It’s another earnings Friday here at What My System Says Today!

But before I delve into potential “bullish” and “bearish” earnings for next week, I would like to take a moment to analyze the earnings that have been reported thus far in the third quarter…

Only 12% of the companies in the S&P 500 have reported earnings, so we’re still early in the process.

As this season plays out, it’s beneficial for us to monitor the percentage of companies reporting positive earnings and revenue surprises throughout the season, since it can give us a general picture of market health.

According to data firm FactSet, the overall index is reporting year-over-year earnings growth for the ninth straight quarter.

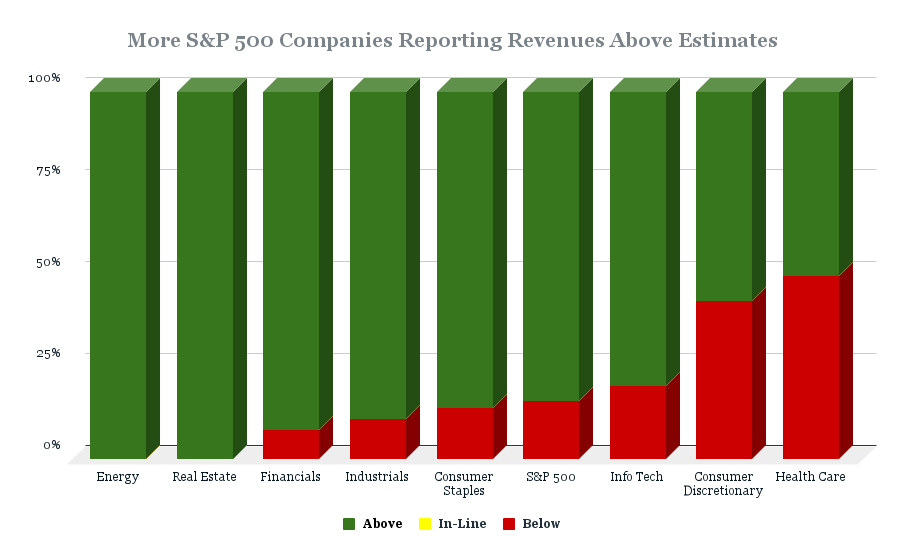

Things get really interesting once we start diving into the revenue numbers these companies are reporting.

Nearly 84% of the companies already in the books have reported actual revenue above estimates, which is above the 5-year average of 70% and the 10-year average of 66%.

We’re still very early in the earnings season, but this is a promising sign for the weeks ahead.

Due to this upward trajectory in revenue, blended revenue growth now stands at 6.6%, compared to a revenue growth rate of 6.3% at the end of the quarter.

If the 6.6% revenue growth holds, it will be the second-highest growth rate reported by the benchmark index since the third quarter of 2022. It will also be the 20th consecutive quarter of revenue growth for the index.

Now, let’s get into “bullish” earnings potentials for next week…

“Bullish” Earnings to Watch

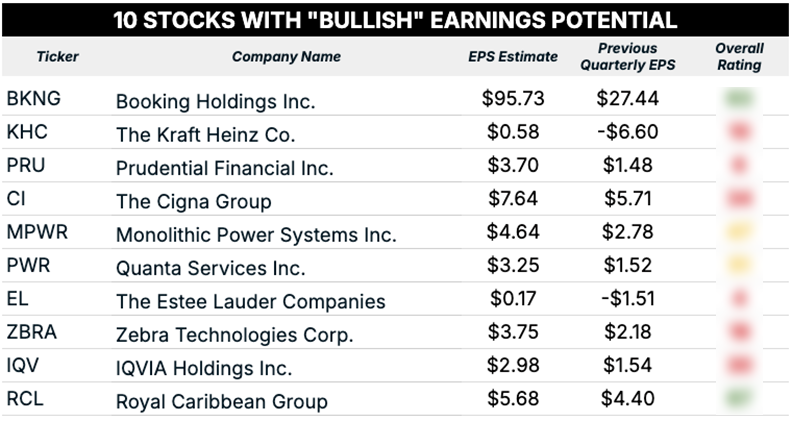

These stocks are expected to beat their previous quarter’s earnings per share (EPS), and thus, if those expectations are met or exceeded, they could potentially trade higher.

For this screen, stocks must meet four criteria:

- 10 or more analysts cover the stock.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Here are 10 companies that made this week’s list:

The first thing I noticed when reviewing this list was the significant quarter-over-quarter increase in earnings.

Take, for example, The Kraft Heinz Co. (KHC). Last quarter, their reported earnings per share were -$6.60. EPS estimates for the third quarter are $0.58. That is a huge turnaround.

Another is Prudential Financial Inc. (PRU). Expectations are for the company’s EPS to go from $1.48 last quarter to $3.70 this quarter.

Given the state of revenues reported so far, coupled with an 8.5% earnings growth rate for the S&P 500, I would not be surprised if most or all of these estimates are either met or actually beaten this quarter.

Any of these companies beating those already high estimates should expect a move on Adam’s Green Zone Power Ratings system in the coming weeks.

Now, let’s move on to potential “bearish” earnings next week…

“Bearish” Earnings to Watch

For our “bearish” earnings screen, we’re only looking for two things:

- 10 or more analysts must cover the stock.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

Here are 10 companies that passed this screen:

The “bullish” list showed an impressive quarter-over-quarter rise in EPS for those companies.

On the other hand, our “bearish” list indicates some substantial declines in EPS.

Take, for example, Coinbase Global Inc. (COIN). The cryptocurrency exchange platform is projected to drop EPS by nearly $4.

Regeneron Pharmaceuticals Inc. (REGN) may see a $3 drop in EPS, while Expand Energy Corp. (EXE) could see a similar quarter-over-quarter decrease.

Of course, the opposite for these “bearish” earnings is true regarding their standing on Adam’s Green Zone Power Ratings system.

Significant drops in earnings could spell trouble for their future ratings.

Definitely things to keep an eye on next week.

I hope you all have a great weekend.

Until next week,

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets