The stock market has rallied more than 20% since cratering in record time from the novel coronavirus pandemic, juxtaposed alongside the backdrop of historic job losses putting millions of Americans out of work.

The conflicting narratives haven’t gone unnoticed among politicians and average Americans alike, leading to growing anger in the never-ending battle of Main Street vs. Wall Street.

Main Street vs. Wall Street

The following tweet from Rep. Alexandria Ocasio-Cortez, D-N.Y., which has been retweeted nearly 44,000 times and “liked” more than 205,000 times, highlights this scenario to a T.

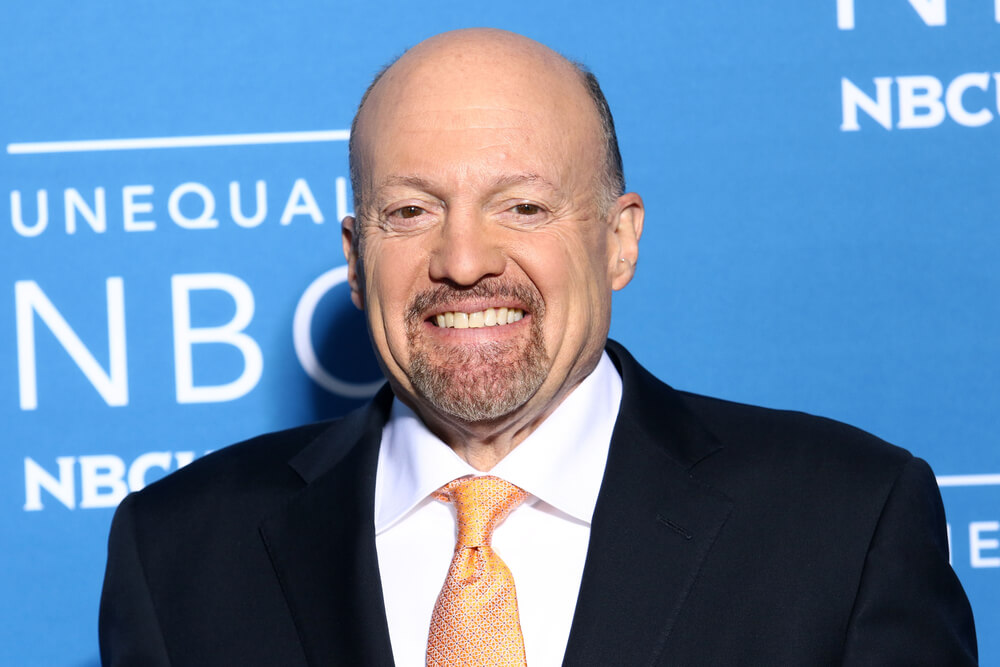

The screen above CNBC’s Jim Cramer’s head notes the Dow Jones Industrial Average just had its best week since 1938 while the chyron below notes more than 16 million Americans had lost their jobs in three weeks — and that was before this week’s jobless claims report added another 5.2 million to the unemployment line.

When late stage capitalism takes a selfie: pic.twitter.com/2OMI8JRz95

— Alexandria Ocasio-Cortez (@AOC) April 10, 2020

Cramer himself admitted the optics are particularly terrible after the above image went viral, noting “a seething anger” that a growing number of Main Street Americans are feeling.

“There’s a seething anger sweeping this country and it’s directed point-blank at Wall Street,” Cramer said Tuesday on his “Mad Money” program. “This relentless rally seems unfair, it seems senseless and it seems heartless.

Lee, who works with Ted Bauman on The Bauman Letter, which specializes in asset protection and tax advantages, said there is another entity exacerbating the ill feelings of Main Street Americans toward Wall Street: The U.S. Federal Reserve.

“The Fed is plowing trillions of dollars to stabilize the markets. They’ve been buying government debt, but now they’re buying corporate debt as well — including junks bonds,” Lee said. “And those seeing the most immediate impact are the ones holding or managing these securities — they’re the closest to this stimulus.

“Meanwhile, the small business loan rescue program is already out of money. And while the Fed did launch a $2.3 trillion program in part to help Main Street businesses, it has to go through the banking system. Who knows how long it will take for those funds to reach those that need it most.”

The Bauman crew at Banyan Hill also has written more on this specific topic recently.

Check out: “Time to Stop Bailing Out Corporate America” by Bauman, and “This Bailout is for Wall Street … not Main Street,” by Angela Jirau, at the Bauman Daily section of BanyanHill.com.