Much like the roads that President Biden and Congress want to fix, the infrastructure bill is in gridlock.

But there is hope. Senate GOP leaders unveiled a $928 billion counteroffer on Thursday after Biden whittled his offer down to $1.7 trillion.

And talks seem to be moving forward … at about the pace anyone could expect from a narrow-majority government that has already spent trillions in the last year.

The deal is still alive, and so is one of the major investment themes of 2021.

Biden wants to “build back better.” In plain English, that means we’ll be throwing a lot of money at infrastructure spending. The latest Senate GOP proposal included $506 billion for roads, bridges and other major infrastructure projects alone. That’s bullish for basic materials stocks.

And this brings me to Vale SA (NYSE: VALE), the Brazilian miner. Vale is one of the largest producers of iron ore in the world. It’s also a major producer of other base metals, precious metals and coal.

Vale stock had a rough decade leading up to 2020. It was in free fall for much of 2010 to 2015. It started to rally but then rolled over and died again in 2018, continuing to drift lower.

Vale had the classic problem of being a nice house in a bad neighborhood. Resource stocks have done poorly since the 2008 crisis, and so have most emerging markets. Vale is both a resource stock and an emerging market stock. It never stood a chance.

But something changed in 2020. Emerging markets finally bottomed out. And with almost every country in the world resorting to extraordinary monetary policy, inflation hedges started performing again. Vale stock has more than tripled since hitting lows in March 2020.

Vale Keeps Soaring Higher

Vale’s stock is even more bullish than when I originally wrote about it back in January. And that’s without an infrastructure bill!

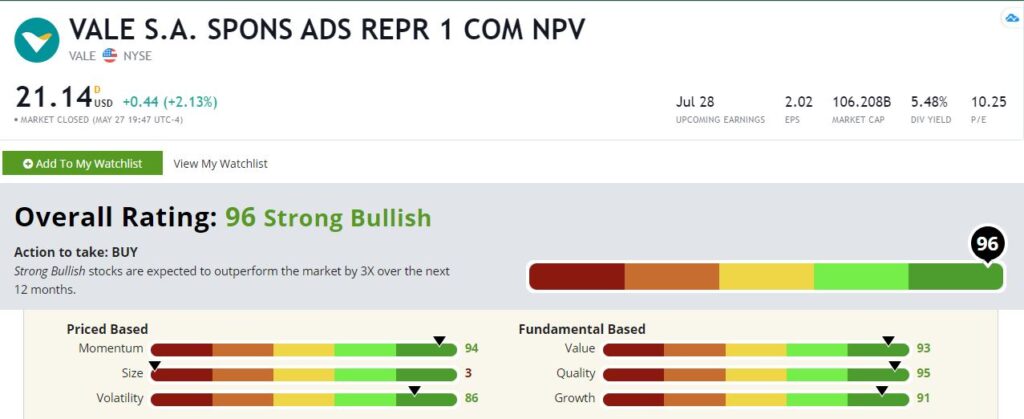

Vale Stock Rating

Vale stock’s overall rating of 96 is “Strong Bullish” on Adam O’Dell’s Green Zone Ratings model. It’s in the top 4% of all stocks we rate and 17 points higher than what it was when I originally wrote about it in January!

We can expect “Strong Bullish” stocks to outperform the market by three times over the following year based on Adam’s historical testing. So, if history is a guide here, this is only the beginning of Vale’s outperformance. Let’s dig a little deeper.

Vale SA's Green Zone Rating on May 27, 2021.

Momentum — Vale rates highest on momentum with a rating of 94. That’s not surprising given the stock’s performance through 2020 and into this year. The essence of momentum investing is buying high and selling higher. And if I’m right about the market shift to more inflationary assets, I think that’s very likely here.

Value —

Here’s where it gets fun. It’s rare to see stocks that rate well on momentum and value. Most of the time, if the stock has momentum, it’s not cheap. Vale rates at a 93, meaning that it is “cheaper” than all but 7% of the stocks in our universe. And that value rating jumped 15 points since I last wrote about Vale!

Quality —Vale also rates well based on quality, scoring a 95. Finding a stock that rates well in the trifecta of value, momentum and quality … well, that’s unicorn territory. We base our quality rating on debt management and profitability. So, Vale is a profitable company that manages its balance sheet responsibly.

Volatility — I’ll admit I was surprised that Vale rated as high as it did in volatility at 86. (Remember, a high score here means less volatility.) Materials stocks are notoriously volatile because commodity prices themselves are notoriously volatile. Vale’s high score here is a nice bonus.

Growth — Vale’s growth has jumped more than 30 points to 91 since I last wrote about it in January when I said its growth rating could perk up over the next several months. It looks like I was on the money, and the stock is benefitting. In the first quarter of 2021, its revenue jumped 121% year-to-year to $69.3 billion, and its net income is 3,000% higher than it was a year ago!

Size — Alas, you can’t win ‘em all. Vale is a large company with a market cap of almost $112 billion, so it rates low on our size scale at a 3.

Bottom line: It’s still early, and a lot can happen this year. But I think 2021 is shaping up to be a great year for materials stocks like Vale.

To safe profits,

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Updated on May 27, 2021.