Home Depot has been a major player in the home improvement and DIY industry since 1978. Does that mean Home Depot stock (NYSE: HD) is a buy in 2023?

As one of the world’s largest home improvement stores, it has a customer base of over 2 million DIY enthusiasts and contractors alike.

Today, we will take a look at Home Depot’s business strategy and outlook for the next few years. We’ll also run Home Depot stock through our proprietary Stock Power Ratings system to see how it stacks up for investors in 2023.

Home Depot’s Business Strategy

Home Depot’s business strategy is to provide customers with quality products, services and solutions that meet their needs at a fair price.

The company relies on its knowledgeable sales associates to engage customers in meaningful conversations about their projects and provide them with helpful advice.

Home Depot also emphasizes convenience by selling its products online. Customers can use its click-and-collect services, where they can place an order online and pick it up in store hours later.

In recent years, Home Depot has invested heavily in its ecommerce platform to ensure that customers can find all of the products they need without having to leave their homes.

This includes creating mobile-friendly websites and apps so customers can shop from the comfort of their own devices.

As such, Home Depot is well positioned to capitalize on the growing demand for online shopping options. It’s a potent combo of online and in-store offerings that appeal to DIY-ers of all kinds.

Business Outlook for 2023

Looking ahead to 2023, analysts expect that Home Depot will continue to be a leader in the home improvement industry due to its strong track record of innovation and customer satisfaction ratings.

As homeowners become more interested in DIY projects and renovations, it is likely that Home Depot will benefit from increased consumer spending on tools, materials and other supplies needed for these activities.

But it could be a tough year as well. Consumers aren’t tightening their purse strings amid higher prices and recession fears.

Instead of getting stuck in the weeds, let’s use our system to see if Home Depot stock is set for a strong year in 2023.

Home Depot Stock Power Ratings

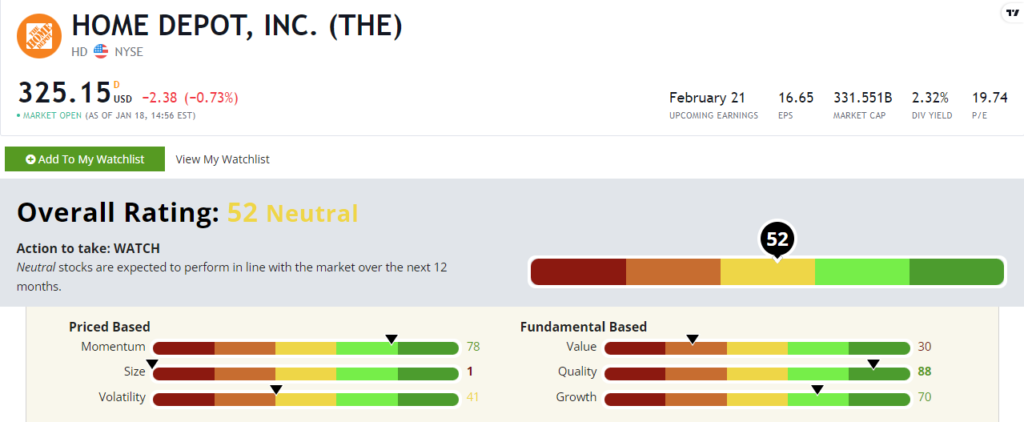

Home Depot stock rates a “Neutral” 52 out of 100. That means our system expects the stock to perform in line with the broader market over the next 12 months.

Home Depot is a huge company. Its market cap (outstanding shares times current stock price) is north of $320 billion as I write. That’s why Home Depot stock rates only a 1 out of 100 on our size factor. It takes a lot of money to move the needle even a little on this stock.

But this is also a company that has been around for a long time, and that takes consistent (and growing) inflows of cash to achieve.

Home Depot reported a 5.5% increase in revenue year over year in its last quarterly earnings call. Net income also increased 5%. And its operating income grew more than 6%.

Numbers like that explain HD’s strong ratings on quality (88) and growth (70).

Bottom Line: Overall, Home Depot looks poised to remain one of the top players in the home improvement industry for many years to come.

But Home Depot stock may not wow anyone in 2023.