You can buy insurance for your car, home and life. Heck, you can even insure yourself in case of an alien abduction.

Every state’s laws require auto insurance if you plan to drive.

This chart shows insurance companies’ projected increases in auto insurance premiums written (i.e., actual policies) through 2024.

They expect a 40.5% jump from 2021 to 2024.

And today’s Power Stock is a major insurance company in the U.S. that will profit from this massive increase: American International Group Inc. (NYSE: AIG).

AIG Stock Power Ratings in May 2022.

AIG services commercial, institutional and individual customers. It writes policies for cars, workers’ compensation, homes and even yachts.

American International Group stock earns a “Strong Bullish” 86 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

AIG Stock: Value, Growth + Momentum

Researching AIG, here’s what stood out to me:

- Last year, AIG increased its revenue from customer premiums to $31.3 billion — up 10% from 2020 — and its total annual revenue by 19%!

- The company made those gains by increasing its net premiums written year over year by 13%.

According to our Stock Power Ratings system, American International Group has great value and growth potential coupled with strong momentum.

But it’s the stock’s value that stands out the most. AIG is a bargain!

Its price-to-earnings (P/E) ratio is a low 5.43 — half the inflated average of stocks in the insurance industry.

Its price-to-sales ratio is 0.96, compared to the industry average of 1.3.

It scores a 93 on our growth metric — better than just 7% of all stocks we rate!

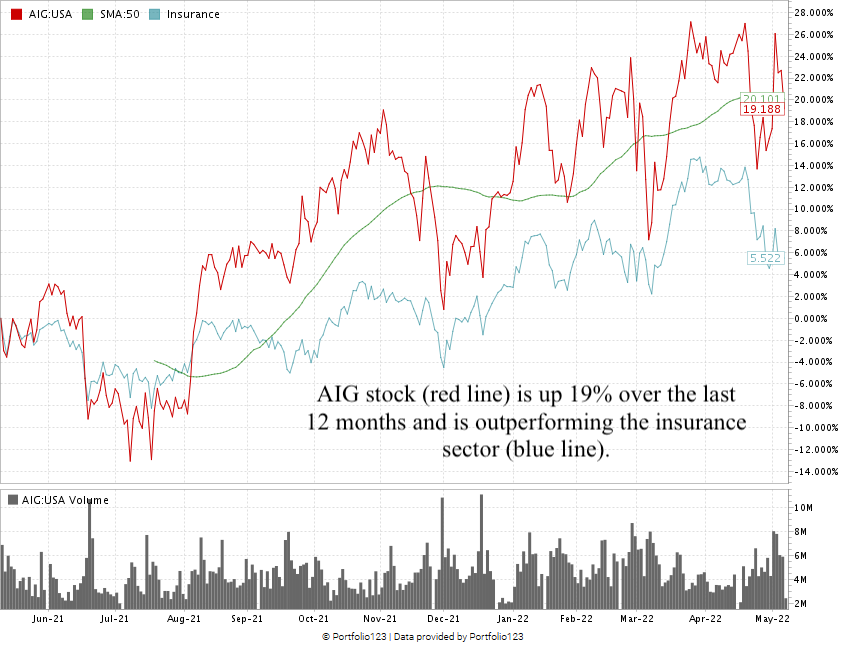

In the last 12 months, AIG stock is up 19.2%, crushing its insurance peers’ average 5.5% gains.

The stock has faced broader market headwinds of late, but it continues to test higher lows — a bullish sign for a coming uptrend.

American International Group Inc. stock scores an 86 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Almost all of us need insurance. Inflation, the war in Ukraine and the Federal Reserve won’t change that.

Bonus: AIG stock comes with a healthy 2.06% forward dividend yield. It pays shareholders $1.28 per share, per year, just to hold the stock.

Stay Tuned: Top-Rated Agriculture Play

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a unique play on commodities.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets