FREE, Unfiltered Insights from the #1 Rated Jobs Predictor on Bloomberg’s Terminal

Major Wall Street firms dominate the financial markets — but they still rely on outdated data and methodology to make some of their most important decisions.

As a result, these financial titans consistently miss the mark on key data points like jobs numbers. This happens so often that we take it for granted, too, with factual government data constantly surprising Wall Street.

Andrew Zatlin recognized this as an opportunity hiding in plain sight … He built a whole new forecasting system from the ground up, focusing on real-time data and pushing research technology to its limits.

His revolutionary new system predicts future jobs numbers with alarming accuracy, earning him the coveted #1 spot on the Bloomberg terminal’s long list of forecasters.

Andrew’s forecasts and insights have only been available to high-paying hedge fund clients and institutional investors.

Until now…

Moneyball Economics is a special 2X per week video broadcast directly from the desk of Andrew Zatlin.

Until recently, Andrew only shared this biweekly video update with a handful of industry insiders and colleagues — mostly top institutional investors and executives from the financial publishing industry.

Now, he’s making Moneyball Economics available to Money & Markets readers — for FREE!

As the name implies, these videos are all about a radical new approach to trading and investing — using advanced analytical tools and real-time data to keep up with today’s fast-growing economy.

Twice each week, you can look for a new issue covering a wide range of topics, from “Big Picture” economic trends to pinpointing opportunities in breakout sectors.

Andrew likes to send out these updates every Tuesday and Thursday, but that schedule is subject to change as different opportunities present themselves.

If you have any questions, comments, or suggestions, don’t hesitate to email my team at Moneyball@MoneyandMarkets.com. This is a two-way street, and we read every email you send.

Forget the “Doom & Gloom” in US Manufacturing February 27, 2026 Moneyball Economics There’s a bit of a storm cloud hanging over the US economy — at least as far as the mainstream financial media is concerned. The logic behind this perception is profoundly simple… “Tariff Bad.” And by the transitive property, “Tariff bad for economy.” This isn’t entirely untrue. But as we’ve learned time and time again […]

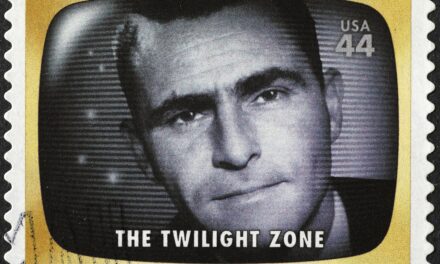

Forget the “Doom & Gloom” in US Manufacturing February 27, 2026 Moneyball Economics There’s a bit of a storm cloud hanging over the US economy — at least as far as the mainstream financial media is concerned. The logic behind this perception is profoundly simple… “Tariff Bad.” And by the transitive property, “Tariff bad for economy.” This isn’t entirely untrue. But as we’ve learned time and time again […] Welcome to the “Twilight Zone” of Economic Data February 25, 2026 Moneyball Economics You are about to enter another dimension… A dimension not only of sight and sound, but of mind. A journey into the wondrous land of imaginary data sets and made-up statistics. Next stop, the Twilight Zone of Economic Data… We are now nearly two full months into 2026 — but the stock market has […]

Welcome to the “Twilight Zone” of Economic Data February 25, 2026 Moneyball Economics You are about to enter another dimension… A dimension not only of sight and sound, but of mind. A journey into the wondrous land of imaginary data sets and made-up statistics. Next stop, the Twilight Zone of Economic Data… We are now nearly two full months into 2026 — but the stock market has […] It’s Time We Put 2026 on Rails February 17, 2026 Moneyball Economics If there’s one word to characterize 2026’s market performance so far, that word would be “uncertainty.” Year-to-date, the S&P 500 index is essentially flat. The vanguard of “Magnificent Seven” mega-cap tech stocks that once drove the market are now down 5% on the year. And individual investors are clearly stuck wondering “what’s next?” Will inflation […]

It’s Time We Put 2026 on Rails February 17, 2026 Moneyball Economics If there’s one word to characterize 2026’s market performance so far, that word would be “uncertainty.” Year-to-date, the S&P 500 index is essentially flat. The vanguard of “Magnificent Seven” mega-cap tech stocks that once drove the market are now down 5% on the year. And individual investors are clearly stuck wondering “what’s next?” Will inflation […] Time for a Reality Check in the Jobs Market… February 13, 2026 Moneyball Economics Hello and welcome back to Moneyball Economics! As you may already know, I have quite a few hedge fund clients who pay a small fortune for access to my economic research. And for the last week, these hedge funds have been ringing my phone off the hook nonstop. They’re calling because, for one, the stock […]

Time for a Reality Check in the Jobs Market… February 13, 2026 Moneyball Economics Hello and welcome back to Moneyball Economics! As you may already know, I have quite a few hedge fund clients who pay a small fortune for access to my economic research. And for the last week, these hedge funds have been ringing my phone off the hook nonstop. They’re calling because, for one, the stock […] 2026 Just Got More Bullish… February 10, 2026 Moneyball Economics 2025 was a rollercoaster for investors all over the market. Everything from cutting-edge big tech to precious metals saw massive moves during the first year of Trump’s second presidential administration. And we saw tremendous volatility as the market struggled to adjust to Trump’s new reality. From the “Liberation Day” tariff selloff to the subsequent surge […]

2026 Just Got More Bullish… February 10, 2026 Moneyball Economics 2025 was a rollercoaster for investors all over the market. Everything from cutting-edge big tech to precious metals saw massive moves during the first year of Trump’s second presidential administration. And we saw tremendous volatility as the market struggled to adjust to Trump’s new reality. From the “Liberation Day” tariff selloff to the subsequent surge […] Market Bloodbath as “Hot Money” Turns Cold January 30, 2026 Moneyball Economics It’s rough out there, folks. Following President Trump’s nomination of Kevin Warsh to be the next Fed Chair, we’re seeing a widespread pullback across, stocks, crypto, gold and silver. And I want to emphasize — this is not just a “knee-jerk” reaction or a one-off pullback… What we’re seeing right now is the beginning of […]

Market Bloodbath as “Hot Money” Turns Cold January 30, 2026 Moneyball Economics It’s rough out there, folks. Following President Trump’s nomination of Kevin Warsh to be the next Fed Chair, we’re seeing a widespread pullback across, stocks, crypto, gold and silver. And I want to emphasize — this is not just a “knee-jerk” reaction or a one-off pullback… What we’re seeing right now is the beginning of […] Fed’s Next Rate Cut = Cause for Alarm? January 27, 2026 Moneyball Economics Hello, and welcome back to Moneyball Economics! It’s been a frosty few days thanks to the massive winter storm that just swept through the United States. In places like Pennsylvania, they’ve clocked more than 20 inches of snow on the ground — so I hope you’ve been keeping warm. All that snow really slowed down […]

Fed’s Next Rate Cut = Cause for Alarm? January 27, 2026 Moneyball Economics Hello, and welcome back to Moneyball Economics! It’s been a frosty few days thanks to the massive winter storm that just swept through the United States. In places like Pennsylvania, they’ve clocked more than 20 inches of snow on the ground — so I hope you’ve been keeping warm. All that snow really slowed down […] Trump’s Agenda Hits Healthcare in 2026 January 23, 2026 Moneyball Economics Donald Trump has been fast and furious in his implementation of new policies and agendas — doing more in his first year than most presidents do in an entire term. As a result, it’s not always easy to pick out the impact of these policies … how effective they might really be … and how […]

Trump’s Agenda Hits Healthcare in 2026 January 23, 2026 Moneyball Economics Donald Trump has been fast and furious in his implementation of new policies and agendas — doing more in his first year than most presidents do in an entire term. As a result, it’s not always easy to pick out the impact of these policies … how effective they might really be … and how […] Carry Trade Whiplash >> Stock Pullback 2026 January 21, 2026 Moneyball Economics For decades now, the “carry trade” has been one of the most reliable ways to bank a quick buck in high finance. It’s simple. You borrow money for next to nothing from Japanese banks (where interest rates have long lingered near 0%), then you invest the same money in interest-bearing T-bills and earn a few […]

Carry Trade Whiplash >> Stock Pullback 2026 January 21, 2026 Moneyball Economics For decades now, the “carry trade” has been one of the most reliable ways to bank a quick buck in high finance. It’s simple. You borrow money for next to nothing from Japanese banks (where interest rates have long lingered near 0%), then you invest the same money in interest-bearing T-bills and earn a few […] The “Phantom Tax” That comes with the Super Bowl… January 16, 2026 Moneyball Economics It’s t-minus three weeks to Super Bowl Sunday, with the Seattle Seahawks and Los Angeles Rams looking like strong contenders to make the game. Of course, it doesn’t matter who makes the game this year. An estimated 127 million Americans is set to tune in anyway … many of whom will only be in it […]

The “Phantom Tax” That comes with the Super Bowl… January 16, 2026 Moneyball Economics It’s t-minus three weeks to Super Bowl Sunday, with the Seattle Seahawks and Los Angeles Rams looking like strong contenders to make the game. Of course, it doesn’t matter who makes the game this year. An estimated 127 million Americans is set to tune in anyway … many of whom will only be in it […]