Sometimes the best road to stock gains is to find companies that are involved in multiple mega trends.

We’re no stranger to energy’s bullish run over the last year or so. And today’s company adds another mega trend for a potent combination: e-commerce.

Oil and gas companies need tons of parts and supplies to function.

The same is true for manufacturers.

Most of these businesses rely on third parties for the equipment they need to be profitable.

And that’s created a multiyear mega trend that’s on everyone’s radar.

A survey by e-commerce developer Sana found that 56% of businesses believe third-party e-commerce platforms will generate the most revenue through 2026.

Today’s Power Stock operates one of the largest e-commerce sites for two massive industries:

- Oil and gas.

- Manufacturing.

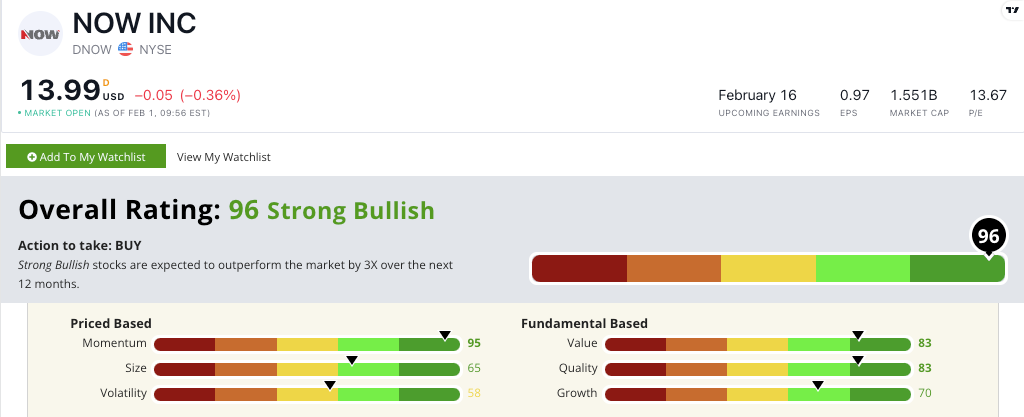

And NOW Inc. (NYSE: DNOW) scores a “Strong Bullish” 96 out of 100 in our proprietary Stock Power Ratings system.

DNOW is a one-stop shop for two of the largest industries around the world. It provides products such as:

- Steel, PVC and fiberglass pipe.

- Electrical cable and motors.

- Cutting and measuring tools.

- Oil and gas pumps.

NOW stock scores a “Strong Bullish” 96 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

DNOW Stock: Nice Upward Trend at a Fantastic Value

NOW recently closed out a strong quarter.

Here are two high points:

- Reported revenue of $577 million — a 31.4% increase over the same period a year ago!

- Its quarterly net income was $40 million — increasing 700% from the same quarter a year ago.

These sales figures show why DNOW stock scores a 70 on our growth factor in our Stock Power Ratings system.

It’s also a strong value stock — scoring an 83 on that factor. DNOW’s price-to-sales and price-to-book value ratios are both lower than industry peer averages.

On quality, DNOW earns an 83 due to healthy margins and returns on assets, equity and investment being in line with its peers.

But its market-busting momentum is the real story:

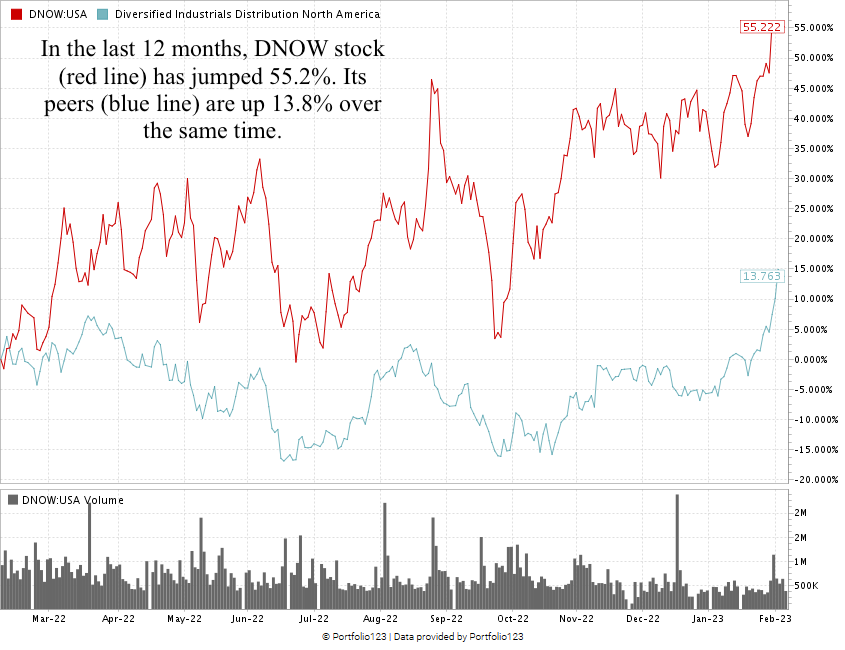

Created in February 2023.

DNOW’s stock price has increased 55.2% over the last 12 months.

For comparison, its diversified industrials distribution peers (that’s a mouthful) have averaged a mere 13.8% gain over the same time.

That shows the “maximum momentum” we want to see in stocks…

DNOW stock scores a 96 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Successful businesses rely on third parties for the parts and services they need.

DNOW operates one of the largest third-party e-commerce sites, providing these essential parts for the oil and gas industry as well as the manufacturing industry.

It’s a strong combination of two mega trends that are set to drive the market higher for years to come: energy and e-commerce.

That’s why DNOW is a great addition to your portfolio.

Stay Tuned: What Drove Last Year’s Bear Market

I’m switching it up again tomorrow.

I want to dive into last year’s bear market and show you what my colleague Adam O’Dell and I think drove the worst sell-off in more than a decade.

And I’ll tell you whether or not I think the worst days are behind us…

Stay tuned.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets