Beat the Market 3-to-1 with Our Revolutionary Stock Rating System

Discover the power of Green Zone Fortunes and take control of your investments today!

Are you tired of watching your portfolio underperform? Frustrated by the complexities of the stock market? It’s time to level the playing field with Green Zone Fortunes – your gateway to market-beating returns.

Introducing the Green Zone Power Ratings System

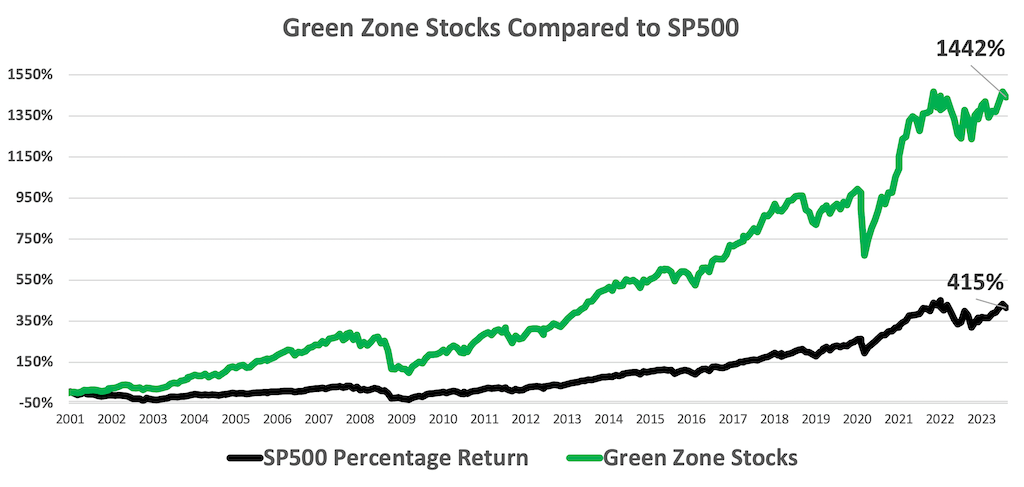

Developed by Adam O’Dell, a Chartered Market Technician in the top 1% of financial experts, our proprietary Green Zone Power Ratings System has consistently outperformed the S&P 500 by 3-to-1 over the past two decades.

How It Works:

Our system analyzes over 6000 stocks daily, evaluating 100 individual metrics across six crucial factors:

- Momentum

- Size

- Volatility

- Value

- Quality

- Growth

The result? A simple, actionable rating from 0 to 100 for each stock:

- 81-100: Green Zone (Very Bullish)

- 61-80: Green Zone (Bullish)

- 41-60: Yellow Zone (Neutral)

- 21-40: Red Zone (Bearish)

- 0-20: Red Zone (High-Risk)

Simplicity at Your Fingertips:

We’ve designed the Green Zone Power Ratings System with simplicity in mind. You don’t need to be a financial expert or spend hours analyzing complex data. Our user-friendly interface allows you to:

- Enter any stock ticker and instantly see its rating

- Understand a stock’s potential at a glance

- Make informed decisions quickly and confidently

Whether you’re a seasoned investor or just starting out, our system provides clear, actionable insights without the confusion of traditional stock analysis.

Proven Track Record:

Our system has identified hundreds of triple-digit winners across various market conditions, including during market downturns. By focusing on stocks in the Green Zone, you can potentially maximize your returns while minimizing risk.

Want to see how the stocks in your portfolio rate?

That’s where Green Zone Fortunes can help.

Here’s exactly what our members see when they search for the Green Zone Power Rating for Alphabet:

A “Bullish” rating of 80 with a perfect 100 quality rating and a near-perfect 95 growth rating.

This is just one example of over 6000 stocks rated by our proprietary system.

What You Get with Green Zone Fortunes:

- 24/7 Access to the Green Zone Power Ratings System

- Check any stock’s rating anytime, anywhere

- Analyze over 5,000 stocks at your fingertips

- Use on your phone or computer for maximum convenience

- Monthly Stock Picks

- Handpicked recommendations from our expert team

- In-depth analysis and research for each selection

- Real-time Trade Alerts

- Know exactly when to buy or sell

- Optional text notifications for timely updates

- Weekly Updates

- You’ll get Adam’s take on what’s happening in the markets, and the profitable trends he’s seeing.

Don’t let another market opportunity pass you by. Join the 56,000+ members already benefiting from Green Zone Fortunes and start beating the market today!

Limited Time Offer: Get a full year of Green Zone Fortunes for just a fraction of the regular $199 price!

Remember, with Green Zone Fortunes you’re not just getting stock picks – you’re gaining the power to evaluate any stock like a Wall Street pro. Don’t wait for the next market rally or crash. Take control of your financial future now!