I’m like a little kid again.

I have been a huge soccer fan for basically my whole life.

I have my favorite teams and players, but I’ll watch any game I can.

Last week, the 2022 World Cup kicked off in Qatar, and I couldn’t be more thrilled.

NBC Sports estimates 5 billion people will watch the World Cup around the globe — an average of 227.3 million per day.

It also presents sports gamblers with a plethora of new betting lines for the world’s most popular sport.

It’s estimated that Americans will bet $1.8 billion on the 2022 World Cup.

But with our Stock Power Ratings system, you can see that, while betting on sports … especially the World Cup, is popular, sports betting stocks are not.

Not Even the World Cup Can Save This Betting Platform

One is DraftKings Inc. (Nasdaq: DKNG).

Our system helps you see the real story behind a company.

DraftKings launched in 2012 from the basement of one of its founders.

It started as a fantasy sports platform but quickly grew into one of the largest sports betting apps in the world.

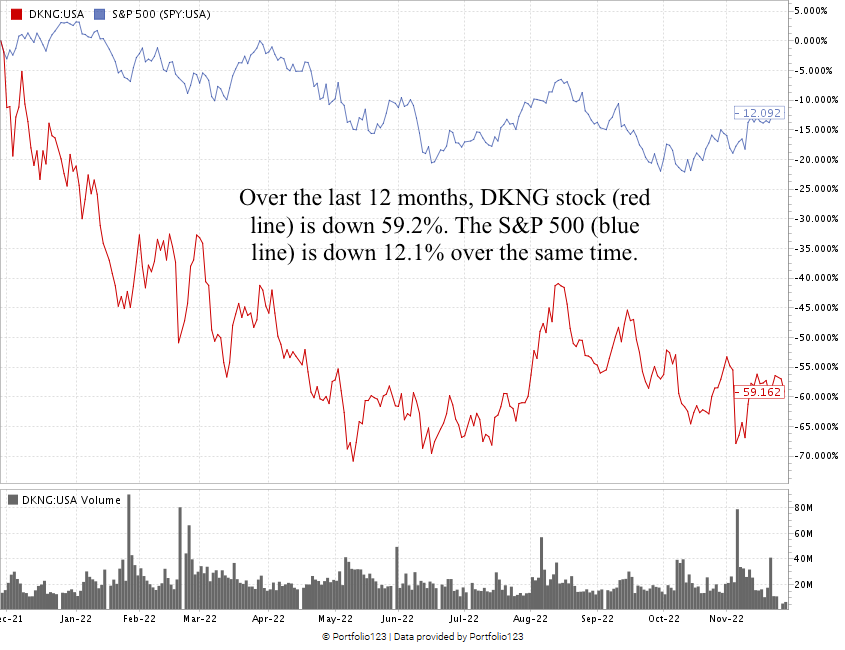

Despite the popularity, DraftKings stock has struggled mightily over the last 12 months.

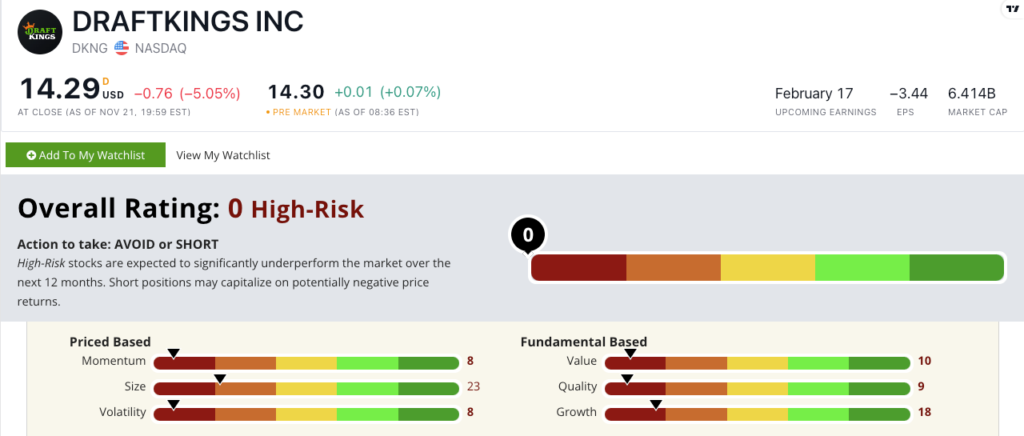

DKNG stock scores a “High-Risk” 0 out of 100 on our Stock Power Ratings system. We expect it to underperform the broader market over the next 12 months.

DraftKings Stock: All I See Is Red

I love highlighting a company’s positive company financials.

DKNG, on the other hand, has struggled:

- In its most recent quarterly report, the company reported a net loss of $450.5 million.

- Over the first nine months of 2022, the company’s net loss is $1.13 billion.

That shows why DKNG scores an 18 on growth.

It also scores in the red on our other five factors.

DKNG has negative price-to-earnings, meaning it’s not making any profit. It scores a 10 on value.

The company has a horrible return on equity of negative 89.6% … and a return on investment of negative 49.4%, earning it a 9 on quality.

It means the stock is overvalued, and the company isn’t turning a profit — all bad news for investors.

Created in November 2022.

DKNG stock has fallen 59.2% over the last 12 months.

The broader S&P 500 dropped an average of 12.1% over the same time.

DraftKings stock scores a 0 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

The 2022 World Cup is here, and I will be watching every game I can.

Sports betters will drop billions of dollars on everything from score lines to who puts the ball in the back of the net.

While DraftKings may be popular with thousands of gamblers, not even the World Cup can save DKNG stock.

Stay Tuned: A Critical Company for the Semiconductor Boom

Tomorrow, we’re returning to our original Stock Power Daily form.

Stay tuned — I’ll share all the details on a critical producer within the booming semiconductor industry. These tiny computer chips power everything from your car’s computer to your refrigerator, and this company plays a key role in manufacturing this innovative technology.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?