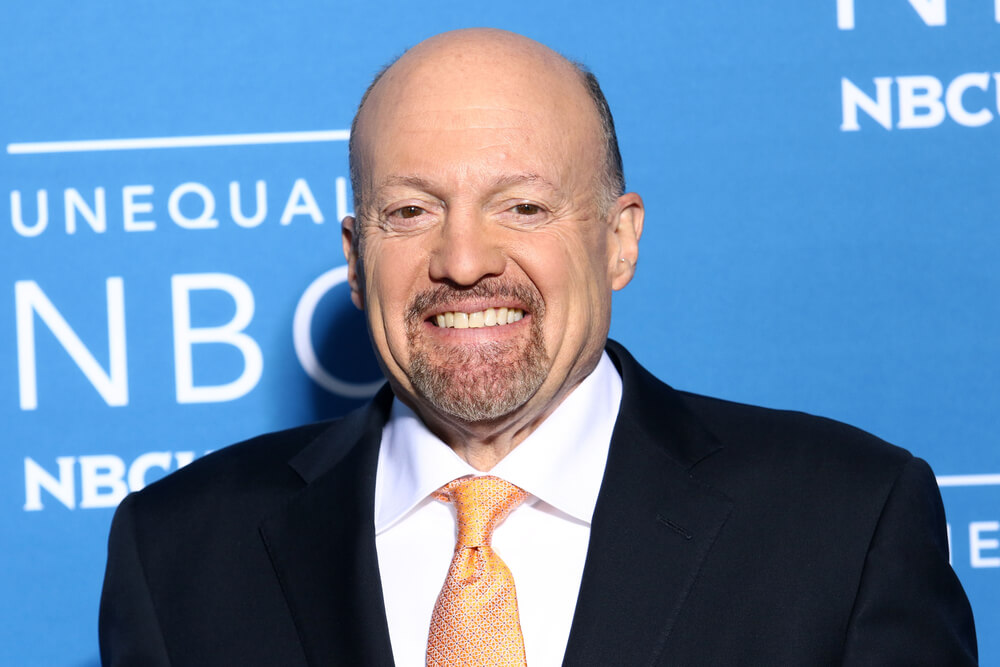

CNBC’s Jim Cramer thinks the cratering stock market is in “uncharted waters” after oil prices and bond yields have collapsed, which in turn is signalling a recession in the near future.

The 10-year Treasury yield hit a new record low of 0.31% early Monday morning before recovering slightly to 0.58% by noon EDT. The S&P 500 fell 7% by 9:34 a.m, which triggered a market “circuit breaker” causing trades to pause for 15 minutes before restarting.

Oil prices had also cratered as much as 30% overnight, and had only recovered to be down around 20% Monday morning. Cramer thinks the bond and oil markets are flashing signs of a coming recession, and his Sunday tweet points out that stocks that weren’t “buyable … will get to be that soon enough at this pace.”

The collapse in yields and oil is signalling an imminent recession…I think we need to parse everything and remember that while most stocks aren’t buyable, they will get to be that soon enough at this pace..

— Jim Cramer (@jimcramer) March 9, 2020

Saudi Arabia and Russia have entered an oil price war after OPEC nations failed to agree on policy that would bring some stability to falling prices. Russia said it didn’t want to slow production, which flies in the face of Saudi Arabia’s efforts to cut back production amid the coronavirus outbreak.

So what are the Saudis doing now? Increasing production further to get Russia back into negotiations, which is only going to drive oil prices down even further.

This has Cramer worried. Early Monday morning he continued his ominous warning of “uncharted waters” on Twitter, saying that the two collapses (oil and yields) “are both unprecedented and exceed the chaos of 2007-2009 today.”

The collapse in oil and the collapse in yields are both unprecedented and exceed the chaos of 2007-2009 today. The algorithms operated all night as if trillions of dollars were trading……Uncharted waters

— Jim Cramer (@jimcramer) March 9, 2020

The speed and thinness of trading was a shock to the “Mad Money” host, who pointed to the “monumental move” in oil stock prices that happened so quickly. “The average oil stock could be down 25% at the opening,” Cramer tweeted.

It’s the speed… The speed and the thinness. That you could have such a monumental move in six hours is truly astounding. The average oil stock could be down 25% at the opening. The average S&P stock could be down 10%. Gold remains the only bull market besides utilities, drugs

— Jim Cramer (@jimcramer) March 9, 2020

The S&P 500 didn’t go quite that low Monday morning, but it did trigger the circuit breaker when it dropped 7% shortly after the opening bell. The index was trading down about 4.6% around noon EDT.

Cramer, continuing his doom and gloom tour Monday morning, appeared on CNBC’s “Squawk on the Street,” where he argued the longest running bull market in U.S. history is in danger of ending at today’s close.

“I think that that’s certainly a realistic thing,” Cramer argued. “It’s been a great run.”

The S&P 500 hit its all-time high last month on Feb. 19 when it closed at 3,393.52 points. But at Friday’s close it was down 12.4% from that high, which means it’s firmly in a correction (a 10% drop from recent record high) and flirting with a bear market after Monday’s crash. A bear market is triggered when an index closes down 20% from recent record highs.

The U.S. has been through 12 bear markets since World War II, and those have last 14 1/2 months on average. Average declines for the previous bear markets is about 32.5%.