Artificial intelligence is here to stay.

Just Google “artificial intelligence” or “AI,” and you’ll see why.

At 9 a.m. Thursday, I found…

- A story about Apple poaching AI researchers from Google.

- How one company is using AI to read 2000-year-old scrolls.

- A senate hearing on digital replicas and nefarious AI uses.

- And a story about how AI cost Americans 800 jobs in April.

These top four results alone show how we’ve moved beyond ChatGPT and AI-generated term papers. AI is affecting job markets, fueling a new arms race for Big Tech and becoming a hot topic for regulation.

Similar headlines are breaking every day. Go ahead and try your own search and see what comes up.

As an investor, it’s a truly exciting time. AI is this generation’s internet, and we have the opportunity to buy stocks with massive potential. Just look at Nvidia Corp. (Nasdaq: NVDA). In the last year alone, it’s up almost 200%, fueled by demand for its industry-leading AI chips.

Of course, there will be bumps in the road along the way. We’re seeing that play out as leading AI stocks (including NVDA) have pulled back recently.

Luckily, we have a system in Green Zone Power Ratings that helps make sense of it all.

What’s Next for AI

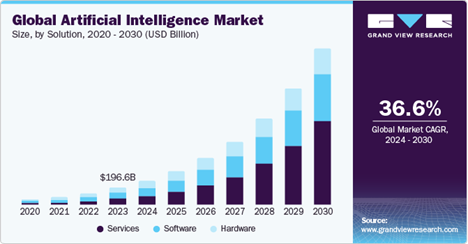

Grandview Research projects the global AI market’s average compound annual growth rate between now and 2030 will be 36.6%.

That massive growth is already creating incredible investing opportunities, and I expect that to continue.

Looking a little closer at the chart…

In 2024, there’s a split between hardware, software and services. Companies are still establishing AI’s infrastructure and researching where the most potential lies.

But you can see that balance shifts as the years go on. By 2030, services are set to command the lion’s share of the market.

Let’s use Adam O’Dell’s Green Zone Power Ratings to look for ways to invest for now and for the future.

AI Stock for 2024

I’ve reviewed NVDA’s ratings a few times here in Money & Markets Daily, so let’s examine another AI stock darling.

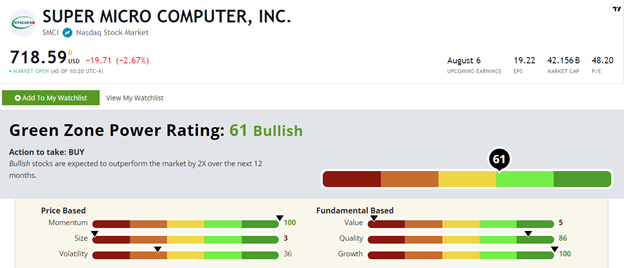

American chipmaker Super Micro Computer Inc. (Nasdaq: SMCI) has gained more than 600% in the last year — and our ratings system points to more outperformance from here.

SMCI’s “Bullish” rating of 61 out of 100 means it’s expected to outperform the broader S&P 500 by 10X over the next 12 months.

Its 600% stock price growth in a year explains its 100 rating on Momentum, but it also explains the stock’s 5 out of 100 on Value. SMCI’s price-to-earnings ratio jumped from 10 this time last year to 41 now. It’s pushed well above the computer hardware and storage industry average of 24.

This is a high-growth tech stock, and investors have been willing to pay a premium for its growth so far.

This is also a swingy stock with a 36 Volatility rating. Double-digit moves are not uncommon for SMCI. Since February, the stock has bounced between a low of $713 and a high of $1,188.

All told, if you’re looking for an AI stock in 2024, Green Zone Power Ratings says SMCI has market-beating potential.

Now, to shift our view to the future…

AI Stock for the Future

We’re still in the early days of AI, and we’ve barely tapped its potential. Heck, we’re still establishing the required infrastructure to make all of this possible. The computing power needed for AI processing is immense.

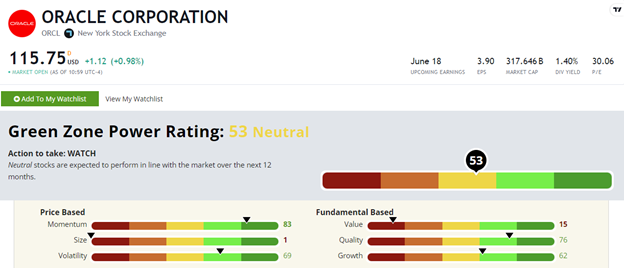

But I’m already on the hunt for the next wave of AI stocks. And Oracle Corp. (NYSE: ORCL) is one to watch.

Green Zone Power Ratings agrees…

ORCL rates a “Neutral” 53 out of 100 in our system. Neutral stocks are expected to perform in line with the market over the next year.

Like SMCI, Oracle stock rates in the green on Momentum (83), Quality (76) and Growth (62). It’s also much less volatile than SMCI, with a 69 Volatility rating.

Oracle is one of the most successful software and cloud computing companies around. It services multiple industries, including health care, information technology and energy — building up a huge list of more than 430,000 customers around the world, such as AT&T, Microsoft and Nvidia.

And as it provides AI solutions to its massive client base in the coming years, Oracle will rake in profits for its investors.

Essentially, going back to that first chart I showed you, ORCL’s time in the AI spotlight is still to come.

I’m watching ORCL stock as the AI revolution develops, and Green Zone Power Ratings says you should, too…

If you can’t tell, I’m bullish on AI. I can’t wait to see what’s next for this innovative tech.

Speaking of innovation, AI needs one thing to meet the surge of demand now and in the future.

Adam’s conducted countless hours of research and found that “one thing.” He’s even gone a step further and identified the only company that can provide it.

It’s going to open up a massive investment opportunity… and he’ll unveil it soon. Click here to reserve your seat this limited presentation before it premieres in less than a week.

Until next time,

Chad Stone

Managing Editor, Money & Markets