Seasonality simply refers to certain stocks performing better at different times of the year.

Many investors consider valuation tools and dozens of data points when looking at stocks. While seeking as much information as possible, many ignore an important factor.

The truth is some stocks will do better than others at different times of the year. This factor is called seasonality.

One way to consider seasonality is by month.

Overall, July is not an especially bullish month for the S&P 500. It’s also not an especially bearish month. It’s about as close to average as we see.

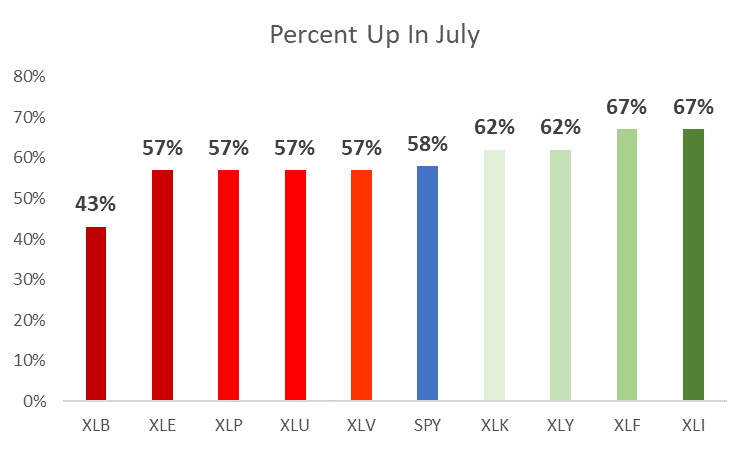

The index has been up about 58% of the time in July.

On average, since 1929, the S&P 500 shows a gain 59.6% of the time for a random one-month holding period.

The chart below drills down to sectors in the S&P 500. It shows some sectors did better than average while others did worse. At the bottom of the chart are ticker symbols of exchange-traded funds, or ETFs, that track each sector.

ETFs allow traders to easily invest directly in a sector, or a full index itself.

July Seasonality Trends for Each S&P 500 Sector

These are seasonality tendencies, and seasonals can help traders find the most promising stocks. Seasonal factors reflect fundamental business operations.

For example, one of the largest holdings of Industrial Select Sector SPDR Fund (NYSE: XLI), the most bullish ETF, is Union Pacific, a railroad. Railroads tend to report lower traffic in the summer and higher traffic loads in the winter months.

It is possible investors buy the stocks in summer while the news looks bad so they can then sell when railroads report higher traffic later in the year.

Many investors argue seasonality patterns like this can’t exist because prices are forward-looking, and smart investors know traffic varies with the seasons. Yet railroad stocks show a tendency to rally every July.

Basic materials are the weakest sector in July. Materials Select Sector SPDR Fund (NYSE: XLB) is among the weakest ETFs in August and September as well.

That information could tell investors to delay purchases in that sector. Stocks they find attractive are likely to be even more attractive in a few weeks.

On the other hand, if you are considering purchases in strong sectors, it could be best to act rather than wait.

In that way alone, sector seasonality can provide valuable information.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.