Investors now know the word “Evergrande” is important. The Chinese property developer went from obscurity to notoriety in recent weeks as its debt problems jumped into the headlines.

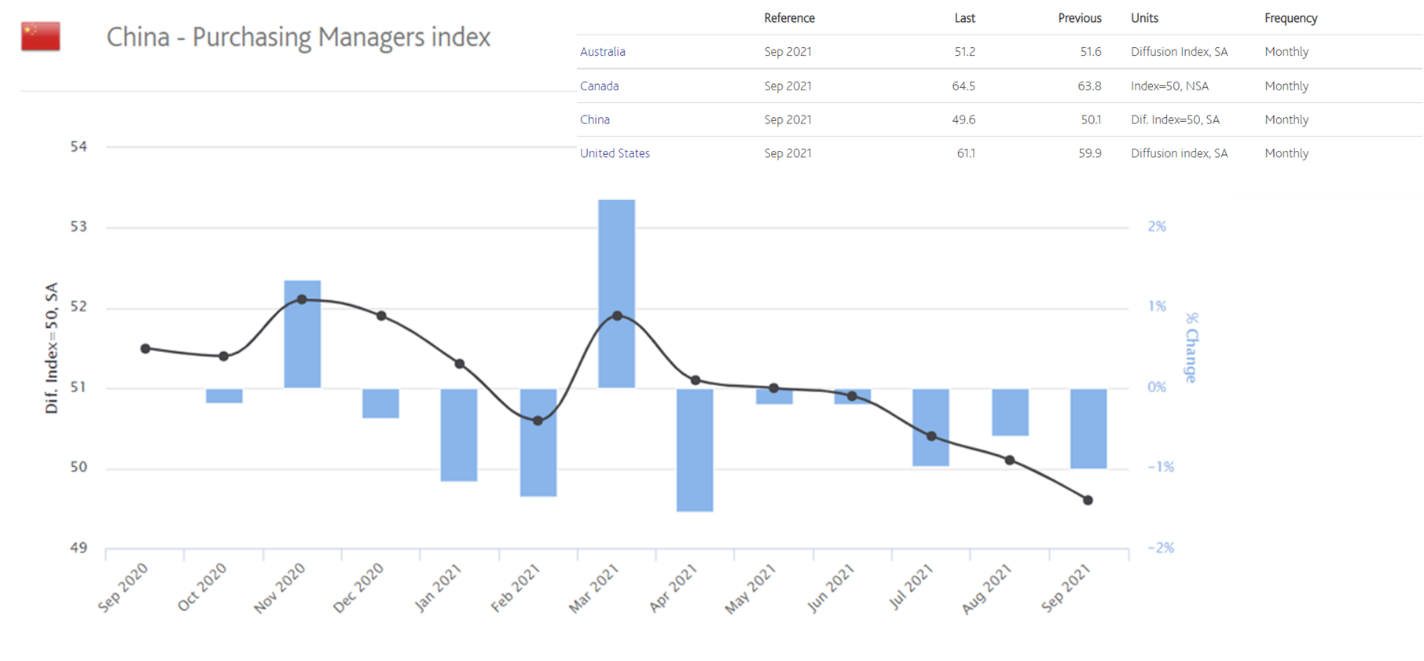

Digging deeper into economic reports from China, we learn that Evergrande might just be the beginning of bad news from the country. China’s Purchasing Manager Index (PMI) dropped below 50 in September, an indicator that their economy could be contracting instead of expanding.

China’s PMI Downturn

Source: Moody’s.

PMI is among the most important economic indicators. It reports on a survey of purchasing managers at factories around the country. Readings above 50 indicate growth in a country’s manufacturing sector, while readings below 50 indicate contraction. China’s reading of 49.6 is a warning that growth is slowing in that country.

Purchasing managers are at the forefront of economic trends. In a factory, they are responsible for ensuring workers stay busy. They are aware of incoming orders and expected maintenance downtime. They need to maintain enough inventory to meet demand without ordering so much inventory that the company needlessly ties up capital or supplies spoil before they can be used.

China’s PMI Is Crucial for Economic Growth

Profitability depends on purchasing managers doing their jobs well. Economists who understand the import role factories play in economic growth have recognized this for a long time. The PMI was one of the first indicators developed to forecast the economy.

In the U.S., the PMI is known as the Institute of Supply Managers (ISM) Index. The ISM Index is a successor to the PMI and is among the most accurate long-term forecasting tools for economists. Components of the ISM report can also help investors trade the stock market.

The importance of these reports makes the news from China an ominous warning for investors. For now, the problem is isolated to China. If PMI or ISM readings fall in other countries, a global recession is likely.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.