When investing legend Stanley Druckenmiller speaks, it’s usually a good idea to listen.

He’s a member of the elite 30-30 club — money managers that have generated annual returns of over 30% per year over more than 30 years. And he’s probably most famous for helping George Soros make over $1 billion, breaking the Bank of England back in 1992.

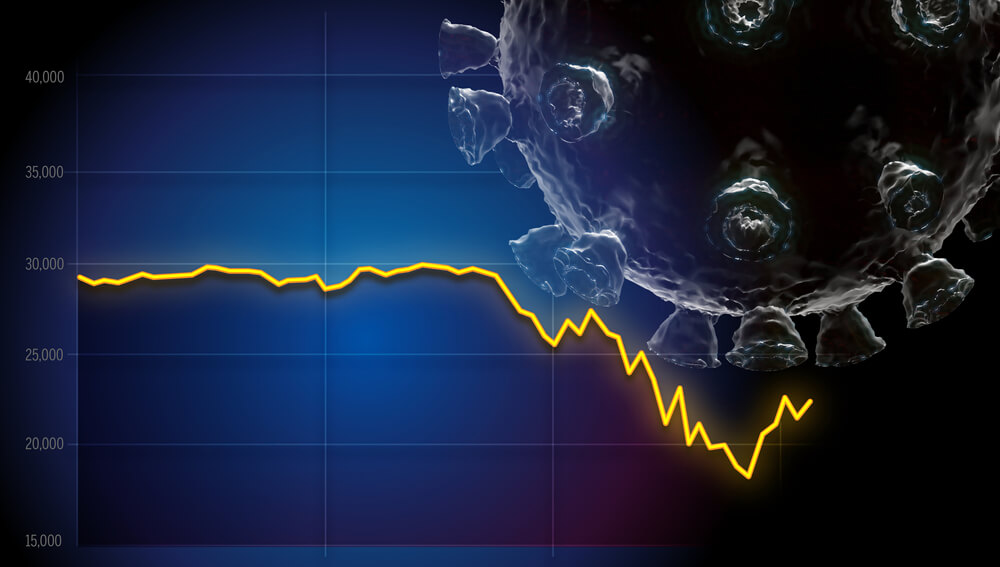

And Druckenmiller isn’t buying this stock market rally, calling the risk-reward trade-off the worst he’s seen in his career during a webcast this week hosted by the Economic Club of New York. He also called the notion of a V-shaped recovery a fantasy.

I’ll be honest. I’m just about euphoric right now to be back in Dallas.

I went to the McDonald’s drive through to buy an iced coffee and then went to Home Depot and wandered the aisles with a massive grin on my face. I bought a shopping cart full of stuff I neither needed nor wanted just for the sheer unbridled joy of buying something.

After 51 days of being quarantined on a Peruvian farm, I’m just happy being back in America and wasting money like a good, frivolous American consumer.

But I’m no fool.

After being stateside for less than a week, I can tell you the notion of a V-shaped recovery is pure fantasy.

My neighborhood looks like a 1950s Norman Rockwell painting. Parents are outside pushing their children on bikes, couples are sitting in lawn chairs with drinks in their hands.

It’s nice. I’d go so far as to say it’s idyllic.

But the fact that all of these people are outside means that they’re not somewhere else spending money. As the stay-at-home orders slowly get relaxed across the country, a lot of these people will slowly return to normal life. But the key word here is “slowly.”

Why the V-Shaped Recovery Is Pure Fantasy

Plenty of Americans are ready to rip the Band-Aid off and resume normal life.

I, for one, would kill to go to a movie or basketball game right now.

But there will be a lot of stragglers that are reluctant to come out of their houses. If even 10% to 20% of them avoid public spaces for another several months, that alone would put a lot of retail and entertainment businesses out of commission.

The V-shaped recovery is a fantasy.

Yes, the economy will start growing again once the lockdowns are phased out. But we don’t snap back to pre-COVID 19 levels immediately. That’s going to take time.

Of course, the stock market isn’t the economy. Even if the economy takes a while to get its legs back, might Federal Reserve stimulus keep the stock rally going?

It might.

But Druckenmiller isn’t so sure. While the Fed has stabilized the market by hoovering up trillions in bonds, Druckenmiller believes new government borrowing will be more than the Fed is willing or able to absorb.

We’ll see. The Fed has the ability to write unlimited checks, so I’m not too worried about them running out of money. But I do worry about the long-term credibility of the dollar if the Fed continues to monetize the entire credit system.

Druckenmiller said he favors market-neutral, long-short strategies over long-only buy-and-hold. I wouldn’t disagree, per se, but I’d expand this to say that short-term trading strategies in general are the best way to go right now.

As I noted last week, large buy-and-hold managers like Warren Buffett are sitting on a lot of cash right now.

None of this means the market has to retest its March lows or head lower from here. But I’d say it makes sense to heed the warnings of Druckenmiller and Buffett here. By all means, trade and make money.

But be careful about starting major new buy-and-hold positions here.

• Money & Markets contributor Charles Sizemore specializes in income and retirement topics, and is a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore