If you are an investor looking for a new opportunity in the retail sector, you might have your eye on Academy Sports and Outdoors Inc. (Nasdaq: ASO). How does Academy Sports stock rate?

The company has experienced tremendous growth over the past few years, with its stock price rising steadily since its initial public offering in 2017.

But how safe is investing in ASO right now?

We’ll take a look at what investors should know about the risks and benefits, as well as the Stock Power Ratings, for Academy Sports stock as we head into 2023.

What You Should Know About ASO

Academy Sports and Outdoors is one of the largest sporting goods retail chains in the United States.

It operates more than 260 stores across 18 states in the southern and central regions of the U.S.

In addition to sporting goods, Academy also sells camping equipment, fishing supplies, hunting gear, clothing, footwear, accessories, home products and toys.

Despite the pandemic’s detrimental effects on many retailers in 2020, ASO managed to remain profitable thanks to strong digital sales as well as an uptick in foot traffic at its reopened stores.

Risks of Investing in ASO Stock

The retail industry is incredibly competitive; there are always new companies entering the market that could potentially overtake Academy Sports if it fails to innovate.

Additionally, relying on third-party vendors means that any supply chain disruptions could lead to shortages or delays that hit sales.

Furthermore, consumer tastes can change quickly. It’s difficult for a retailer like Academy Sports to keep up with trends or anticipate customer demand.

Benefits of Investing in Academy Sports Stock

It’s been a solid year for Academy Sports stock. Its up more than 20% in 2022 as I write.

First off, ASO managed to survive the worst of the pandemic, and it seems to be in recovery mode now.

Additionally, its focus on providing quality products at affordable prices makes it an attractive option for consumers who may be cutting back due to budget constraints brought about by high inflation.

Academy Sports Stock Power Ratings

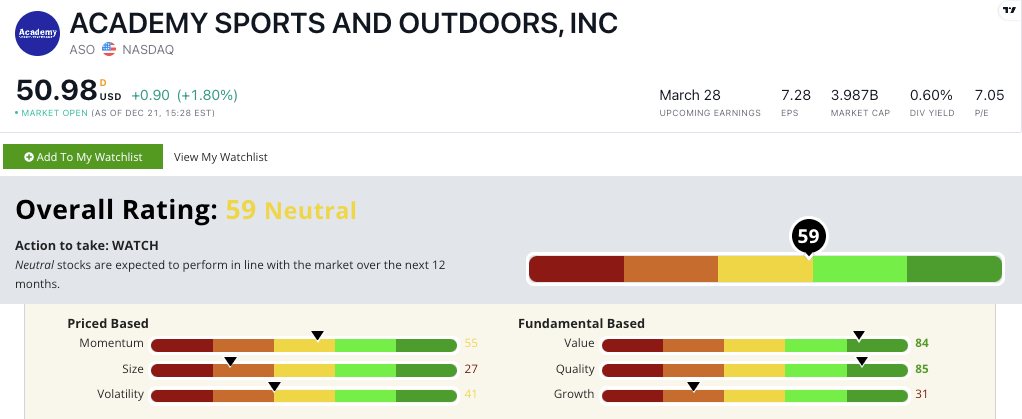

ASO stock rates a 59 out of 100 on our proprietary Stock Power Ratings system.

That means we are “Neutral” on the stock and expect it to perform in line with the broader market over the next 12 months.

ASO earns its highest mark on our quality factor … where it scores an 85.

This is due to double-digit positive returns on assets, equity and investment along with gross and operating margins.

The stock struggles on our growth factor … scoring a 31.

ASO’s prior quarter sales growth rate is negative 6.2% and its earnings-per-share growth rate is negative 5.8%

The bottom line: Investors should always be cautious when making decisions about where they put their money.

With careful research into Academy Sport’s current performance, as well as using our Stock Power Ratings system, investors can decide whether or not investing in Academy Sports stock is right for them this coming year.