Stocks roared back from their March lows so analysts assured us the economy would form a V-shaped recovery.

Economists use letters to describe economic recoveries. A V-shaped recovery is a best-case scenario. It’s a rapid recovery.

An L-shaped recovery is the worst case. It’s a long, protracted bottom with recovery taking months or years after the bottom is reached. In between the extremes is the most common recovery, a U-shaped, which bottoms over several months.

Arguing for a rapid recovery, analysts noted the shutdown was unprecedented. We’d never shut down an economy before, but we saw it happen quickly. Someone simply flicked a switch. Recovery must be just as simple.

All it takes is flicking the switch back on.

If you aren’t an economist, you see problems with that idea. Yes, it’s easy to shut down an economy. But turning everything back on is hard.

To reopen, businesses will need supplies. That means suppliers need to open first. A phased recovery isn’t a V-shaped recovery. That’s a long, slow L.

In addition to supplies, businesses also need personal protective equipment for employees. This is just one increased cost in the new economy.

Some businesses operated on thin profit margins before the shutdown. Now, they won’t reopen as owners decide increased costs will destroy profits.

Economists are ignoring that reality.

Why a V-Shaped Recovery Is Impossible

Reality is getting harder to ignore. New data shows a V-shaped recovery isn’t possible.

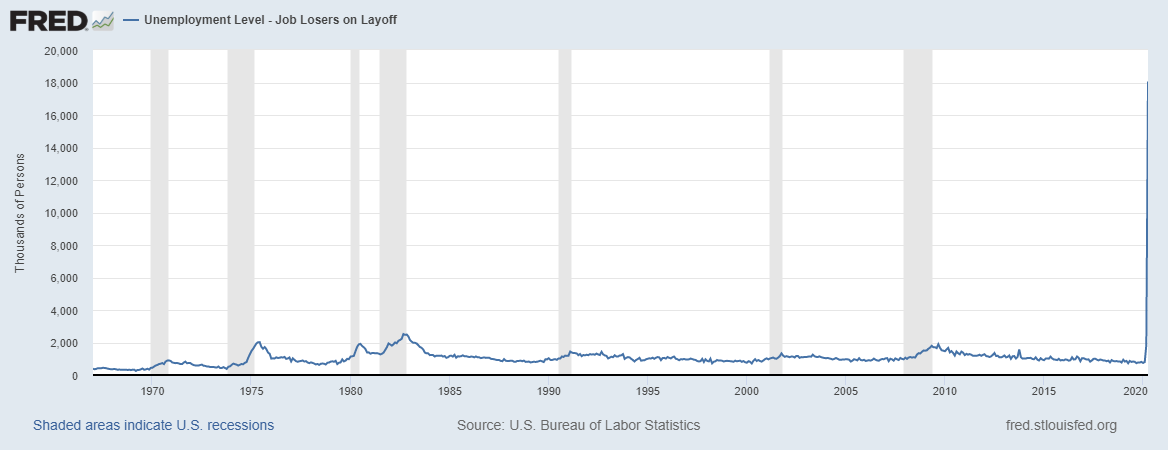

April unemployment data shows 18 million people are on temporary layoffs because of the shutdown.

Source: Federal Reserve

Some of those employees won’t have jobs to return to. Assume just 10% of businesses fail to reopen. Combined with the 2.5 million workers who are “not on temporary layoff,” according to Bureau of Labor Statistics jargon, the unemployment rate doubles from its prepandemic low.

Even if businesses try to reopen, many workers won’t return until August when enhanced unemployment benefits end. That will lead to more business failures.

This month’s employment report showed 17% of Americans have lost their jobs since February. Given additional new claims since that data was collected in mid-April, it’s safe to say over 20% are out of work.

Bringing one out of five workers back into the economy is a complicated process. This process makes a V-shaped recovery impossible.

Expect it to take at least nine months to get America back to work. And if you’re betting the over/under line, over is the safer bet.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru

Editor’s note: Want to learn how to profit from stock market volatility and grow your money 10 times over with just two simple investments? Sign up for The 10X Switch, a free webinar with Money & Markets Chief Investment Strategist Adam O’Dell on Thursday, May 14, at 8 p.m. EDT. You’ll also receive a free copy of Adam’s report, “The Simplest Investing Strategy Ever,” just for registering. Sign up here and reserve your spot!