Billionaire hedge fund titan Ray Dalio reportedly said coronavirus fears are overblown when it comes to U.S. stock markets, but the Bridgewater Associates founder refuted those reports in a Twitter thread today.

The Original Story

It’s been hard to get a decent gauge on the impact the coronavirus might eventually have for investors. For every expert pooh-poohing the impact as overblown or exaggerated, there’s another calling it a “black swan” event for particular sectors and economies around the world.

So far the virus has killed more than 1,000 people and infected about 45,000 people in nearly 30 countries, and “probably had a bit of an exaggerated effect on the pricing of assets,” Dalio told an audience at the Milken Conference in Abu Dhabi on Tuesday.

“Because of the temporary nature of that, I would expect more of a rebound,” he said. “It most likely will be something that in another year or two will be well beyond what everyone will be talking about.”

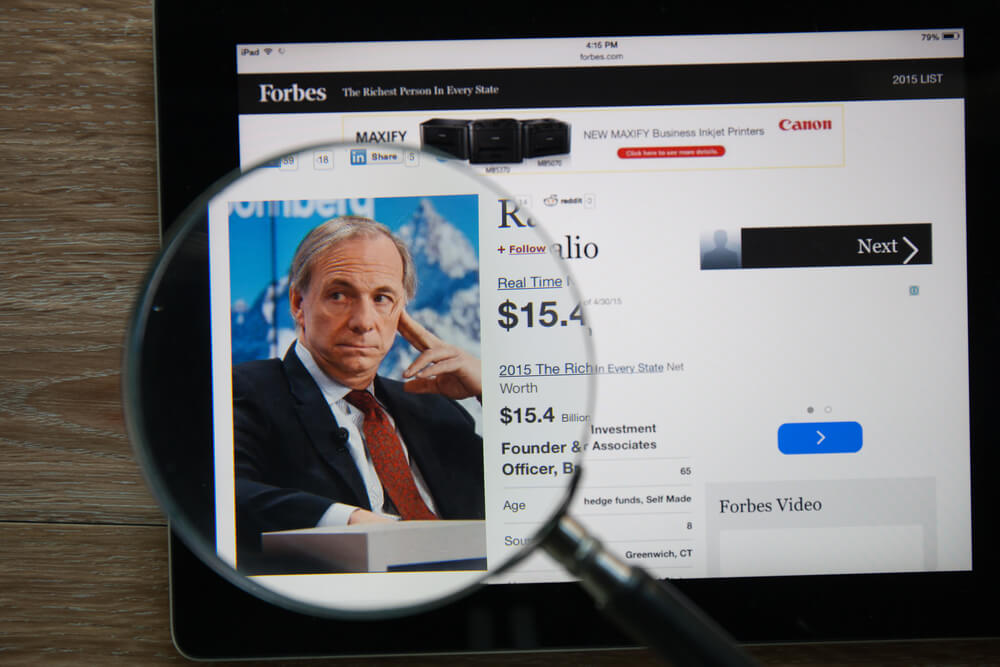

Dalio, the founder and Co-Chief Investment Officer of Bridgewater Associates, the largest hedge fund in the world with more than $190 billion under management, is taking a more calm, wait-and-see approach to the virus. Some say it could evolve into something worse than the flu, sending China’s economy into the abyss and impacting the entire global economy.

Wall Street bulls like Ed Yardeni say a stock market correction around 10% is in the cards, posing a threat to the record long bull market in the U.S.

“The global economy was actually starting to show signs of improving before the virus became headline news,” he said. “And now I suspect that the longer this virus threat continues to weigh on the global economy, the more it poses the risk for at least a correction in the stock market.”

U.S. markets so far have largely shaken off coronavirus fears. The S&P 500 and Dow closed down on Friday after a strong week, including a new record for the Standard & Poor’s.

Both indexes closed better than 0.5% up on Monday while the Nasdaq rose 1.1%, and all three major U.S. indexes are up 0.2% to 0.8% this morning.

Dalio, who is worth $18 billion, said a bigger concern to him is growing wealth inequality and the competitive threat from China, the world’s second-largest economy.

As far as the divide between the haves and the have-nots, about half of all Americans don’t own any stocks, so they’ve completely missed out on the bull market of the past decade-plus while the rich have gotten exponentially richer. The richest 1% own about 55% of all stocks while the bottom 90% owns a mere 12% of all stocks.

“Each one will interact,” he said of the rich and poor. “What concerns me most if you did have a downturn — we are now 11 years in expansion — whether that’s one, two, three years forward, with the larger polarity that exists, the wealth gap and the political gap. I would be more concerned about that.”

What Dalio Said Today

Dalio took to Twitter this afternoon to clarify what he said, noting that he is ultimately ignorant on the subject of pandemics with some rather colorful language when referring to his expertise — or lack thereof.

I think that I am a “dumb shit” relative to experts on the subject so I shouldn’t be asked, but if I were to guess, there is a wide range of possible outcomes. (2/4)

— Ray Dalio (@RayDalio) February 12, 2020

While my statement wasn’t accurately reported, I probably should have just stopped answering at the point of trying to convey that I’m a dumb shit on that subject. Sorry for my part of that confusion. (4/4)

— Ray Dalio (@RayDalio) February 12, 2020