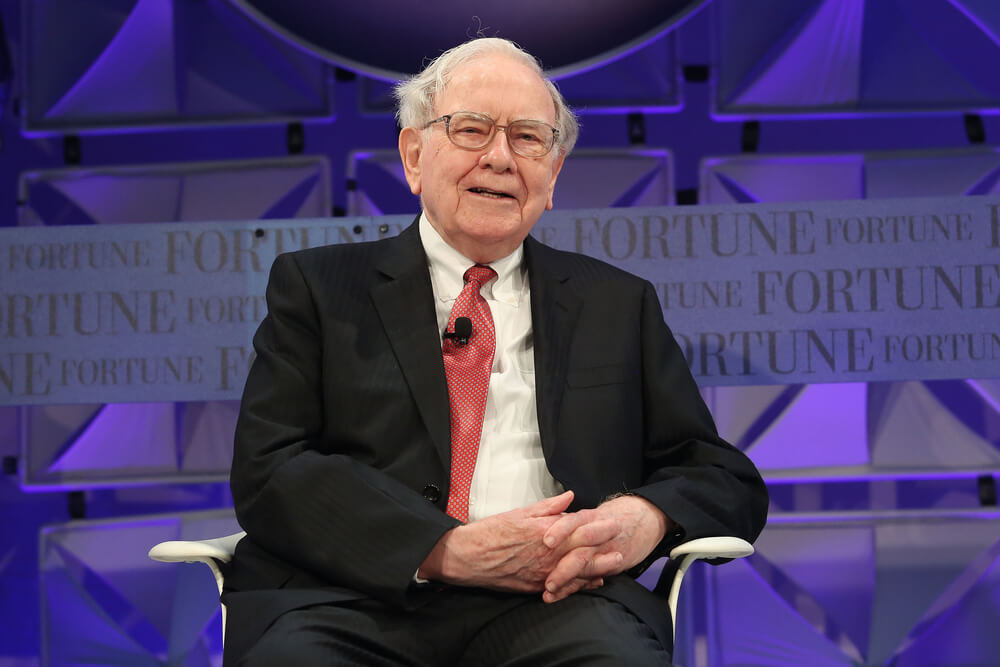

Berkshire Hathaway CEO Warren Buffett said in his annual letter released Saturday that the company is “100 % prepared” for his eventual death, and he even detailed what will happen to his vast $90 billion fortune when that day comes.

Buffett, 89, wrote about how a friend of his had gotten “an irritating letter” from a local newspaper “in blunt words” looking for biographical information for the friend’s eventual obituary. When the friend didn’t respond, he received another letter marked “URGENT.”

“Charlie (Munger) and I long ago entered the urgent zone,” Buffett quipped in his annual letter. “That’s not exactly great news for us. But Berkshire shareholders need not worry: Your company is 100% prepared for our departure.”

Buffett went on to say there’s plenty to be optimistic about regarding the future of Berkshire Hathaway when he and Munger, 96, his long-time right-hand man, are no longer at the helm.

What Happens to Warren Buffett’s Money When He Dies?

“Today, my will specifically directs its executors — as well as the trustees who will succeed them in administering my estate after the will is closed — not to sell any Berkshire shares,” he wrote.

Buffett co-founded The Giving Pledge in 2010 with fellow billionaire Bill Gates, the founder and CEO of Microsoft. The pledge encourages the world’s richest people to give more than half of their vast fortunes away to charity, and Buffett’s stock will be converted and eventually cashed out and donated.

Berkshire Hathaway has two different stock offerings, (NYSE: BRK.A) and (NYSE: BRK.B). Berkshire’s A offering goes for about $333,760 a share as of this morning, while the B offering was trading at about $223 this morning.

“The will goes on to instruct the executors — and, in time, the trustees — to each year convert a portion of my A shares into B shares and then distribute the Bs to various foundations,” he wrote. “Those foundations will be required to deploy their grants promptly. In all, I estimate that it will take 12 to 15 years for the entirety of the Berkshire shares I hold at my death to move into the market.”

The executors and trustees will then sell the shares under their temporary control and reinvest the proceeds in U.S. Treasury bonds with maturities matching the scheduled distribution dates.

“That strategy would leave the fiduciaries immune from both public criticism and the possibility of personal liability for failure to act in accordance with the ‘prudent man’ standard,” he wrote.

Buffett concluded this section of the letter by saying he’s comfortable the stock “will provide a safe and rewarding investment” during the holding period with just a slight chance he’s wrong.

“I believe, however, that there is a high probability that my directive will deliver substantially greater resources to society than would result from a conventional course of action,” he said. “Key to my ‘Berkshire-only’ instructions is my faith in the future judgment and fidelity of Berkshire directors. They will regularly be tested by Wall Streeters bearing fees. At many companies, these super-salesmen might win. I do not, however, expect that to happen at Berkshire.”