actually a disaster waiting to happen. Today we are awaiting an even bigger disaster!

— Peter Schiff (@PeterSchiff) October 7, 2019

In case anyone is wondering, no, Peter, a libertarian, is not related to Rep. Adam Schiff, D-Calif.

Just to be clear I have no relation to Adam Schiff. If he keeps this up I may have to consider changing my last name!

— Peter Schiff (@PeterSchiff) October 3, 2019